Abercrombie & Fitch 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

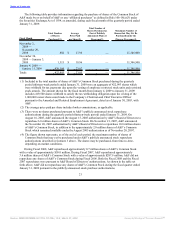

Marketing, General and Administrative Expense

Marketing, general and administrative expense during the fourth quarter of Fiscal 2008 decreased

2.1% to $101.0 million compared to $103.2 million during the comparable period in Fiscal 2007. The

reduction in the marketing, general and administrative expense included savings in incentive

compensation and benefits, travel and outside services. The marketing, general and administrative expense

rate (marketing, general and administrative expense divided by net sales) was 10.1%, up 1.7 percentage

points from 8.4% in the fourth quarter of Fiscal 2007.

Other Operating Income, Net

Fourth quarter other operating income for Fiscal 2008 was $5.5 million compared to $3.0 million for

the fourth quarter of Fiscal 2007. Other operating income included gift cards for which the Company has

determined the likelihood of redemption to be remote for Fiscal 2008 and Fiscal 2007, as well as losses on

foreign currency transactions for Fiscal 2007. In Fiscal 2008, other operating income also included an

other-than-temporary loss of $14.0 million related to the Company’s trading auction rate securities, offset

by a gain on the related put option of $12.3 million.

Operating Income

Operating income for the fourth quarter of Fiscal 2008 decreased to $124.6 million from

$337.1 million in the comparable period in Fiscal 2007. The operating income rate (operating income

divided by net sales) for the fourth quarter of Fiscal 2008 was 12.5% compared to 27.4% for the fourth

quarter of Fiscal 2007.

Interest Income, Net and Income Tax Expense

Fiscal 2008 fourth quarter interest income was $2.5 million, offset by interest expense of $1.1 million

compared to interest income of $6.6 million, offset by interest expense of $0.2 million in the fourth

quarter of Fiscal 2007. The decrease in interest income was primarily due to a lower average rate of return

on investments. The increase in interest expense was due to borrowings made under the unsecured credit

agreement in Fiscal 2008.

The effective tax rate for the fourth quarter of Fiscal 2008 was 45.7% compared to 36.9% for the

Fiscal 2007 comparable period. The fourth quarter of Fiscal 2008 tax rate reflects a charge of $9.9 million

to tax expense as a result of the Chairman and Chief Executive Officer’s (“CEO”) new employment

agreement, which pursuant to section 162(m) results in the exclusion of previously recognized tax

benefits. Under the previous employment agreement, the Company recorded deferred tax assets based on

the anticipated delivery of benefits to the CEO in the calendar year following the year of his retirement.

As a result of the new employment agreement, the CEO receives the benefits during his employment;

therefore the expected tax benefits are no longer available.

Net Income and Net Income per Share

Net income for the fourth quarter of Fiscal 2008 was $68.4 million versus $216.8 million for the

fourth quarter of Fiscal 2007. Net income per diluted weighted-average share outstanding for the fourth

quarter of Fiscal 2008 was $0.78, including a non-cash, after-tax charge of $0.21 associated with the

impairment of store-related assets and a charge to tax expense of $0.11 related to the execution of the

CEO’s new employment agreement, which pursuant to Section 162(m) of the Internal Revenue Code

resulted in the

30

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠