Avon 2000 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

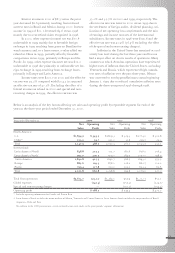

Consolidated net sales increased 7% in 2000 to

$5.67 billion from $5.29 billion in 1999. Sales in North

America increased 5% to $2.15 billion in 2000.

International sales increased 9% to $3.53 billion due to

strong growth in the Latin American and Pacific regions

and, to a lesser extent, in the European region. In 1999,

consolidated net sales of $5.29 billion increased 1% from

$5.21 billion in 1998. Sales in North America increased

1% to $2.05 billion in 1999. International sales increased

2% to $3.24 billion due to strong growth in the Pacific

region and in Europe, partially offset by declines in Latin

America. Excluding the unfavorable impact of foreign

currency translation, consolidated net sales would have

increased 11% and 9% in 2000 and 1999, respectively.

Other revenue includes shipping and handling fees

billed to Representatives and totaled $40.9, $38.8 and

$35.0 in 2000, 1999 and 1998, respectively.

Cost of sales as a percentage of net sales was 37.4%

in 2000, compared with 38.4% in 1999 and 39.4% in

1998. The 1999 and 1998 cost of sales included $46.0 and

$37.9, respectively, of non-recurring charges for inventory

write-downs related to the Company’s bpr program. The

charges related to the closure of facilities, discontinuation

of certain product lines, size-of-line reductions and a

change in strategy for product dispositions. See Note 13

of the Notes to Consolidated Financial Statements for fur-

ther discussion of these charges. Excluding the charges,

cost of sales as a percentage of sales was 37.5% in 1999

versus 38.7% in 1998.

In 2000, the favorable gross margin variance versus

1999 was due to improvements in all international

regions, most significantly in the Pacific region, includ-

ing Japan and China, as well as Central and Eastern

Europe, due to lower product costs on imports from euro

countries coupled with a shift in mix to higher margin

products, and in Russia, due to a favorable comparison

resulting from a discount pricing policy in 1999. Gross

margins remained level with prior year in Brazil and the

u.s. These improvements were partially offset by declines

in Puerto Rico, due to inventory variations related to

the consolidation of operations, and in Mexico and the

Philippines, resulting from higher sales of a lower margin

mix of cosmetics, fragrance and toiletries (“cft”) products

and selective price cuts to meet competition.

In 1999, the favorable gross margin variance versus

1998 was due to improvements in all regions, most sig-

nificantly in Europe, including the United Kingdom,

Germany, Italy and Central Europe, due to a continuing

focus on pricing strategies and improved profitability of

Beauty Plus categories, including fashion jewelry and

accessories. Japan, Mexico and the u.s. also posted strong

gross margin improvements. These improvements were

partially offset by a decline in Brazil, resulting from

higher costs in the second half of 1999 as a result of a

major currency devaluation, and in Russia, due to a pric-

ing discount policy begun in the fourth quarter of 1998.

Marketing, distribution and administrative

expenses of $2.80 billion increased $161.4, or 6%, over

prior year, but decreased as a percentage of total revenue

to 49.1% from 49.6% in 1999. The overall improvement

in the expense ratio was due to a favorable expense ratio

in Mexico, resulting from lower marketing and promo-

tional expenses associated with product introductions, in

Russia, due to strict expense controls as well as favorable

comparisons against prior year, and in the Philippines

and China, reflecting fixed administrative expenses on a

higher sales base. Expense ratio improvements were par-

tially offset by higher expenses in Argentina, reflecting

increased advertising and brochure costs, in the United

Kingdom, due to increased shipping and distribution

costs from decreased capacity of shipping lines during

transition to a new system, and in Puerto Rico, reflecting

higher transitional expenses related to the consolidation

of operations.

Marketing, distribution and administrative

expenses of $2.64 billion in 1999 increased $36.8, or 1%,

over 1998, but remained level as a percentage of total

revenue versus 1998. Expense ratio improvements were

reported in Brazil reflecting strict expense management

and bpr initiatives, in Japan reflecting bpr efforts, and in

Central Europe reflecting volume efficiencies and a signif-

icant reduction in expenses. These improvements were

offset by higher expense ratios in Mexico due to increased

advertising and incentive programs in 1999, in Germany

due to strategic marketing investments, in Venezuela

due to increased incentive programs and in the United

Kingdom due to higher shipping expenses, most signifi-

cantly in the fourth quarter of 1999.

Interest expense increased $41.5 in 2000 to $84.7

and $8.5 in 1999 to $43.2. The increases in both 2000

and 1999 are primarily the result of increased domestic

borrowings related to the acceleration of the Company’s

share repurchase program, which occurred in the second

half of 1999, and working capital requirements.

34