Abercrombie & Fitch 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

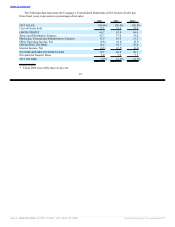

Other Operating Income, Net

Other operating income for Fiscal 2008 was $8.9 million compared to $11.7 million for Fiscal 2007.

The decrease was primarily driven by losses on foreign currency transactions for Fiscal 2008 compared to

gains on foreign currency transactions for Fiscal 2007, as well as a decrease in income related to gift cards

for which the Company has determined the likelihood of redemption to be remote.

Operating Income

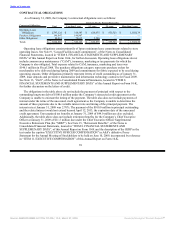

Fiscal 2008 operating income was $439.4 million compared to $740.5 million for Fiscal 2007. The

operating income rate for Fiscal 2008 was 12.4% compared to 19.7% for Fiscal 2007.

Interest Income, Net and Income Tax Expense

Fiscal 2008 interest income was $14.8 million, offset by interest expense of $3.4 million compared to

interest income of $19.8 million, offset by interest expense of $1.0 million for Fiscal 2007. The decrease

in interest income was primarily due to a lower average rate of return on investments. The increase in

interest expense in Fiscal 2008 was due to borrowings made under the unsecured credit agreement in

Fiscal 2008.

The effective tax rate for Fiscal 2008 was 39.6% compared to 37.4% for the Fiscal 2007 comparable

period. The higher rate was primarily due to the non-deductibility, pursuant to Internal Revenue Code

section 162(m), of certain compensation related to the execution of the CEO’s new employment

agreement during the year.

Net Income and Net Income per Share

Net income for Fiscal 2008 was $272.3 million compared to $475.7 million for Fiscal 2007. Net

income per diluted weighted-average share was $3.05 in Fiscal 2008 versus $5.20 in Fiscal 2007.

FISCAL 2007 COMPARED TO FISCAL 2006

FOURTH QUARTER RESULTS

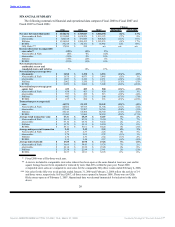

Net Sales

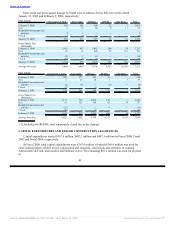

Fourth quarter net sales for the thirteen week period ended February 2, 2008 were $1.229 billion, up

7.9% versus net sales of $1.139 billion for the fourteen week period ended February 3, 2007. The net sales

increase was attributed primarily to the net addition of 91 stores and a 46.8% increase in

direct-to-consumer business (including shipping and handling revenue), partially offset by an extra selling

week in the fourth quarter of Fiscal 2006 and the resulting impact of the calendar shift in Fiscal 2007 due

to Fiscal 2006 being a 53-week fiscal year, as well as a 1% decrease in comparable store sales.

Comparable store sales by brand for the fourth quarter of Fiscal 2007 were as follows:

Abercrombie & Fitch increased 1% with men’s comparable store sales increasing by a low double-digit

and women’s decreasing by a mid single-digit; abercrombie decreased 3% with boys’ increasing by a mid

single-digit and girls’ decreasing by a mid single-digit; Hollister decreased 2% with dudes’ increasing by

a high single-digit and bettys’ decreasing by a mid single-digit; and RUEHL decreased 19% with men’s

decreasing by a high single-digit and women’s decreasing by the high twenties.

Comparable regional store sales ranged from increases in the high teens to decreases in the mid

single-digits. Stores located in Canada and the Southwest and North Atlantic regions had the strongest

comparable

32

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠