Avon 2000 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

the 10 days preceding the date of grant. These shares are

also restricted as to transfer until the director retires from

the Board. The annual grant made in 2000 and 1999 con-

sisted of a total of 5,232 and 4,284 shares, respectively.

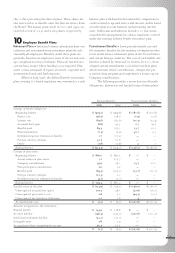

10 Employee Benefit Plans

Retirement Plans > Avon and certain subsidiaries have con-

tributory and noncontributory retirement plans for sub-

stantially all employees. Benefits under these plans are

generally based on an employee’s years of service and aver-

age compensation near retirement. Plans are funded on a

current basis except where funding is not required. Plan

assets consist primarily of equity securities, corporate and

government bonds and bank deposits.

Effective July 1998, the defined benefit retirement

plan covering u.s.-based employees was converted to a cash

balance plan with benefits determined by compensation

credits related to age and service and interest credits based

on individual account balances and prevailing interest

rates. Additional amendments include a 10 year transi-

tional benefit arrangement for certain employees covered

under the existing defined benefit retirement plan.

Postretirement Benefits > Avon provides health care and

life insurance benefits for the majority of employees who

retire under Avon’s retirement plans in the United States

and certain foreign countries. The cost of such health care

benefits is shared by Avon and its retirees. In 2000, Avon

adopted certain amendments to its retiree medical plans

which increases retiree contributions, changes the pre-

scription drug program and implements a future cap on

Company contributions.

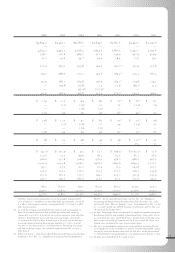

The following provides a reconciliation of benefit

obligations, plan assets and funded status of these plans:

Pension Benefits Postretirement Benefits

2000 1999 2000 1999

Change in benefit obligation:

Beginning balance $ (919.2) $ (999.8) $ (181.6) $ (201.8)

Service cost (36.5) (38.1) (1.9) (3.6)

Interest cost (65.6) (67.6) (11.2) (13.4)

Actuarial (loss) gain (6.8) 43.5 2.7 19. 5

Benefits paid 84.3 155.1 13.7 12.1

Plan amendments (1.5) (2.9) 42.1 5.5

Settlements/special termination benefits 1.7 (17.2) ——

Foreign currency changes 31.2 10.6 ——

Other (1.8) (2.8) .2 .1

Ending balance $ (914.2) $ (919.2) $ (136.0) $ (181.6)

Change in plan assets:

Beginning balance $ 860.0 $ 863.1 $— $ —

Actual return on plan assets 7.1 113.7 ——

Company contributions 39.9 36.1 13.7 12.1

Plan participant contributions 2.0 2.2 ——

Benefits paid (84.3) (155.1) (13.7) (12.1)

Foreign currency changes (21.3)2.0 ——

Settlements/special termination benefits (4.1) (2.0) ——

Ending balance $ 799.3 $ 860.0 $— $—

Funded status of the plan $ (114.9) $ (59.2) $ (136.0) $ (181.6)

Unrecognized actuarial loss (gain) 107.5 48.1 (27.6) (26.1)

Unrecognized prior service cost 2.8 3.0 (44.3) (5.0)

Unrecognized net transition obligation 2.1 1.6 .3 .4

Accrued benefit cost $ (2.5) $ (6.5) $ (207.6) $ (212.3)

Amount recognized in the statements:

Prepaid benefit $ 143.9 $138.8 $— $—

Accrued liability (146.4) (145.3)(207.6) (212.3)

Additional minimum liability (31.1) (22.0) ——

Intangible asset 7.8 7.9 ——

Accumulated other comprehensive income 23.3 14.1 ——

$ (2.5) $(6.5)$ (207.6) $(212.3)