Avon 2000 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2000 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

The following discussion of the results of operations and

financial condition of Avon Products, Inc. (“Avon” or the

“Company”) should be read in conjunction with the infor-

mation contained in the Consolidated Financial Statements

and Notes thereto. These statements have been prepared

in conformity with generally accepted accounting princi-

ples which require management to make estimates and

assumptions that affect amounts reported and disclosed in

the financial statements and related notes. Actual results

could differ from these estimates.

Cautionary Statement for Purposes of the “Safe

Harbor” Statement Under the Private Securities

Litigation Reform Act of 1995

Certain statements in this report which are not historical

facts or information are forward-looking statements

within the meaning of the Private Securities Litigation

Reform Act of 1995, including, but not limited to, the

information set forth herein. Such forward-looking state-

ments involve known and unknown risks, uncertainties

and other factors which may cause the actual results,

levels of activity, performance or achievement of the

Company, or industry results, to be materially different

from any future results, levels of activity, performance

or achievement expressed or implied by such forward-

looking statements. Such factors include, among others,

the following: General economic and business conditions;

the ability of the Company to implement its business

strategy; the Company’s access to financing and its man-

agement of foreign currency risks; the Company’s ability

to successfully identify new business opportunities; the

Company’s ability to attract and retain key executives; the

Company’s ability to achieve anticipated cost savings and

profitability targets; the impact of substantial currency

exchange devaluations in the Company’s principal foreign

markets; changes in the industry; competition; the effect

of regulatory and legal restrictions imposed by foreign

governments; the effect of regulatory and legal proceed-

ings and other factors discussed in Item 1of the Company’s

Form 10-k. As a result of the foregoing and other factors,

no assurance can be given as to the future results and

achievements of the Company. Neither the Company nor

any other person assumes responsibility for the accuracy

and completeness of these statements.

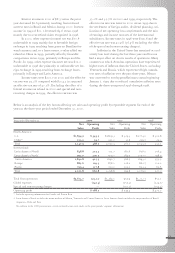

Results of Operations

Consolidated > Net income in 2000 was $478.4 com-

pared with $302.4 in 1999. Basic and diluted earnings

per share in 2000 were $2.01 and $1.99, respectively,

compared with $1.18 and $1.17, respectively, in 1999.

Net income for 1998 was $270.0 and basic and diluted

earnings per share were $1.03 and $1.02, respectively.

Effective January 1, 2000, the Company changed

its method of accounting for revenue recognition in accor-

dance with Staff Accounting Bulletin (“sab”) No. 101,

“Revenue Recognition in Financial Statements.” See Note

2of the Notes to Consolidated Financial Statements. The

cumulative effect of the change on prior years resulted in

a charge of $6.7, net of a tax benefit of $3.5, or $.03 per

share on a basic and diluted basis, which is included in

net income for the year ended December 31, 2000. The

effect of the accounting change in 2000 was to decrease

net income before the cumulative effect of the accounting

change by $1.1.

In addition, the 2000 results include the settlement

of a federal income tax refund, which was received in

January 2001, consisting of $32.5 of tax and $62.7 of

interest related to the years ended December 31, 1982,

1983, 1985 and 1986. For the year ended December 31,

2000, the Company recognized $40.1 ($.17 and $.16 per

share on a basic and diluted basis, respectively) as an income

tax benefit in the Consolidated Statements of Income,

resulting from the impact of the tax refund offset by taxes

due on interest received and other related tax obligations.

Special and non-recurring charges were recorded

in the first quarter of 1999 for the Company’s business

process redesign (“bpr”) program. These charges totaled

$151.2 pretax, which reduced net income by $121.9 after

tax, or $.47 per share on a basic and diluted basis. The

1998 results include special and non-recurring charges

totaling $154.4 pretax, which reduced net income by

$122.8 after tax, or $.46 per share on a basic and diluted

basis. See Note 13 of the Notes to Consolidated Financial

Statements for further discussion of this program.

Before special and non-recurring charges in 1999,

earnings per share of $1.65 and $1.64 on a basic and

diluted basis, respectively, both increased 11% over the

comparable period in 1998.

Management’s Discussion and Analysis

Avon Products, Inc.

Dollars in millions, except share data