Avon 2000 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

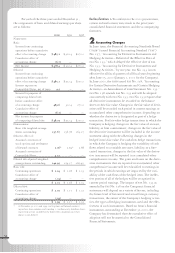

Effective January 1, 2000, the Company adopted

Staff Accounting Bulletin No. 101, “Revenue Recognition

in Financial Statements” (“sab 101”). sab 101 provides

the Securities and Exchange Commission’s views in

applying generally accepted accounting principles to

revenue recognition in the financial statements. As a

result of adopting sab 101, Avon changed its revenue

recognition policy to recognize revenue upon delivery,

when both title and risks and rewards of ownership pass

to the independent Representative. In accordance with

the provisions of sab 101, the Company recorded a

charge to earnings of $6.7, net of a tax benefit of $3.5,

to reflect the accounting change. This charge is reflected

as a cumulative effect of an accounting change in the

accompanying Consolidated Statements of Income. The

effect of the change on the year ended December 31,

2000, was to decrease net income before the cumulative

effect of the accounting change by $1.1. The change in

accounting method would not have a material effect on

the Statements of Income in 1999 or 1998 if adopted in

these periods.

In September 2000, the Emerging Issues Task Force

(“eitf”) issued eitf 00-10, “Accounting for Shipping and

Handling Fees and Costs.” Under the provisions of eitf

00-10, amounts billed to a customer in a sales transaction

related to shipping and handling should be classified as

revenue. eitf 00-10 also requires the disclosure of the

income statement classification of any shipping and han-

dling costs. Prior to October 1, 2000, the Company

included shipping and handling fees in Marketing, distri-

bution and administrative expenses in the Consolidated

Statements of Income. Effective October 1, 2000, the

Company adopted eitf 00-10, with restatement of all

comparative prior period financial statements. The adop-

tion has no impact on the determination of net income.

In March 2000, the eitf reached a consensus on the

application of eitf Issue No. 96-13, “Accounting for

Derivative Financial Instruments Indexed to, and

Potentially Settled in, a Company’s Own Stock,” with

Issue No. 00-7, “Equity Derivative Transactions that

Require Net Cash Settlement if Certain Events Outside

the Control of the Issuer Occur” (“eitf 00-7”). Equity

derivative contracts that contain any provision that could

require net cash settlement (except upon the complete

liquidation of the Company) must be marked to fair value

through earnings under eitf 00-7. In September 2000,

the eitf reached a consensus on Issue No. 00-19,

“Determination of Whether Share Settlement Is Within

the Control of the Issuer for Purposes of Applying Issue

No. 96-13, “Accounting for Derivative Financial

Instruments Indexed to, and Potentially Settled in, a

Company’s Own Stock” (“eitf 00-19”). eitf 00-19

addresses questions regarding the application of eitf

00-7 and sets forth a model to be used to determine

whether equity derivative contracts should be recorded

as equity. Under the transition provisions of eitf 00-19,

all contracts existing prior to the date of the consensus

are grandfathered until June 30, 2001, with a cumula-

tive catch-up adjustment to be recorded at that time.

Additionally, any contracts entered into prior to

September 20, 2000, which are not revised to comply

with the requirements of eitf 00-19 by December 31 ,

2000, will require reclassification out of permanent

equity and into temporary equity pursuant to Accounting

Series Release No. 268. This reclassification will remain

until the contracts are revised to comply with eitf

00-19 through June 30, 2001. At December 31, 2000,

contracts aggregating $51.0 do not comply with the

provisions of eitf 00-19 and have been included in the

accompanying Consolidated Balance Sheets in Share

repurchase commitments with a corresponding decrease

in Additional paid-in capital. The Company believes that

the equity derivative contracts that may remain outstand-

ing at June 30, 2001, if any, will be in accordance with

the requirements of eitf 00-19 and does not anticipate

that such adoption will have a material impact on the

consolidated financial statements. On March 1, 2001, the

Company purchased 260,000 shares of Avon common

stock at a purchase price of $11.5 under these contracts.

In May 2000, the eitf reached a consensus on eitf

00-14, “Accounting for Certain Sales Incentives,” which

provides guidance on accounting for discounts, coupons,

rebates and free products, as well as the income statement

classification of these discounts, coupons, rebates and free

products. eitf 00-14 is effective April 1, 2001, for the

Company. The Company is currently evaluating the

impact of this new guidance.

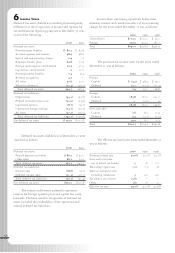

3Inventories

Inventories at December 31 consisted of the following:

2000 1999

Raw materials $168.0 $156.9

Finished goods 442.6 366.6

Total $610.6 $523.5