Abercrombie & Fitch 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

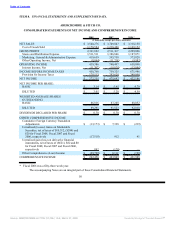

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

long-lived assets relating to the Company’s international operations as of January 31, 2009 and

February 2, 2008 were not material and were not reported separately from domestic revenues and

long-lived assets.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

PRINCIPLES OF CONSOLIDATION

The consolidated financial statements include the accounts of A&F and its subsidiaries. All

intercompany balances and transactions have been eliminated in consolidation.

CASH AND EQUIVALENTS

Cash and equivalents include amounts on deposit with financial institutions and investments,

primarily held in money market accounts, with original maturities of less than 90 days. Outstanding

checks at year-end are reclassified from cash to liabilities in the Consolidated Balance Sheets.

INVESTMENTS

Investments with original maturities greater than 90 days are accounted for in accordance with

SFAS No. 115, “Accounting for Certain Investments in Debt and Equity Securities” (“SFAS No. 115”).

See Note 5, “Cash and Equivalents and Investments” for additional detail.

CREDIT CARD RECEIVABLES

As part of the normal course of business, the Company has approximately three to four days of sales

transactions outstanding with its third-party credit card vendors at any point. The Company classifies

these outstanding balances as receivables.

INVENTORIES

Inventories are principally valued at the lower of average cost or market utilizing the retail method.

The Company determines market value as the anticipated future selling price of the merchandise less a

normal margin. Therefore, an initial markup is applied to inventory at cost in order to establish a

cost-to-retail ratio. Permanent markdowns, when taken, reduce both the retail and cost components of

inventory on hand so as to maintain the already established cost-to-retail relationship. At first and third

fiscal quarter end, the Company reduces inventory value by recording a valuation reserve that represents

the estimated future anticipated selling price decreases necessary to sell-through the current season

inventory. At second and fourth fiscal quarter end, the Company reduces inventory value by recording a

valuation reserve that represents the estimated future selling price decreases necessary to sell-through any

remaining carryover inventory from the season just passed. The valuation reserve was $9.1 million,

$5.4 million and $6.8 million at January 31, 2009, February 2, 2008 and February 3, 2007, respectively.

The inventory balance was $372.4 million and $333.2 million at January 31, 2009 and February 2, 2008,

respectively.

Additionally, as part of inventory valuation, inventory shrinkage estimates, based on historical trends

from actual physical inventories, are made that reduce the inventory value for lost or stolen items. The

Company performs physical inventories throughout the year and adjusts the shrink reserve accordingly.

The

55

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠