Avon 2000 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

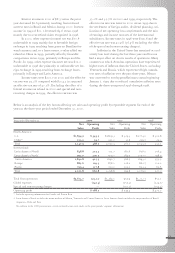

In connection with the May 1998 Bond issuance,

Avon entered into a five-year interest rate swap contract

with a notional amount of $50.0 to effectively convert

fixed interest on a portion of the Bonds to a variable inter-

est rate, based on libor.

During 1997, the Company issued $100.0 of

6.55% notes, due August 1, 2007, to pay down commer-

cial paper borrowings.

During 1996, the Company entered into an agree-

ment (the “credit facility”), which expires in 2001, with

various banks to amend and restate the five-year, $600.0

revolving credit and competitive advance facility agree-

ment. The Company is currently negotiating with various

banks to renew this credit facility and expects to have a

final agreement by the end of the second quarter of 2001.

Within this facility, the Company is able to borrow, on an

uncommitted basis, various foreign currencies.

The credit facility is primarily to be used to finance

working capital, provide support for the issuance of com-

mercial paper and support the stock repurchase program.

At the Company’s option, the interest rate on borrowings

under the credit facility is based on libor or the higher

of prime or federal fund rates. The credit facility has an

annual facility fee of $.4. The credit facility contains a

covenant for interest coverage, as defined. The Company

is in compliance with this covenant. At December 31,

2000 and 1999, the Company has $29.9 and $226.4,

respectively, outstanding under a $600.0 commercial

paper program supported by the credit facility.

The Company has uncommitted lines of credit

available of $49.0 in 2000 and 1999 with various

banks that have no compensating balances or fees. As

of December 31, 2000 and 1999, $11.1 of these lines

are being used for letters of credit. In addition, as of

December 31, 2000 and 1999, there were international

lines of credit totaling $449.5 and $399.5, respectively,

of which $74.8 and $81.6, respectively, were outstanding.

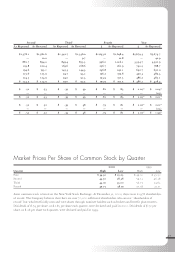

Inventories > Avon’s products are marketed during 12 to

26 individual sales campaigns each year. Each campaign

is conducted using a brochure offering a wide assortment

of products, many of which change from campaign to

campaign. It is necessary for Avon to maintain relatively

high inventory levels as a result of the nature of its busi-

ness, including the number of campaigns conducted

annually and the large number of products marketed.

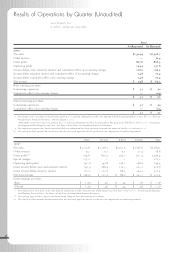

Avon’s operations have a seasonal pattern characteristic of

many companies selling cft, fashion jewelry and acces-

sories, gift and decorative items, and apparel. Holiday

sales cause a peak in the fourth quarter, which results in

the build up of inventory at the end of the third quarter.

Inventory levels are then reduced by the end of the fourth

quarter. Inventories of $610.6 at December 31, 2000 were

$87.1 higher than 1999 as a result of worldwide inven-

tory investments due to sales increases; an increase in

beauty inventories to protect service levels, primarily in

the u.s. and Europe; transitional start-up related to new

distribution/manufacturing facilities in Taiwan, Mexico

and Poland; and European new market entries. It is

Avon’s objective to continue to manage purchases and

inventory levels maintaining the focus of operating the

business at efficient inventory levels. However, the addi-

tion or expansion of product lines, which are subject to

changing fashion trends and consumer tastes, as well as

planned expansion in high growth markets, may cause the

inventory levels to grow periodically.

Capital Expenditures > Capital expenditures during 2000

were $193.5 (1999–$203.4). These expenditures were

made for capacity expansion in high growth markets,

maintenance of worldwide facilities, contemporization

and replacement of information systems, the new Internet

strategy and a new manufacturing facility in Poland.

Numerous construction and information systems projects

were in progress at December 31, 2000 with an estimated

cost to complete of approximately $130.0. Capital expen-

ditures in 2001 are currently expected to be in the range

of $200.0–$220.0. These expenditures will include

improvements on existing facilities, continued invest-

ments for capacity expansion in high growth markets,

facility modernization, information systems, including

spending on the new Internet strategy, and equipment

replacement projects.

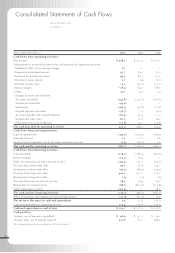

Foreign Operations > For the three years ended 2000,

1999 and 1998, the Company derived approximately 60%

of its consolidated net sales and consolidated operating

profit from operations from its subsidiaries outside of

North America. In addition, as of December 31, 2000 and

1999, these subsidiaries comprised approximately 51% of

the Company’s consolidated total assets.

Avon’s operations in many countries utilize numer-

ous currencies. Avon has significant net assets in Brazil,

Mexico, the United Kingdom, Japan, Argentina, Canada,

the Philippines and Poland. Changes in the value of

non-hyperinflationary countries’ currencies relative to

42