Avon 2000 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

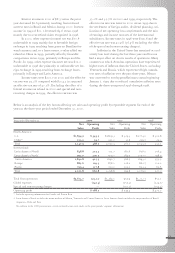

Accounting Changes > See Note 2of the Notes to

Consolidated Financial Statements for a discussion

regarding recently issued accounting standards, includ-

ing Financial Accounting Standard No. 137, Staff

Accounting Bulletin No. 101, Emerging Issues Task

Force (“eitf”) 00-10, eitf 00-14 and eitf 00-19.

Contingencies > Although Avon has completed its

divestiture of all discontinued operations, various law-

suits and claims (asserted and unasserted) are pending or

threatened against Avon. The Company is also involved

in a number of proceedings arising out of the federal

Superfund law and similar state laws. In some instances,

Avon, along with other companies, has been designated

as a potentially responsible party which may be liable for

costs associated with these various hazardous waste sites.

In the opinion of Avon’s management, based on its review

of the information available at this time, the total cost

of resolving such contingencies at December 31, 2000

should not have a material adverse impact on Avon’s

consolidated financial position, results of operations or

cash flows.

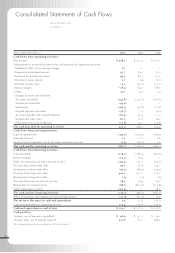

Liquidity and Capital Resources

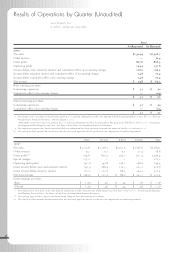

Cash Flows > Net cash provided by operating activities

was $323.9 in 2000 compared to $448.7 in 1999. The

2000 decrease principally reflects higher working capital

levels, which primarily included increased inventory

levels and a use of cash related to accounts payable and

accrued expenses, partially offset by higher net income.

The increase in inventory was mainly due to higher sales

volume and additional stock on hand to protect service

levels. Accounts payable and accrued expenses reflected

the payout of the Company’s long-term incentive plan in

2000, as well as a decline in days in payables, to a level

that is consistent with valuable supply chain partnerships

developed in recent years.

Excluding changes in debt and other financing

activities, net cash usage of $97.1 in 2000 was $639.5

favorable compared to net cash usage of $736.6 in 1999.

The $639.5 variance primarily reflects a decrease in repur-

chases of common stock resulting from the acceleration

of the buyback program in the second half of 1999. See

Note 9of the Notes to Consolidated Financial Statements

for further discussion of the Company’s share repurchase

program. In addition, the variance was also a result of a

favorable exchange rate impact on cash and decreased cash

used for investing activities in 2000, due to the acquisi-

tion of a manufacturing facility in Poland in 1999 and

lower capital expenditures in 2000. These sources of cash

were partially offset by lower cash provided by operating

activities, discussed above, and a reduction in book over-

drafts in 2000. During 1998 and 1997, the Company

received net proceeds of approximately $58.1 and $58.6,

respectively, under securities lending transactions that

were settled in the fourth quarter of 2000 and are

included in the cash flows as other financing activities.

See Note 4of the Notes to Consolidated Financial

Statements for further discussion of these transactions.

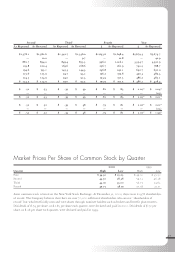

For the period 1994 through 2000, 59.6 million

shares of common stock have been purchased for

approximately $1.51 billion under the stock repurchase

programs. See Note 9of the Notes to Consolidated

Financial Statements for further details of the share

repurchase programs.

Working Capital > At December 31, 2000, current assets

exceeded current liabilities by $186.4 while at December

31, 1999, current liabilities exceeded current assets by

$375.0. This increase of $561.4 is primarily due to

decreased net debt (short-term debt less cash and equiva-

lents), the repayment of $101.4 related to securities lend-

ing transactions that were included in other accrued

liabilities in 1999, the payout of the long-term incentive

plan in 2000 as well as the net effect of the 2000 tax

refund. In addition, higher inventory levels, as discussed

in the Inventories Section, also contributed to the variance.

Although current liabilities exceeded current assets

at December 31, 1999, management believes this is due

to the Company’s direct selling business format which

results in lower receivable and working capital levels.

Avon’s liquidity results from its ability to generate signif-

icant cash flows from operations and its ample unused

borrowing capacity. At December 31, 1999, the large

excess of current liabilities over current assets as well as

the issuance of long-term debt in 1999, discussed in Note

4of the Notes to Consolidated Financial Statements,

reflects the acceleration of the Company’s share repurchase

program. These share repurchases resulted in a sharehold-

ers’ deficit balance at December 31, 2000 and 1999, of

$215.8 and $406.1, respectively. Avon’s credit agree-

ments do not contain any provisions or requirements with

respect to working capital or equity balances.

40