Avon 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

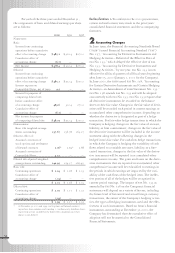

At December 31, 2000, Avon had foreign operating

loss carryforwards of approximately $78.7. The loss carry-

forwards expiring between 2001 and 2008 were $35.5

and the loss carryforwards which do not expire were

$43.2. Capital loss carryforwards, which expire in 2001

and may be used to offset capital gains, if any, were

approximately $.7at December 31, 2000.

In January 2001, the Company received a federal

income tax refund consisting of $32.5 of tax and $62.7 of

interest related to the carryback of foreign tax credits and

general business credits to the years ended December 31,

1982, 1983, 1985 and 1986. The Company recognized

$40.1 million as an income tax benefit in 2000 resulting

from the impact of the tax refund offset by taxes due on

interest received and other related tax obligations.

7Financial Instruments and Risk Management

Risk Management > The Company operates globally, with

manufacturing and distribution facilities in various loca-

tions around the world. The Company may reduce its

exposure to fluctuations in interest rates and foreign

exchange rates by creating offsetting positions through

the use of derivative financial instruments. The Company

does not use derivative financial instruments for trading

or speculative purposes, nor is the Company a party to

leveraged derivatives.

The notional amount of forward exchange contracts

and options is the amount of foreign currency bought or

sold at maturity. The notional amount of interest rate

swaps is the underlying principal amount used in deter-

mining the interest payments exchanged over the life of

the swap. The notional amounts are not a direct measure

of the Company’s exposure through its use of derivatives.

Interest Rates > The Company periodically uses interest

rate swaps to hedge portions of interest payable on its

debt. In addition, the Company may periodically employ

interest rate caps to reduce exposure, if any, to increases in

variable interest rates.

As discussed in Note 4of the Notes to Consolidated

Financial Statements, the Company entered into a five-

year interest rate swap contract with a notional amount of

$50.0 to effectively convert fixed interest on a portion of

the Bonds to a variable interest rate based on libor. The

Company has also entered into four-year and nine-year

interest rate swap contracts with notional amounts of

$200.0 and $300.0, respectively, to convert fixed interest

on the Notes to a variable interest rate, based on libor.

In May 2000, Avon entered into an interest rate cap

agreement with a notional amount of $150.0 expiring on

May 31, 2001, to convert a variable interest rate, resulting

from the interest rate swaps above, to a fixed interest rate.

The cap rate under this contract is 7%.

Foreign Currencies > The Company may periodically

hedge foreign currency royalties, net investments in

foreign subsidiaries, firm purchase commitments and

contractual foreign currency cash flows or obligations,

including third-party and intercompany foreign cur-

rency transactions. The Company regularly monitors

its foreign currency exposures and ensures that hedge

contract amounts do not exceed the amounts of the

underlying exposures.

At December 31, 2000, the Company held foreign

currency forward contracts with notional amounts total-

ing $393.7 (1999 –$290.2) and option contracts with

notional amounts totaling $19.1 (1999–$20.0) to hedge

foreign currency items. All of these contracts mature

within the next 13 months. Additionally, the Company

also held forward contracts with notional amounts total-

ing $34.2 (1999 –$66.7) which do not qualify as hedg-

ing transactions under the current accounting definitions

and, accordingly, have been marked to market. The

mark-to-market adjustments on these forward contracts

at December 31, 2000 and 1999, were not material.

These forward and option contracts to purchase

and sell foreign currencies, including cross-currency

contracts to sell one foreign currency for another currency

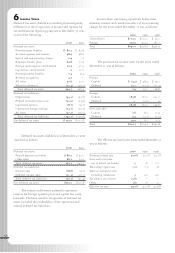

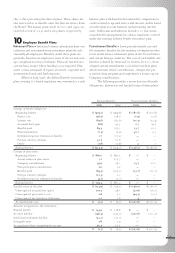

at December 31, are summarized below:

2000 1999

Buy Sell Buy Sell

Argentine peso $ — $15.0 $—$—

Brazilian real —8.0 15.0 65.0

British pound 5.5 41.7 7.3 30.1

Canadian dollar — 10.8 — 23.8

Euro 151.3 104.1 82.9 10.0

French franc .9 — 10.9 —

Indonesian rupiah .9 — 1.7 —

Irish punt 2.8 — 1.7 —

Italian lira 1.6 — 4.7 —

Japanese yen 13.7 20.0 4.8 60.5

Mexican peso — 43.8 — 45.0

Polish zloty —8.4 ——

Taiwanese dollar —7.0 —3.0

Other currencies 2.3 9.2 6.2 4.3

Total $179.0 $268.0 $135.2 $241.7

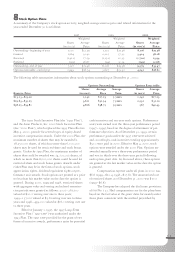

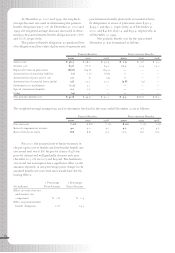

At December 31, 2000, the Company has entered

into forward contracts to purchase approximately

1,374,400 shares of Avon common stock at an average

price of $37.09 per share at December 31, 2000. The

contracts mature over the next 10 months and provide

for physical or net share settlement to the Company.

Accordingly, no adjustment for subsequent changes in

fair value has been recognized. In accordance with the

provisions of eitf 00-19, $51.0 of these contracts have

been included in the accompanying Consolidated Balance

Sheets in Share repurchase commitments with a

corresponding decrease in Additional paid-in capital.