Abercrombie & Fitch 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

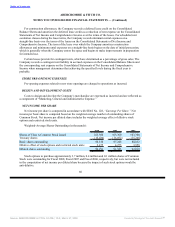

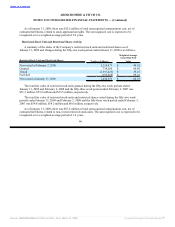

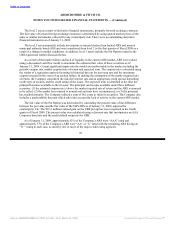

The level 2 assets consist of derivative financial instruments, primarily forward exchange contracts.

The fair value of forward foreign exchange contracts is determined by using quoted market prices of the

same or similar instruments, reduced for any counterparty risk. There were no outstanding derivative

financial instruments as of January 31, 2009.

The level 3 assets primarily include investments in insured student loan backed ARS and insured

municipal authority bonds ARS and were transferred from level 2 in the first quarter of Fiscal 2008 as a

result of a change in market conditions. In addition, level 3 assets include the Put Option related to the

UBS Agreement further discussed below.

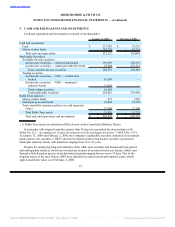

As a result of the market failure and lack of liquidity in the current ARS market, ARS were valued

using a discounted cash flow model to determine the estimated fair value of these securities as of

January 31, 2009. Certain significant inputs into the model are unobservable in the market including the

periodic coupon rate, market required rate of return and expected term. The coupon rate is estimated using

the results of a regression analysis factoring in historical data on the par swap rate and the maximum

coupon rate paid in the event of an auction failure. In making the assumption of the market required rate

of return, the Company considered the risk-free interest rate and an appropriate credit spread, depending

on the type of security and the credit rating of the issuer. The expected term is identified at the time the

principal becomes available to the investor. The principal can become available under three different

scenarios: (1) the assumed coupon rate is above the market required rate of return and the ARS is assumed

to be called; (2) the market has returned to normal and auctions have recommenced; or (3) the principal

has reached maturity. The Company utilized a term of five years to value its securities. The Company also

includes a marketability discount which takes into account the lack of activity in the current ARS market.

The fair value of the Put Option was determined by calculating the present value of the difference

between the par value and the fair value of the UBS ARS as of January 31, 2009, adjusted for

counterparty risk. The $12.3 million realized gain on the UBS put option was recognized in the fourth

quarter of Fiscal 2008. The present value was calculated using a discount rate that incorporates an AAA

Corporate bond rate and the credit default swap rate for UBS.

As of January 31, 2009, approximately 62% of the Company’s ARS were “AAA” rated and

approximately 37% of the Company’s ARS were “AA” or “A” rated with the remaining ARS having an

“A−” rating in each case, as rated by one or more of the major credit rating agencies.

70

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠