Avon 2000 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

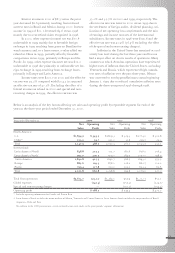

the u.s. dollar result in direct charges or credits to equity.

Effective January 1, 1997, Mexico was designated as a

country with a highly inflationary economy due to the

cumulative inflation rates over the three-year period

1994–1996. However, Mexico was converted to non-

hyperinflationary status effective January 1, 1999 due to

reduced cumulative inflation rates during the three-year

period 1996 through 1998.

The euro devalued significantly during 2000 and,

as a result, negatively affected the 2000 u.s. dollar results

of the European countries using this common currency.

Net sales from these countries represent 5% of Avon’s

consolidated net sales. The impact on earnings of this

devaluation was reduced by foreign exchange contracts

previously in place.

The Brazilian real devalued significantly in January

1999 and, as a result, negatively affected Brazil’s u.s. dol-

lar results in 1999. The effect of exchange rates was

reduced by foreign exchange contracts previously in place

and several actions taken by local management to offset

the devaluation, including a focused effort directed at

vendor negotiations and local sourcing to reduce imports.

Brazil’s 1999 net sales represented approximately 9% of

Avon’s consolidated net sales.

On April 21, 1998, the Chinese government issued

a directive banning all direct selling in China resulting

in the shutdown of the Company’s sales operations for

most of the second quarter. As of the beginning of June

1998, the Company received Chinese governmental

approval to resume operations as a wholesale and retail

business and became operational again on June 15, 1998.

The Company converted its 75 branches into retail out-

lets to serve customers. During the end of the second

quarter of 1998, Avon received government approval

to utilize sales promoters, much like Representatives,

to promote product sales in China.

In early April 1999, the United States and China

agreed to remove all market access restrictions on direct

selling in China by January 1, 2003, including the cur-

rent ban on direct selling imposed by the Chinese govern-

ment in April 1998. The agreement is contingent upon

successful completion of the World Trade Organization

accession negotiations between the United States and

China and also includes development of regulations for

direct selling based on the World Federation of Direct

Selling Association’s World Code of Conduct. Avon sup-

ports resolution of this direct selling issue in China and

remains committed to the opportunities this promising

region offers.

Avon’s well diversified global portfolio of busi-

nesses has demonstrated that the effects of weak economies

and currency fluctuations in certain countries may be off-

set by strong results in others. Fluctuations in the value of

foreign currencies cause u.s. dollar-translated amounts to

change in comparison with previous periods. Accordingly,

Avon cannot project in any meaningful way the possible

effect of such fluctuations upon translated amounts or

future earnings. This is due to the large number of cur-

rencies, the complexity of intercompany relationships,

the hedging activity entered into in an attempt to mini-

mize certain effects of exchange rate changes where eco-

nomically feasible, and the fact that all foreign currencies

do not react in the same manner against the u.s. dollar.

Certain of the Company’s financial instruments,

which are discussed below under Risk Management

Strategies and Market Rate Sensitive Instruments and in

Note 7of the Notes to Consolidated Financial Statements,

are used to hedge various amounts relating to certain

international subsidiaries. However, the Company’s for-

eign currency hedging activities are not material when

compared to the Company’s international financial posi-

tion or results of operations.

Some foreign subsidiaries rely primarily on borrow-

ings from local commercial banks to fund working capital

needs created by their highly seasonal sales pattern. From

time to time, when tax and other considerations dictate,

Avon will finance subsidiary working capital needs or

borrow foreign currencies. At December 31, 2000, the

total indebtedness of foreign subsidiaries was $76.5.

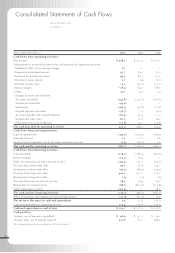

It is Avon’s policy to remit all the available cash

(cash in excess of working capital requirements, having no

legal restrictions and not considered permanently rein-

vested) of foreign subsidiaries as rapidly as is practical.

During 2000, these subsidiaries remitted, net of taxes,

$393.3 in dividends and royalties. This sum is a substan-

tial portion of the 2000 consolidated net earnings of

Avon’s foreign subsidiaries.

43