Abercrombie & Fitch 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

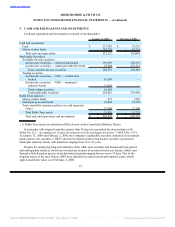

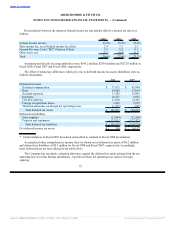

On February 13, 2008, the Company began to experience failed auctions. Based on the failure rate of

these auctions, the frequency of the failures and the overall lack of liquidity in the ARS market, the

Company determined that the ARS should be classified as non-current assets on the Consolidated Balance

Sheets for periods subsequent to February 13, 2008 and that the fair value of the ARS no longer

approximated par value.

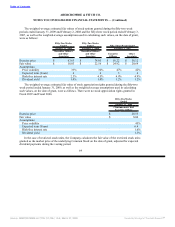

Marketable securities with a par value of $194.7 million and $530.5 million as of January 31, 2009

and February 2, 2008, respectively, were classified as available-for-sale securities in accordance with

SFAS No. 115. For the fifty-two week period ended January 31, 2009, the Company recorded a pre-tax

temporary impairment of $28.2 million, all related to the available-for-sale ARS, included as a component

of accumulated other comprehensive loss on the Consolidated Balance Sheet as of January 31, 2009.

There were no unrealized gains or losses on ARS for the fifty-two week period ended February 2, 2008.

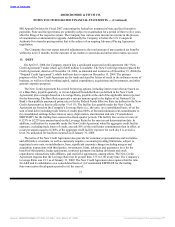

FASB Staff Positions FAS 115-1 and FAS 124-1, “The Meaning of Other-Than-Temporary

Impairment and Its Application to Certain Investments,” states that an investment is considered impaired

when the fair value is less than the cost. Significant judgment is required to determine if impairment is

other-than-temporary. The Company deemed the unrealized loss on the available-for-sale ARS to be

temporary based primarily on the following: (1) as of the Consolidated Balance Sheet date, the Company

had the ability and intent to hold the impaired securities to maturity; (2) the lack of deterioration in the

financial performance, credit rating or business prospects of the issuers; (3) the lack of evident factors that

raise significant concerns about the issuers’ ability to continue as a going concern; and (4) the lack of

significant changes in the regulatory, economic or technological environment of the issuers. If it becomes

probable that the Company will not receive 100% of the principal and interest as to any of the

available-for-sale ARS or if events occur to change any of the factors described above, the Company will

be required to recognize an other-than-temporary impairment charge against net income. The securities

continue to accrue interest and be auctioned until one of the following: the auction succeeds; the issuer

calls the securities; or the securities mature.

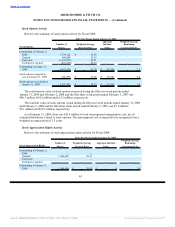

On November 13, 2008, the Company executed an agreement (the “UBS Agreement”) with UBS AG

(“UBS”), a Swiss corporation, relating to ARS with a par value of approximately $76.5 million (“UBS

ARS”) as of January 31, 2009. By entering into the UBS Agreement, UBS received the right to purchase

these UBS ARS at par, commencing on November 13, 2008. The Company received a right (“Put

Option”) to sell the UBS ARS back to UBS at par, at the Company’s sole discretion, commencing on

June 30, 2010. Upon acceptance of the UBS Agreement, the Company no longer had the intention to hold

the UBS ARS until maturity. Therefore, the impairment could no longer be considered temporary. As a

result, the Company transferred the UBS ARS with a par value of $76.5 million from available-for-sale

securities to trading securities and simulataneously recognized an other-than-temporary impairment of

$14.0 million in other income in the fourth quarter of Fiscal 2008.

See Note 6, “Fair Value” for further discussion on the valuation of the ARS.

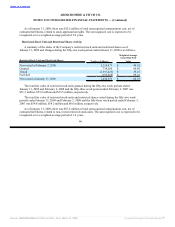

The irrevocable rabbi trust (the “Rabbi Trust”) is intended to be used as a source of funds to match

respective funding obligations to participants in the Abercrombie & Fitch Nonqualified Savings and

Supplemental Retirement Plan (I), the Abercrombie & Fitch Nonqualified Savings and Supplemental

Retirement Plan (II) and the Chief Executive Officer Supplemental Executive Retirement Plan. The Rabbi

Trust assets are consolidated in accordance with Emerging Issues Task Force Issue No. 97-14,

“Accounting for Deferred Compensation Agreements Where Amounts Earned Are Held in a Rabbi Trust

and Invested”

68

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠