Abercrombie & Fitch 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Commission’s approval of Public Company Accounting Oversight Board amendments to AU Section 411,

“The Meaning of ’Present fairly in conformity with generally accepted accounting principles’.” The

Company is currently evaluating the potential impact, if any, of the adoption of SFAS No. 162 on its

consolidated financial statements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

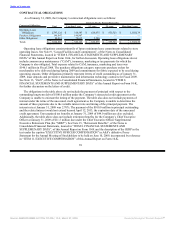

The Company maintains its cash equivalents in financial instruments, primarily money market funds,

with original maturities of 90 days or less. The Company also holds investments in investment grade

auction rate securities (“ARS”) that have maturities ranging from 10 to 34 years. As of January 31, 2009,

the Company held ARS with a fair value of approximately $229.1 million, with $166.5 million classified

as available-for-sale securities and $62.5 million classified as trading securities. The Company recognized

a temporary impairment of $28.2 million on ARS classified as available-for-sale and an

other-than-temporary impairment of $14.0 million on ARS classified as trading. All ARS are classified as

non-current marketable securities as of January 31, 2009. Approximately $12.0 million of the trading

securities were invested in insured municipal authority bonds and approximately $50.6 million were

invested in insured student loan backed securities. Approximately $27.3 million of the available-for-sale

securities were invested in insured municipal authority bonds and approximately $139.2 million were

invested in insured student loan backed securities.

On November 13, 2008, the Company entered into an agreement with UBS, relating to ARS with a

par value of approximately $76.5 million as of January 31, 2009. By entering into the agreement, UBS

received the right to purchase these UBS ARS at par at anytime, commencing on November 13, 2008. The

Company received a Put Option to sell the UBS ARS back to UBS at par, at the Company’s sole

discretion, commencing on June 30, 2010. The UBS ARS were classified as trading securities as of

January 31, 2009 and any gains and losses related to changes in fair value will be recorded in the

Consolidated Statement of Net Income and Comprehensive Income in the period incurred. For the

fifty-two weeks ended January 31, 2009, the Company recognized an other-than-temporary impairment of

$14.0 million related to the UBS ARS on the Consolidated Statement of Net Income and Comprehensive

Income and recognized $12.3 million as the fair value of the Put Option as an asset within other assets on

the Consolidated Balance Sheet at January 31, 2009.

As of January 31, 2009, approximately 62% of the Company’s ARS were “AAA” rated and

approximately 37% of the Company’s ARS were “AA” or “A” rated with the remaining ARS having an

“A−” rating, in each case as rated by one or more of the major credit rating agencies. The ratings take into

account insurance policies guaranteeing both the principal and accrued interest. Each investment in

student loans is fully insured by (1) the U.S. government under the Federal Family Education Loan

Program, (2) a private insurer or (3) a combination of both. The credit ratings may change over time and

would be an indicator of the default risk associated with the ARS and could have a material effect on the

value of the ARS.

As of January 31, 2009, the Company had $100.0 million in long-term debt outstanding. This

borrowing and any future borrowings will bear interest at negotiated rates and would be subject to interest

rate risk. The unsecured credit agreement has several borrowing options, including interest rates that are

based on (i) a Base Rate, payable quarterly, or (ii) an Adjusted Eurodollar Rate (as defined in the

unsecured credit agreement) plus a margin based on a Leverage Ratio, payable at the end of the applicable

interest period for the borrowing. The Base Rate represents a rate per annum equal to the higher of

(a) National City Bank’s then publicly announced prime rate or (b) the Federal Funds Effective Rate (as

defined in the unsecured credit agreement) as then in effect plus 1/2 of 1%. The average interest rate was

3.1% for the fifty-two week period ended January 31, 2009. Additionally, as of January 31, 2009, the

Company had $350 million available, less

48

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠