Avon 2000 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

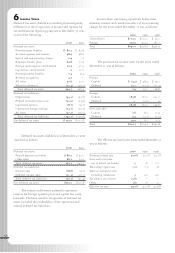

53

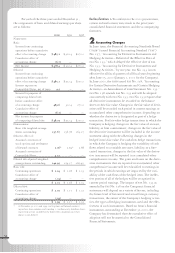

Contracts that require physical or net share settlement are

initially measured at fair value with subsequent changes

in fair value not recognized. Contracts that require net

cash settlement are initially measured at fair value with

subsequent changes in fair value recognized as gains or

losses in the income statement.

Research and Development > Research and development

costs are expensed as incurred and aggregated in

2000–$43.1 (1999 –$38.2; 1998 –$31.4).

Advertising > Advertising costs are expensed as incurred

and aggregated in 2000–$92.4 (1999 –$63.4;

1998 –$65.0).

Income Taxes > Deferred income taxes have been provided

on items recognized for financial reporting purposes in

different periods than for income tax purposes at future

enacted rates.

u.s. income taxes have not been provided on

approximately $204.0 of undistributed income of sub-

sidiaries that has been or is intended to be permanently

reinvested outside the United States.

Shipping and Handling > Shipping and handling costs are

expensed as incurred and aggregated in 2000–$533.2

(1999 –$495.4; 1998 –$440.9). Shipping and handling

costs are included in Marketing, distribution and adminis-

trative expenses on the Consolidated Statements of Income.

Earnings per Share > Basic earnings per share (“eps”)

are computed by dividing net income by the weighted-

average number of shares outstanding during the year.

Diluted earnings per share are calculated to give effect

to all potentially dilutive common shares that were out-

standing during the year.

Depreciation > Substantially all buildings, improvements

and equipment are depreciated using the straight-line

method over estimated useful lives. Estimated useful lives

for buildings and improvements range from approximately

20 to 45 years and equipment range from 3to 15 years.

Deferred Software > Systems development costs related

to the development of major information and account-

ing systems are capitalized and amortized over the esti-

mated useful life of the related project, not to exceed

five years. Unamortized deferred software costs totaled

$121.2 and $90.7 at December 31, 2000 and 1999,

respectively, and are included in Other assets on the

Consolidated Balance Sheets.

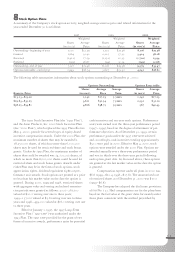

Stock Options > Avon applies apb Opinion 25, “Account-

ing for Stock Issued to Employees,” and related interpre-

tations in accounting for its long-term incentive plans.

Compensation cost for fixed price options is measured as

the excess, if any, of the quoted market price of Avon’s

stock at the grant date or other measurement date over

the amount an employee must pay to acquire the stock.

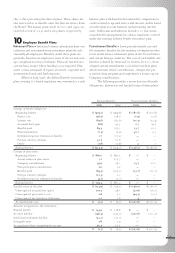

Financial Instruments > The Company uses derivative

financial instruments, including swaps, forward contracts

and options, to manage interest rate and foreign currency

exposures. Gains and losses on existing assets, liabilities

and firm commitments designated as hedged items are

deferred and included in other assets or liabilities and rec-

ognized when the offsetting gains and losses are recog-

nized on the related financial instrument. Gains and

losses and cash flows from derivative instruments desig-

nated as hedges are classified consistent with the items

being hedged. Items which do not qualify for hedge

accounting are marked to market with the resulting gain

or loss recognized in other expense (income), net. Gains

and losses on terminations of foreign exchange and inter-

est rate swap contracts are deferred and amortized over

the remaining terms of the original agreements.

The Company also uses financial instruments,

including forward contracts to purchase Avon common

stock, to hedge certain employee benefit costs and the

cost of the Company’s share repurchase program.