Abercrombie & Fitch 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

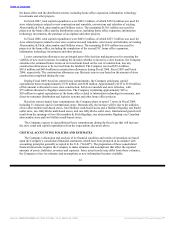

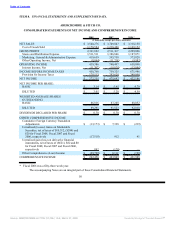

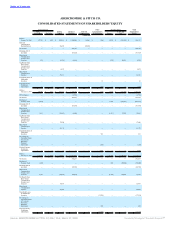

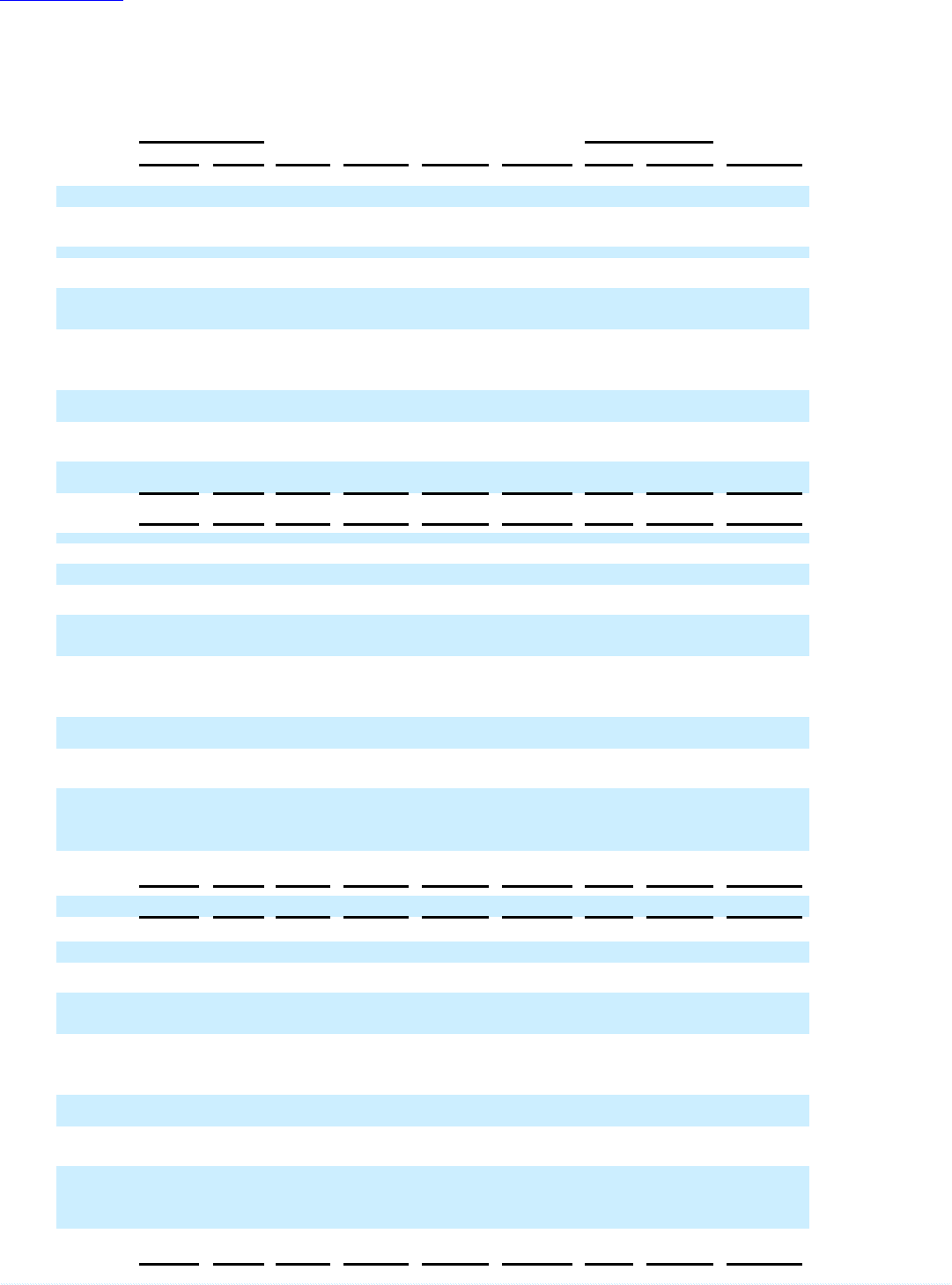

ABERCROMBIE & FITCH CO.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Common Stock Other Treasury Stock Total

Shares Paid-In Retained Deferred Comprehensive At Average Shareholders’

Outstanding Par Value Capital Earnings Compensation (Loss) Income Shares Cost Equity

(Thousands)

Balance,

January 28, 2006 87,726 $ 1,033 $ 229,261 $ 1,290,208 $ 26,206 $ (796) 15,574 $ (550,795) $ 995,117

Deferred

Compensation

Reclassification — — 26,206 — (26,206) — — — —

Net Income — — — 422,186 — — — — 422,186

Dividends ($0.70

per share) — — — (61,623) — — — — (61,623)

Share-based

Compensation

Issuances and

Exercises 574 — (6,326) (4,481) — — (574) 20,031 9,224

Tax Benefit from

Share-based

Compensation

Issuances and

Exercises — — 5,472 — — — — — 5,472

Share-based

Compensation

Expense — — 35,119 — — — — — 35,119

Unrealized Gains on

Marketable

Securities — — — — — 41 — — 41

Foreign Currency

Translation

Adjustments — — — — — (239) — — (239)

Balance,

February 3, 2007 88,300 $ 1,033 $ 289,732 $ 1,646,290 $ — $ (994) 15,000 $ (530,764) $ 1,405,297

FIN 48 Impact — — — (2,786) — — — — (2,786)

Net Income — — — 475,697 — — — — 475,697

Purchase of

Treasury Stock (3,654) — — — — — 3,654 (287,916) (287,916)

Dividends ($0.70

per share) — — — (61,330) — — — — (61,330)

Share-based

Compensation

Issuances and

Exercises 1,513 — (19,051) (6,408) — — (1,513) 57,928 32,469

Tax Benefit from

Share-based

Compensation

Issuances and

Exercises — — 17,600 — — — — — 17,600

Share-based

Compensation

Expense — — 31,170 — — — — — 31,170

Unrealized Gains on

Marketable

Securities — — — — — 912 — — 912

Net Change in

Unrealized Gains

or Losses on

Derivative

Financial

Instruments — — — — — (128) — — (128)

Foreign Currency

Translation

Adjustments — — — — — 7,328 — — 7,328

Balance,

February 2, 2008 86,159 $ 1,033 $ 319,451 $ 2,051,463 $ — $ 7,118 17,141 $ (760,752) $ 1,618,313

Net Income — — — 272,255 — — — — 272,255

Purchase of

Treasury Stock (682) — — — — — 682 (50,000) (50,000)

Dividends ($0.70

per share) — — — (60,769) — — — — (60,769)

Share-based

Compensation

Issuances and

Exercises 2,159 — (49,844) (18,013) — — (2,159) 104,554 36,697

Tax Benefit from

Share-based

Compensation

Issuances and

Exercises — — 16,839 — — — — — 16,839

Share-based

Compensation

Expense — — 42,042 — — — — — 42,042

Unrealized Losses

on Marketable

Securities — — — — — (17,518) — — (17,518)

Net Change in

Unrealized Gains

or Losses on

Derivative

Financial

Instruments — — — — — 892 — — 892

Foreign Currency

Translation

Adjustments — — — — — (13,173) — — (13,173)

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠