Abercrombie & Fitch 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

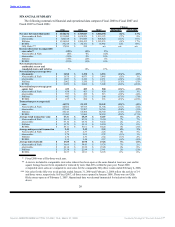

store sales performance, while stores located in the South, Midwest and West regions had the weakest

comparable store sales performance on a consolidated basis.

From a merchandise classification standpoint across all brands, stronger performing masculine

categories included graphic tees, fragrance and fleece, while pants, jeans and knits posted negative

comparable sales. In the feminine businesses, across all brands, stronger performing categories included

graphics tees, jeans and sweaters, while knits and fleece posted negative comparable sales.

Direct-to-consumer net merchandise sales, which are sold through the Company’s websites and

catalogue, in the fourth quarter of Fiscal 2007 were $108.6 million, an increase of 45.2% versus the

previous year’s fourth quarter net merchandise sales of $74.8 million. Shipping and handling revenue for

the corresponding periods was $15.6 million in Fiscal 2007 and $9.8 million in Fiscal 2006. The

direct-to-consumer business, including shipping and handling revenue, accounted for 10.1% of total net

sales in the fourth quarter of Fiscal 2007 compared to 7.4% in the fourth quarter of Fiscal 2006. The

increase was driven by store expansion, both domestically and internationally, improved in-stock

inventory availability, an improved targeted e-mail marketing strategy and improved website

functionality.

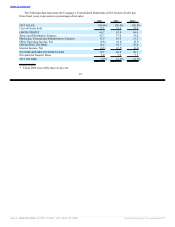

Gross Profit

Gross profit during the fourth quarter of Fiscal 2007 was $825.6 million compared to $755.6 million

for the comparable period in Fiscal 2006. The gross profit rate for the fourth quarter of Fiscal 2007 was

67.2%, up 80 basis points from the fourth quarter of Fiscal 2006 rate of 66.4%. The increase in gross

profit rate can be attributed to both a higher IMU rate and a lower shrink rate compared to the fourth

quarter of Fiscal 2006, partially offset by a higher markdown rate.

Stores and Distribution Expense

Stores and distribution expense for the fourth quarter of Fiscal 2007 was $388.4 million compared to

$349.8 million for the comparable period in Fiscal 2006. The stores and distribution expense rate for the

fourth quarter of Fiscal 2007 was 31.6%, up 90 basis points from 30.7% in the fourth quarter of Fiscal

2006. The increase in rate was primarily related to the impact of minimum wage and management salary

increases and higher store fixed cost rates.

Marketing, General and Administrative Expense

Marketing, general and administrative expense during the fourth quarter of Fiscal 2007 was

$103.2 million compared to $101.6 million during the same period in Fiscal 2006. For the fourth quarter

of Fiscal 2007, the marketing, general and administrative expense rate was 8.4% compared to 8.9% in the

fourth quarter of Fiscal 2006. The decrease in the marketing, general and administrative expense rate was

a result of lower travel, samples and outside service expense rates, partially offset by an increase in the

home office payroll expense rate.

Other Operating Income, Net

Fourth quarter net other operating income for Fiscal 2007 was $3.0 million compared to $4.6 million

for the fourth quarter of Fiscal 2006. The decrease was driven primarily by losses on foreign currency

transactions in the fourth quarter of Fiscal 2007 as compared to gains on foreign currency transactions in

the fourth quarter of Fiscal 2006.

33

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠