Avon 2000 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

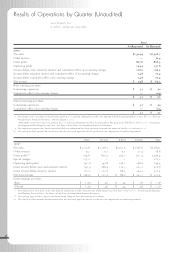

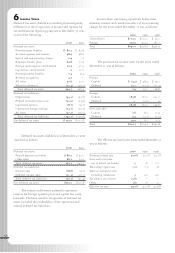

For each of the three years ended December 31,

the components of basic and diluted earnings per share

are as follows:

2000 1999 1998

Numerator:

Basic:

Income from continuing

operations before cumulative

effect of accounting change $ 485.1 $ 302.4 $270.0

Cumulative effect of

accounting change (6.7) ——

Net Income $ 478.4 $ 302.4 $270.0

Diluted:

Income from continuing

operations before cumulative

effect of accounting change $ 485.1 $ 302.4 $270.0

Interest expense on

Convertible Notes, net of taxes 4.5 ——

Income for purposes of

computing diluted eps

before cumulative effect

of accounting change 489.6 302.4 270.0

Cumulative effect of

accounting change (6.7) ——

Net income for purposes

of computing diluted eps $ 482.9 $ 302.4 $270.0

Denominator:

Basic eps weighted-average

shares outstanding 237.67 256.78 263.27

Dilutive effect of:

Assumed conversion of

stock options and settlement

of forward contracts 2.06* 2.59* 2.68

Assumed conversion of

Convertible Notes 3.22 ——

Diluted eps adjusted weighted-

average shares outstanding 242.95 259.37 265.95

Basic eps:

Continuing operations $2.04 $ 1.18 $ 1.03

Cumulative effect of

accounting change (.03) ——

$2.01 $ 1.18 $ 1.03

Diluted eps:

Continuing operations $2.02 $ 1.17 $ 1.02

Cumulative effect of

accounting change (.03) ——

$1.99 $ 1.17 $ 1.02

* At December 31, 2000 and 1999, stock options and forward contracts

to purchase Avon common stock totaling 1.1 million and 3.8 million shares,

respectively, are not included in the diluted eps calculation since their

impact is anti-dilutive.

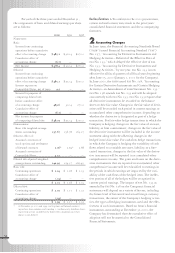

Reclassifications > To conform to the 2000 presentation,

certain reclassifications were made to the prior years’

consolidated financial statements and the accompanying

footnotes.

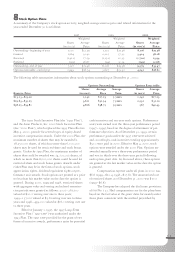

2Accounting Changes

In June 1999, the Financial Accounting Standards Board

(“fasb”) issued Financial Accounting Standard (“fas”)

No. 137, “Accounting for Derivative Instruments and

Hedging Activities–Deferral of the Effective Date of

fas No. 133,” which delayed the effective date of fas

No. 133, “Accounting for Derivative Instruments and

Hedging Activities,” by one year. fas No. 133 is now

effective for all fiscal quarters of all fiscal years beginning

after June 15, 2000 (January 1, 2001 for the Company).

In June 2000, the fasb issued fas No. 138, “Accounting

for Certain Derivative Instruments and Certain Hedging

Activities–an Amendment of fasb Statement No. 133.”

fas No. 138 amends fas No. 133 and will be adopted

concurrently with fas No. 133. fas No. 133 requires that

all derivative instruments be recorded on the balance

sheet at their fair value. Changes in the fair value of deriv-

atives will be recorded each period in current earnings or

accumulated other comprehensive income, depending on

whether the derivative is designated as part of a hedge

transaction. For fair-value hedge transactions in which the

Company is hedging changes in the fair value of an asset,

liability, or firm commitment, changes in the fair value of

the derivative instrument will be included in the income

statement along with the offsetting changes in the

hedged item’s fair value. For cash-flow hedge transactions

in which the Company is hedging the variability of cash

flows related to a variable rate asset, liability, or a fore-

casted transaction, changes in the fair value of the deriva-

tive instrument will be reported in accumulated other

comprehensive income. The gains and losses on the deriv-

ative instruments that are reported in accumulated other

comprehensive income will be reclassified to earnings in

the periods in which earnings are impacted by the vari-

ability of the cash flows of the hedged item. The ineffec-

tive portion of all of the hedges will be recognized in

current period earnings. The impact of fas No. 133 as

amended by fas No. 138 on the Company’s financial

statements will depend on a variety of factors, including

the future level of forecasted and actual foreign currency

transactions, the extent of the Company’s hedging activi-

ties, the types of hedging instruments used and the effec-

tiveness of such instruments. Based on Avon’s financial

instruments outstanding at December 31, 2000, the

Company has determined that the cumulative effect of

adoption will not be material to the Consolidated

Financial Statements.

54