Abercrombie & Fitch 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

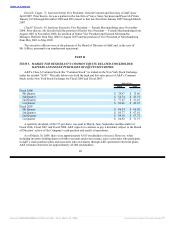

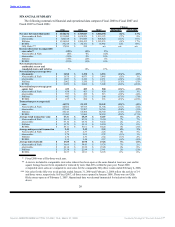

Comparable store sales by brand for the fourth quarter of Fiscal 2008 were as follows:

Abercrombie & Fitch decreased 23% with men’s comparable store sales decreasing by a high double-digit

and women’s decreasing by a low thirty; abercrombie decreased 30% with boys’ decreasing by a low

twenty and girls’ decreasing by a low thirty; Hollister decreased 25% with dudes’ decreasing by a low

teen and bettys’ decreasing by a low thirty; and RUEHL decreased 25% with men’s decreasing by a mid

teen and women’s decreasing by a low thirty.

Regionally, comparable store sales were down in all U.S. regions and Canada. Comparable store sales

were stronger in the flagship stores, particularly in the United Kingdom.

From a merchandise classification standpoint across all brands, stronger performing masculine

categories included denim, fragrance and knit tops, while graphic tees and fleece were weakest. In the

feminine businesses, across all brands, knit tops, fleece and graphic tees were the primary drivers in the

negative comparable store sales result.

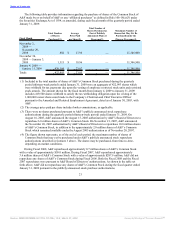

Direct-to-consumer net merchandise sales, which are sold through the Company’s websites, for the

fourth quarter of Fiscal 2008 were $95.1 million, a decrease of 12.4% from Fiscal 2007 fourth quarter net

merchandise sales of $108.6 million. Shipping and handling revenue for the corresponding periods was

$14.3 million in Fiscal 2008 and $15.6 million in Fiscal 2007. The direct-to-consumer business, including

shipping and handling revenue, accounted for 11.0% of total net sales in the fourth quarter of Fiscal 2008

compared to 10.1% in the fourth quarter of Fiscal 2007.

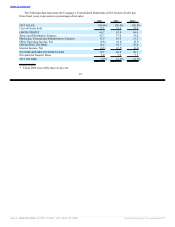

Gross Profit

Gross profit during the fourth quarter of Fiscal 2008 was $642.6 million compared to $825.6 million

for the comparable period in Fiscal 2007. The gross profit rate (gross profit divided by net sales) for the

fourth quarter of Fiscal 2008 was 64.4%, down 280 basis points from the fourth quarter of Fiscal 2007

rate of 67.2%. The decrease in gross profit rate can be attributed to a higher IMU rate being more than

offset by an increase in markdown rate versus last year. The higher markdown rate resulted from the need

to clear through seasonal merchandise as a result of declining sales and the Company’ limited ability to

reduce fourth quarter deliveries.

Stores and Distribution Expense

Stores and distribution expense for the fourth quarter of Fiscal 2008 was $422.5 million compared to

$388.4 million for the comparable period in Fiscal 2007. The stores and distribution expense rate (stores

and distribution expense divided by net sales) for the fourth quarter of Fiscal 2008 was 42.3%, up

10.7 percentage points from 31.6% in the fourth quarter of Fiscal 2007. Although the Company

introduced a number of initiatives to reduce store payroll hours in response to the declining sales, the

increase in rate was primarily related to the limitation on leveraging fixed expenses due to the comparable

store sales decline and additional direct expenses related to flagship pre-opening rent expenses, as well as

minimum wage and manager salary increases. The fourth quarter of Fiscal 2008’s stores and distribution

expense also included a $30.6 million non-cash impairment charge as the Company determined that the

carrying amount of assets related to 11 Abercrombie & Fitch, six abercrombie, three Hollister and nine

RUEHL stores exceeded the fair value of those assets. The majority of the impairment charge was

associated with the nine RUEHL stores. Long-lived assets are reviewed at the store level periodically for

impairment or whenever events or changes in circumstances indicate that full recoverability of net assets

through future cash flows is in question. Factors used in the evaluation include, but are not limited to,

management’s plans for future operations, recent operating results and projected cash flows.

29

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠