Abercrombie & Fitch 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

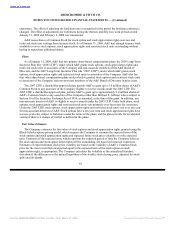

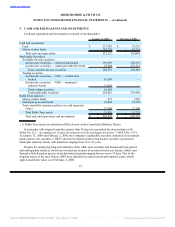

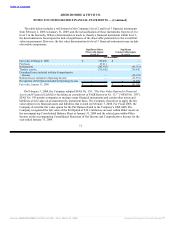

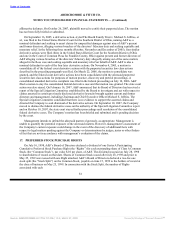

7. PROPERTY AND EQUIPMENT

Property and equipment, at cost, consisted of (thousands):

2008 2007

Land $ 32,302 $ 32,302

Building 235,738 193,344

Furniture, fixtures and equipment 628,195 540,114

Information technology 138,096 81,110

Leasehold improvements 1,143,656 977,947

Construction in progress 114,280 177,887

Other 47,017 51,571

Total $ 2,339,284 $ 2,054,275

Less: Accumulated depreciation and amortization 940,629 735,984

Property and equipment, net $ 1,398,655 $ 1,318,291

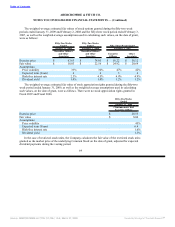

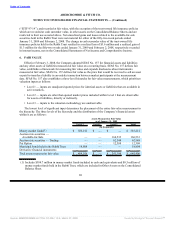

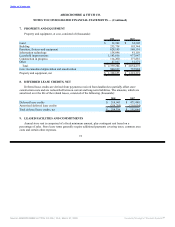

8. DEFERRED LEASE CREDITS, NET

Deferred lease credits are derived from payments received from landlords to partially offset store

construction costs and are reclassified between current and long-term liabilities. The amounts, which are

amortized over the life of the related leases, consisted of the following (thousands):

2008 2007

Deferred lease credits $ 514,041 $ 471,498

Amortized deferred lease credits (259,705) (219,834)

Total deferred lease credits, net $ 254,336 $ 251,664

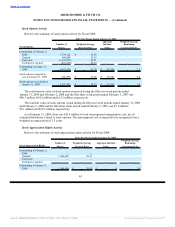

9. LEASED FACILITIES AND COMMITMENTS

Annual store rent is comprised of a fixed minimum amount, plus contingent rent based on a

percentage of sales. Store lease terms generally require additional payments covering taxes, common area

costs and certain other expenses.

72

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠