Avon 2000 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

Foreign Exchange > Financial statement translation of

subsidiaries operating in highly inflationary economies

and foreign currency transactions resulted in losses (gains)

in 2000 netting to $12.6 (1999–$7.5; 1998–$(1.1)),

which are included in other expense (income), net and

income taxes. In addition, cost of sales and expenses

include the unfavorable impact of the translation of

inventories and prepaid expenses at historical rates in

countries with highly inflationary economies in 2000 of

$3.2 (1999 –$7.1; 1998 –$15.8).

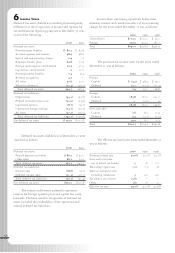

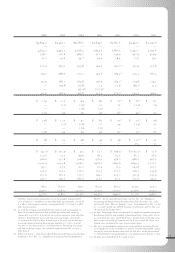

12 Leases and Commitments

Minimum rental commitments under noncancellable

operating leases, primarily for equipment and office facili-

ties at December 31, 2000, consisted of the following:

Year

2001 $ 69.1

2002 52.8

2003 40.6

2004 33.1

2005 29.1

Later years 225.3

Sublease rental income (4.5)

Total $445.5

Rent expense in 2000 was $85.4 (1999 –$84.5;

1998 –$84.7). Various construction and information sys-

tems projects were in progress at December 31, 2000, with

an estimated cost to complete of approximately $130.0.

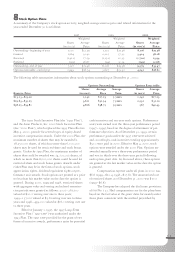

13 Special and Non-Recurring Charges

In October 1997, the Company announced a worldwide

business process redesign program to streamline opera-

tions and improve profitability through margin improve-

ment and expense reductions. The special and non-

recurring charges associated with this program totaled

$151.2 pretax ($121.9 net of tax, or $.47 per share on a

basic and diluted basis) for the year ended December 31,

1999 and totaled $154.4 pretax ($122.8 net of tax, or

$.46 per share on a basic and diluted basis) for the year

ended December 31, 1998.

Special and non-recurring charges by business seg-

ment are as follows:

1999 1998

North America $ 33.6 $ 84.6

Latin America 14.7 6.3

Europe 69.8 18.2

Pacific 11.8 27.3

Corporate 21.3 18.0

Total $151.2 $ 154.4

Special and non-recurring charges by category

of expenditures are as follows for the years ended

December 31:

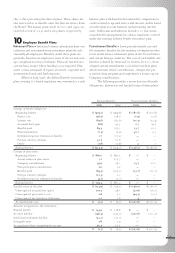

1999

Cost of

Special Sales

Charges Charge Total

Employee severance costs $ 57.0 $ — $ 57.0

Inventories — 46.0 46.0

Writedown of assets to net

realizable value 26.4 — 26.4

Recognition of foreign

currency translation adjustment 9.8 — 9.8

Other 12.0 — 12.0

$105.2 $ 46.0 $151.2

1998

Cost of

Special Sales

Charges Charge Total

Employee severance costs $ 56.4 $ — $ 56.4

Inventories — 37.9 37.9

Writedown of assets to net

realizable value 31.8 — 31.8

Field program buy-out 14.4 — 14.4

Other 13.9 — 13.9

$116.5 $ 37.9 $154.4

Employee severance costs are expenses, both domes-

tic and international, associated with the realignment

of the Company’s global operations. Certain employee

severance costs were accounted for in accordance with the

Company’s existing fas 112 (“Employers’ Accounting

for Postemployment Benefits”) severance plans. Remaining

severance costs were accounted for in accordance with

other accounting literature. The workforce was reduced

by approximately 3,700 employees, or 9% of the total.

Approximately one-half of the terminated employees

related to the facility closures. As of December 31, 2000,

all employees under the program have been terminated.

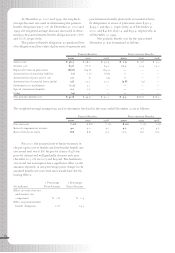

Inventory-related charges represent losses to write

down the carrying value of non-strategic inventory prior

to disposal. The 1999 charges primarily result from a

new business strategy for product dispositions which

fundamentally changes the way the Company markets

and sells certain inventory. This new strategy, approved

and effective in March 1999, is meant to complement

other redesign initiatives, with the objective of reducing

inventory clearance sales, building core brochure sales

and building global brands. The 1998 charges resulted

from the closure of facilities, discontinuation of certain

product lines, size-of-line reductions and a change in

strategy for product dispositions.