Avon 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

cap ra In May 1998, Avon issued $100.0 of bonds embed-

ded with option features (the “Bonds”) to pay down com-

mercial paper borrowings. The Bonds have a twenty-year

maturity; however, after five years, the Bonds, at the

holder’s option, can be sold back to the Company at par

or can be called at par by the underwriter and resold to

investors as fifteen-year debt. The coupon rate on the

Bonds is 6.25% for the first five years, but will be refi-

nanced at 5.69% plus the then corporate spread if the

Bonds are reissued.

In connection with the May 1998 Bond issuance,

Avon entered into a five-year interest rate swap contract

with a notional amount of $50.0 to effectively convert

fixed interest on a portion of the Bonds to a variable

interest rate, based on libor.

During 1997, the Company issued $100.0 of

6.55% notes, due August 1, 2007, to pay down commer-

cial paper borrowings.

Under the terms of a revolving credit and competi-

tive advance facility agreement amended in 1996 and

expiring in 2001 (the “credit facility”), the Company

may borrow up to $600.0. The Company is currently

negotiating with various banks to renew this credit facil-

ity and expects to have a final agreement by the end of

the second quarter of 2001. Within this facility, the

Company is able to borrow, on an uncommitted basis,

various foreign currencies.

The credit facility is primarily to be used to finance

working capital, provide support for the issuance of com-

mercial paper and support the stock repurchase program.

At the Company’s option, the interest rate on borrowings

under the credit facility is based on libor or the higher of

prime or federal fund rates. The credit facility has an

annual facility fee of $.4. The credit facility contains a

covenant for interest coverage, as defined. The Company

is in compliance with this covenant. At December 31,

2000 and 1999, the Company has $29.9 and $226.4,

respectively, outstanding under a $600.0 commercial

paper program supported by the credit facility.

The Company has uncommitted lines of credit

available of $49.0 in 2000 and 1999 with various banks

which have no compensating balances or fees. As of

December 31, 2000 and 1999, $11.1 of these lines are

being used for letters of credit.

The maximum borrowings under these combined

facilities during 2000 and 1999 were $515.4 and $840.7,

respectively, and the annual average borrowings during

each year were approximately $313.7 and $304.0, respec-

tively, at average annual interest rates of approximately

6.5% and 5.3%, respectively.

At December 31, 2000 and 1999, international

lines of credit totaled $449.5 and $399.5, respectively, of

which $74.8 and $81.6 were outstanding, respectively.

The maximum borrowings under these facilities during

2000 and 1999 were $86.4 and $121.0, respectively, and

the annual average borrowings during each year were

$77.8 and $73.0, respectively, at average annual interest

rates of approximately 6.4% and 6.2%, respectively. Such

lines have no compensating balances or fees.

At December 31, 2000 and 1999, Avon also had

letters of credit outstanding totaling $15.5, which guar-

antee various insurance activities. In addition, Avon had

outstanding letters of credit for various trade activities.

During 1998 and 1997, the Company entered into

securities lending transactions resulting in the borrowing

of securities which were subsequently sold for net pro-

ceeds approximating $58.1 and $58.6, respectively, used

to repay commercial paper borrowings. The borrowed

securities were paid during 2000. The obligations are

included in other accrued liabilities on the balance sheet

at December 31, 1999. The effective rates on the transac-

tions were 5.5% and 6.5%, respectively.

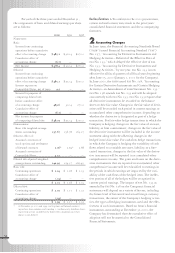

5Comprehensive Income

The following table reflects comprehensive income as of

December 31:

2000 1999 1998

Net income $478.4 $302.4 $270.0

Other comprehensive loss:

Foreign currency

translation adjustments (42.9) (49.7) (15.6)

Available-for-sale securities

Unrealized loss (9.3) ——

Income taxes 3.3 ——

Minimum pension liability

adjustment (.8) 2.0 (24.6)

Income taxes .3 (.7) 9.2

Comprehensive income $429.0 $254.0 $239.0

Accumulated other comprehensive loss at

December 31 consisted of the following:

2000 1999

Foreign currency translation adjustments $(378.5) $(335.6)

Unrealized loss from available-for-sale

securities, net of tax (6.0) —

Minimum pension liability

adjustment, net of tax (14.6) (14.1)

Total $(399.1) $(349.7)