Abercrombie & Fitch 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

IRS Appeals Division for Fiscal 2007 concerning the federal tax treatment of state and local incentive

payments. State and foreign returns are generally subject to examination for a period of three to five years

after the filing of the respective return. The Company has various state income tax returns in the process

of examination or administrative appeals. Additionally the Company is before the U.S. Competent

Authority for a transfer pricing matter that is the subject of an ongoing Advanced Pricing Agreement

negotiation.

The Company does not expect material adjustments to the total amount of unrecognized tax benefits

within the next 12 months, but the outcome of tax matters is uncertain and unforeseen results can occur.

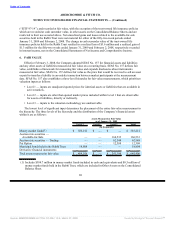

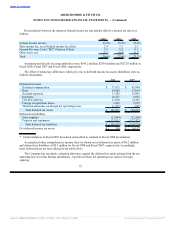

13. DEBT

On April 15, 2008, the Company entered into a syndicated unsecured credit agreement (the “New

Credit Agreement”) under which up to $450 million is available. The New Credit Agreement replaced the

Credit Agreement, dated as of November 14, 2002, as amended and restated as of December 15, 2004 (the

“Original Credit Agreement”), which had been due to expire on December 15, 2009. The primary

purposes of the New Credit Agreement are for trade and stand-by letters of credit in the ordinary course of

business, as well as to fund working capital, capital expenditures, acquisitions and investments, and other

general corporate purposes.

The New Credit Agreement has several borrowing options, including interest rates that are based on

(i) a Base Rate, payable quarterly, or (ii) an Adjusted Eurodollar Rate (as defined in the New Credit

Agreement) plus a margin based on a Leverage Ratio, payable at the end of the applicable interest period

for the borrowing. The Base Rate represents a rate per annum equal to the higher of (a) National City

Bank’s then publicly announced prime rate or (b) the Federal Funds Effective Rate (as defined in the New

Credit Agreement) as then in effect plus 1/2 of 1%. The facility fees payable under the New Credit

Agreement are based on the Company’s Leverage Ratio (i.e., the ratio, on a consolidated basis, of (a) the

sum of total debt (excluding trade letters of credit) plus 600% of forward minimum rent commitments to

(b) consolidated earnings before interest, taxes, depreciation, amortization and rent (“Consolidated

EBITDAR”) for the trailing four-consecutive-fiscal-quarter periods. The facility fees accrue at a rate of

0.125% to 0.225% per annum based on the Leverage Ratio for the most recent determination date. In

addition, a utilization fee is payable under the New Credit Agreement when the aggregate credit facility

exposure, excluding trade letters of credit, exceeds 50% of the total lender commitments then in effect, at

a rate per annum equal to 0.100% of the aggregate credit facility exposure for each day it is at such a

level. No utilization fee had been incurred as of January 31, 2009.

The terms of the New Credit Agreement also provide for customary representations and warranties

and affirmative covenants, as well as customary negative covenants providing limitations, subject to

negotiated carve-outs, on indebtedness, liens, significant corporate changes including mergers and

acquisition transactions with third parties, investments, loans, advances and guarantees in or for the

benefit of third parties, hedge agreements, restricted payments (including dividends and stock

repurchases), transactions with affiliates, and restrictive agreements, among others. The New Credit

Agreement requires that the Leverage Ratio not be greater than 3.75 to 1.00 at any time. The Company’s

Leverage Ratio was 2.13 as of January 31, 2009. The New Credit Agreement also requires that the ratio

for A&F and its subsidiaries on a consolidated basis of (i) Consolidated EBITDAR for the trailing

four-consecutive-fiscal-quarter period to (ii) the sum of,

77

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠