Avon 2000 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

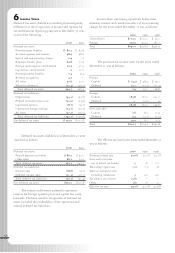

Supplemental Retirement Program > Avon maintains a

supplemental retirement program consisting of a

Supplemental Executive Retirement Plan (“serp”) and a

Benefits Restoration Pension Plan (“Restoration Plan”)

under which non-qualified supplemental pension benefits

are paid to higher paid employees in addition to amounts

received under Avon’s qualified retirement plan which is

subject to irs limitations on covered compensation. The

annual cost of this program has been included in the

determination of the net periodic benefit cost shown

above and in 2000 amounted to $10.2 (1999 –$10.1,

1998 –$6.1). The benefit obligation under this program

at December 31, 2000 was $32.9 (1999 –$29.3) and is

primarily included in Employee Benefit Plans.

Avon also maintains a Supplemental Life Insurance

Plan (“slip”) under which additional death benefits rang-

ing from $.35 to $2.0 are provided to certain active and

retired officers. Avon has acquired corporate-owned life

insurance policies to provide partial funding of the

benefits. The cash surrender value of these policies at

December 31, 2000 was $26.1 (1999–$24.2) and is held

in a grantor trust.

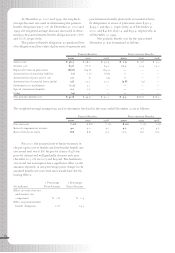

Avon has established a grantor trust to provide

funding for the benefits payable under the serp and slip

and further provides for funding of obligations under

Avon’s Deferred Compensation Plan. The trust is irrevo-

cable and assets contributed to the trust can only be used

to pay such benefits with certain exceptions. The assets

held in the trust at December 31, 2000, amounting to

$96.2 (1999 –$99.6), consisted of a fixed income portfo-

lio, a managed portfolio of equity securities and corpo-

rate-owned life insurance policies. These assets are

included in Other assets.

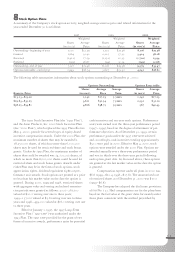

The equity securities and fixed income portfolio

included in the grantor trust are classified as available-

for-sale and recorded at current market value. In 2000,

net unrealized gains and losses on these securities were

recorded in Other Comprehensive Income (see Note 5).

In 1999, the net unrealized gains and losses on these secu-

rities were not recorded as the carrying value approxi-

mated market. The cost, gross unrealized gains and losses

and market value of the available-for-sale securities as of

December 31, 2000, are as follows:

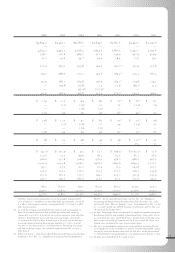

Gross Gross

Cost Unrealized Unrealized Market

Gains Losses Value

Equity Securities $44.3 $2.5 $(12.2) $34.6

u.s. Government

Bonds 1.5 — — 1.5

State and Municipal

Bonds 30.9 0.6 (.2) 31.3

Mortgage Backed 1.9 — — 1.9

Corporate Bonds 0.8 — — .8

Tota l $79.4 $3.1 $(12.4) $70.1

Payments, proceeds and net realized gains from

the purchases and sales of these securities totaled $98.3,

$100.3 and $6.0, respectively, during 2000. For the pur-

pose of determining realized gains and losses, the cost of

securities sold was based on specific identification.

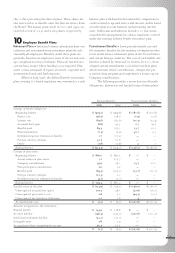

Postemployment Benefits > Avon provides postem-

ployment benefits which include salary continuation, sev-

erance benefits, disability benefits, continuation of health

care benefits and life insurance coverage to former

employees after employment but before retirement. At

December 31, 2000, the accrued cost for postemployment

benefits was $31.9 (1999–$38.5) and is included in

Employee Benefit Plans.