Abercrombie & Fitch 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

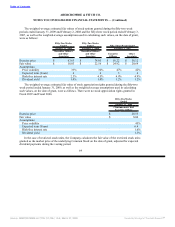

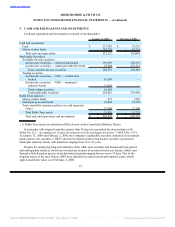

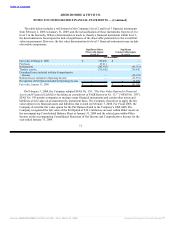

The table below includes a roll forward of the Company’s level 2 and level 3 financial instruments

from February 2, 2008 to January 31, 2009, and the reclassification of these instruments from level 2 to

level 3 in the hierarchy. When a determination is made to classify a financial instrument within level 3,

the determination is based upon the lack of significance of the observable parameters to the overall fair

value measurement. However, the fair value determination for level 3 financial instruments may include

observable components.

Significant Other Significant

Observable Inputs Unobservable Inputs

(Level 2) (Level 3)

(In thousands)

Fair value, February 2, 2008 $ 530,486 $ —

Purchases 49,411 —

Redemptions (242,955) (65,718)

Tranfers (out)/in (336,942) 336,942

Unrealized losses included in Other Comprehensive

Income — (28,192)

Realized losses included in Operating Income — (13,951)

Recognition of Put Option included in Operating Income — 12,309

Fair value, January 31, 2009 $ — $ 241,390

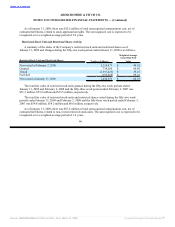

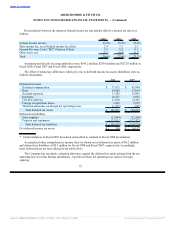

On February 3, 2008, the Company adopted SFAS No. 159, “The Fair Value Option for Financial

Assets and Financial Liabilities-Including an amendment of FASB Statement No. 115” (“SFAS No. 159”).

SFAS No. 159 permits companies to measure many financial instruments and certain other assets and

liabilities at fair value on an instrument by instrument basis. The Company elected not to apply the fair

value option to its financial assets and liabilities that existed on February 3, 2008. For Fiscal 2008, the

Company elected the fair value option for the Put Option related to the Company’s UBS ARS. The

Company recognized the fair value of the Put Option of $12.3 million as an asset within Other Assets on

the accompanying Consolidated Balance Sheet at January 31, 2009 and the related gain within Other

Income on the accompanying Consolidated Statement of Net Income and Comprehensive Income for the

year ended January 31, 2009.

71

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠