Avon 2000 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company also engages in various hedging

activities in order to reduce potential losses due to for-

eign currency risks. Consistent with the nature of the

economic hedge of such foreign exchange contracts, any

unrealized gain or loss would be offset by corresponding

decreases or increases, respectively, of the underlying

instrument or transaction being hedged. These financial

instruments are discussed above and in Note 7of the

Notes to Consolidated Financial Statements. Based on the

Company’s foreign exchange contracts at December 31,

2000, the impact of a 10% appreciation or 10% depre-

ciation of the u.s. dollar against the Company’s foreign

exchange contracts would not represent a material

potential loss in fair value, earnings or cash flows. This

potential loss does not consider the underlying foreign

currency transaction or translation exposures of the

Company. The hypothetical impact was calculated on the

combined option and forward positions using forward

rates at December 31, 2000 adjusted for an assumed

10% appreciation or 10% depreciation of the u.s. dollar

against the foreign contracts. The impact of payoffs on

option contracts is not significant to this calculation.

In 2000, net foreign exchange losses associated with the

Company’s foreign exchange contracts did not represent

a material loss in fair value, earnings or cash flows.

As of December 31, 2000, the primary currencies

for which the Company has net underlying foreign cur-

rency exchange rate exposure are the u.s. dollar versus

the Mexican peso, Brazilian real, Argentine peso, British

pound, Philippine peso, Polish zloty, Japanese yen and

the euro. The Company is also exposed to other South

American and Asian currencies.

The Company does not hedge its foreign cur-

rency exposure in a manner that would entirely eliminate

the effect of changes in foreign exchange rates on the

Company’s consolidated financial position, results of

operations and cash flows. The impact of a 10% appreci-

ation or 10% depreciation of the u.s. dollar against the

Company’s net underlying foreign currency transaction

and translation exposures could be material.

Other Information

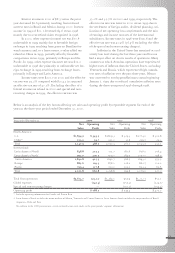

In October 1997, the Company announced its bpr pro-

gram to streamline operations and improve profitability

through margin improvement and expense reductions.

The special and non-recurring charges associated with

this program totaled $151.2 pretax ($121.9 net of tax, or

$.47 per share on a basic and diluted basis) for the year

ended December 31, 1999 and $154.4 pretax ($122.8 net

of tax, or $.46 per share on a basic and diluted basis) for

the year ended December 31, 1998.

In connection with these programs, bpr initiatives

reduced costs by approximately $400.0 in 2000 versus

1997 levels, with a portion of the savings being reinvested

primarily in consumer-focused initiatives.

Euro

A single currency called the euro was introduced in

Europe on January 1, 1999. Eleven of the fifteen member

countries of the European Union adopted the euro as their

common legal currency on that date. Fixed conversion

rates between these participating countries’ existing cur-

rencies (the “legacy currencies”) and the euro were estab-

lished as of that date. The legacy currencies are scheduled

to remain legal tender as denominations of the euro until

June 30, 2002 after which they will be withdrawn from

circulation. During this transition period, parties may

settle transactions using either the euro or a participating

country’s legal currency. Beginning in January 2002, new

euro-denominated bills and coins will be issued.

Avon operating subsidiaries affected by the euro

conversion have established plans to address issues raised

by the euro currency conversion. These issues include,

among others, the need to adapt information technology

systems, business processes and equipment to accommo-

date euro-denominated transactions, the impact of one

common currency on pricing and recalculating currency

risk. Avon does not expect system and equipment con-

version costs to be material. Due to the numerous uncer-

tainties associated with the market impact of the euro

conversion, the Company cannot reasonably estimate the

effects one common currency will have on pricing and the

resulting impact, if any, on results of operations, financial

position or cash flows.

45