Abercrombie & Fitch 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

in the year 2013 and some have an indefinite carryforward period. As of January 31, 2009 and February 2,

2008, the valuation allowance totaled $1.3 million and $0.9 million, respectively. No other valuation

allowances have been provided for deferred tax assets because the Company believes that it is more likely

than not that the full amount of the net deferred tax assets will be realized in the future.

In June 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income

Tax — An Interpretation of FASB Statement No. 109” (“FIN 48”). FIN 48 clarifies the accounting for

uncertainty in income taxes recognized in a company’s financial statements in accordance with

SFAS No. 109. This interpretation prescribes a recognition threshold and measurement attribute for the

financial statement recognition and measurement of a tax position taken or expected to be taken in a tax

return. This interpretation also provides guidance on derecognition, classification, interest and penalties,

accounting in interim periods, disclosure and transition. The Company recognizes accrued interest and

penalties related to unrecognized tax benefits as a component of tax expense.

In connection with the Company’s adoption of FIN 48 on February 4, 2007, a $2.8 million cumulative

effect adjustment was recorded as a reduction to beginning of the year retained earnings. The Company’s

unrecognized tax benefits as of February 4, 2007 were reclassified from current taxes payable to other

long-term liabilities.

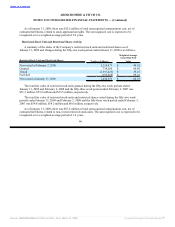

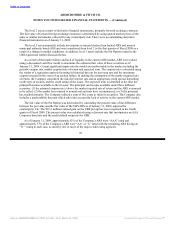

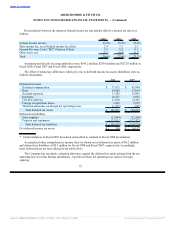

A reconciliation of the beginning and ending amounts of unrecognized tax benefits is as follows:

2008 2007

Unrecognized tax benefits, beginning of year $ 38,894 $ 29,613

Gross addition for tax positions of the current year 5,539 5,146

Gross addition for tax positions of prior years 8,754 12,789

Reductions of tax positions of prior years for:

Changes in judgment/excess reserve (4,206) (4,726)

Settlements during the period (1,608) (3,291)

Lapses of applicable statutes of limitations (3,689) (637)

Unrecognized tax benefits, end of year $ 43,684 $ 38,894

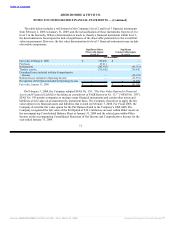

The amount of the above unrecognized tax benefits at January 31, 2009 and February 2, 2008 which

would impact the Company’s effective tax rate, if recognized, was $33.3 million and $38.9 million,

respectively.

The Company recognizes accrued interest and penalties related to unrecognized tax benefits as a

component of income tax expense. The Company’s policy did not change as a result of adopting FIN 48.

Tax expense includes $0.5 million and $2.7 million of accrued interest, as of January 31, 2009 and

February 2, 2008, respectively. Interest and penalties of $9.7 million and $10.5 million had been accrued

as of January 31, 2009 and February 2, 2008, respectively.

The Internal Revenue Service (“IRS”) is currently conducting an examination of the Company’s

U.S. federal income tax return for Fiscal 2008 as part of the IRS’s Compliance Assurance Process

program. The IRS has completed its examinations for Fiscal 2007 and prior years with the Company

being before the

76

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠