Abercrombie & Fitch 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

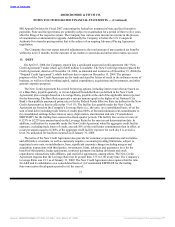

without duplication, (x) net interest expense for such period, (y) scheduled payments of long-term debt

due within twelve months of the date of determination and (z) the sum of minimum rent and contingent

store rent, not be less than 2.00 to 1.00 at any time. The Company’s Coverage Ratio was 3.49 as of

January 31, 2009. The Company was in compliance with such ratio requirements at January 31, 2009.

The terms of the New Credit Agreement include customary events of default such as payment

defaults, cross-defaults to other material indebtedness, bankruptcy and insolvency, the occurrence of a

defined change in control, or the failure to observe the negative covenants and other covenants related to

the operation and conduct of the business of A&F and its subsidiaries. Upon an event of default, the

lenders will not be obligated to make loans or other extensions of credit and may, among other things,

terminate their commitments to the Company, and declare any then outstanding loans due and payable

immediately.

The obligations of the Company under the New Credit Agreement are guaranteed by the Company

and the Company’s direct and indirect domestic subsidiaries.

On December 29, 2008, the Company entered into an amendment to the New Credit Agreement

which, permitted the Company to borrow under the UBS Credit Line, as further discussed in Note 19,

“Subsequent Event” and to secure such borrowings with the collateral required by the UBS Credit Line.

The New Credit Agreement will mature on April 12, 2013. Trade letters of credit totaling

approximately $21.1 million and $61.6 million were outstanding on January 31, 2009 and February 2,

2008, respectively. Standby letters of credit totaling approximately $16.9 million and $14.5 million were

outstanding on January 31, 2009 and February 2, 2008, respectively. The standby letters of credit are set

to expire primarily during the fourth quarter of Fiscal 2009. To date, no beneficiary has drawn upon the

standby letters of credit.

As of January 31, 2009, the Company had $100.0 million outstanding under the New Credit

Agreement. The Company classified the debt as a long-term liability on the Company’s Consolidated

Balance Sheet. The average interest rate during Fiscal 2008 was 3.1%. No borrowings were outstanding as

of February 2, 2008 under the Original Credit Agreement.

14. DERIVATIVES

The Company operates in foreign countries, which results in exposure to market risk associated with

foreign currency exchange rate fluctuations. The Company enters into forward foreign currency exchange

contracts to obtain economic hedges on U.S. dollar forecasted merchandise purchases by or on behalf of

its foreign subsidiaries. These contracts are designated as cash flow hedges.

The Company accounts for derivative instruments in accordance with SFAS No. 133, “Accounting for

Derivative Instruments and Hedging Activities” (“SFAS No. 133”). For a derivative instrument to qualify

as a hedge at inception and throughout the contract, the Company formally documents the risk

management objective and strategy, including the identification of the hedging instrument, the hedged

item, the risk exposure and an assessment of the effectiveness both prospectively and retrospectively. In

addition, for forecasted transactions, the significant characteristics and expected term of the transaction is

specifically identified, and the fact that it is probable that the forecasted transaction will occur. If it were

deemed probable that the forecasted transaction would not occur, the gain or loss would be recognized in

earnings immediately. No such gains or losses were recognized in Fiscal 2008 and Fiscal 2007.

78

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠