Abercrombie & Fitch 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

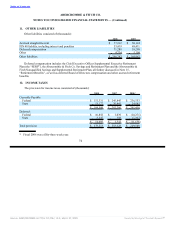

18. QUARTERLY FINANCIAL DATA (UNAUDITED)

Summarized unaudited quarterly financial results for Fiscal 2008 and Fiscal 2007 follows (thousands,

except per share amounts):

Fiscal 2008 Quarter First Second Third Fourth

Net sales $ 800,178 $ 845,799 $ 896,344 $ 997,955

Gross profit $ 534,166 $ 592,969 $ 591,943 $ 642,614

Operating income $ 90,621 $ 123,980 $ 100,140 $ 124,645

Net income $ 62,116 $ 77,832 $ 63,900 $ 68,407

Net income per basic share $ 0.72 $ 0.90 $ 0.73 $ 0.79

Net income per diluted share $ 0.69 $ 0.87 $ 0.72 $ 0.78

Fiscal 2007 Quarter First Second Third Fourth

Net sales $ 742,410 $ 804,538 $ 973,930 $ 1,228,969

Gross profit $ 487,269 $ 553,438 $ 645,043 $ 825,617

Operating income $ 92,710 $ 124,132 $ 186,587 $ 337,068

Net income $ 60,081 $ 81,275 $ 117,585 $ 216,756

Net income per basic share $ 0.68 $ 0.92 $ 1.35 $ 2.52

Net income per diluted share $ 0.65 $ 0.88 $ 1.29 $ 2.40

19. SUBSEQUENT EVENT

UBS CREDIT LINE

On March 6, 2009, the Company entered into the UBS Credit Line. The UBS Credit Line represents a

secured, uncommitted demand line of credit under which up to $44.3 million may initially be available,

subject to adjustment from time-to-time. The UBS Credit Line is to be used for general corporate

purposes. Being a demand line of credit, the UBS Credit Line does not have a stated maturity date.

As security for the payment and performance of the Company’s obligations under the UBS Credit

Line, the UBS Credit Line provides that the Company grants a security interest to UBS Bank USA in each

account of the Company at UBS Financial Services Inc. that is identified as a Collateral Account (as

defined in the UBS Credit Line), as well as any and all money, credit balances, securities, financial assets

and other investment property and other property maintained from time-to-time in any Collateral Account,

any over-the-counter options, futures, foreign exchange, swap or similar contracts between the Company

and UBS Financial Services Inc. or any of its affiliates, any and all accounts of the Company at UBS

Bank USA or any of its affiliates, any and all supporting obligations and other rights relating to the

foregoing property, and any and all interest, dividends, distributions and other proceeds of any of the

foregoing property, including proceeds of proceeds.

Because certain of the Collateral consists of ARS (as defined in the UBS Credit Line), the UBS Credit

Line provides further that the interest rate payable by the Company will reflect any changes in the

composition of such ARS Collateral (as defined in the UBS Credit Line) as may be necessary to cause

83

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠