Abercrombie & Fitch 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

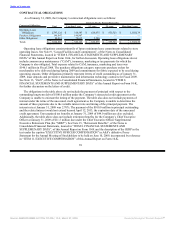

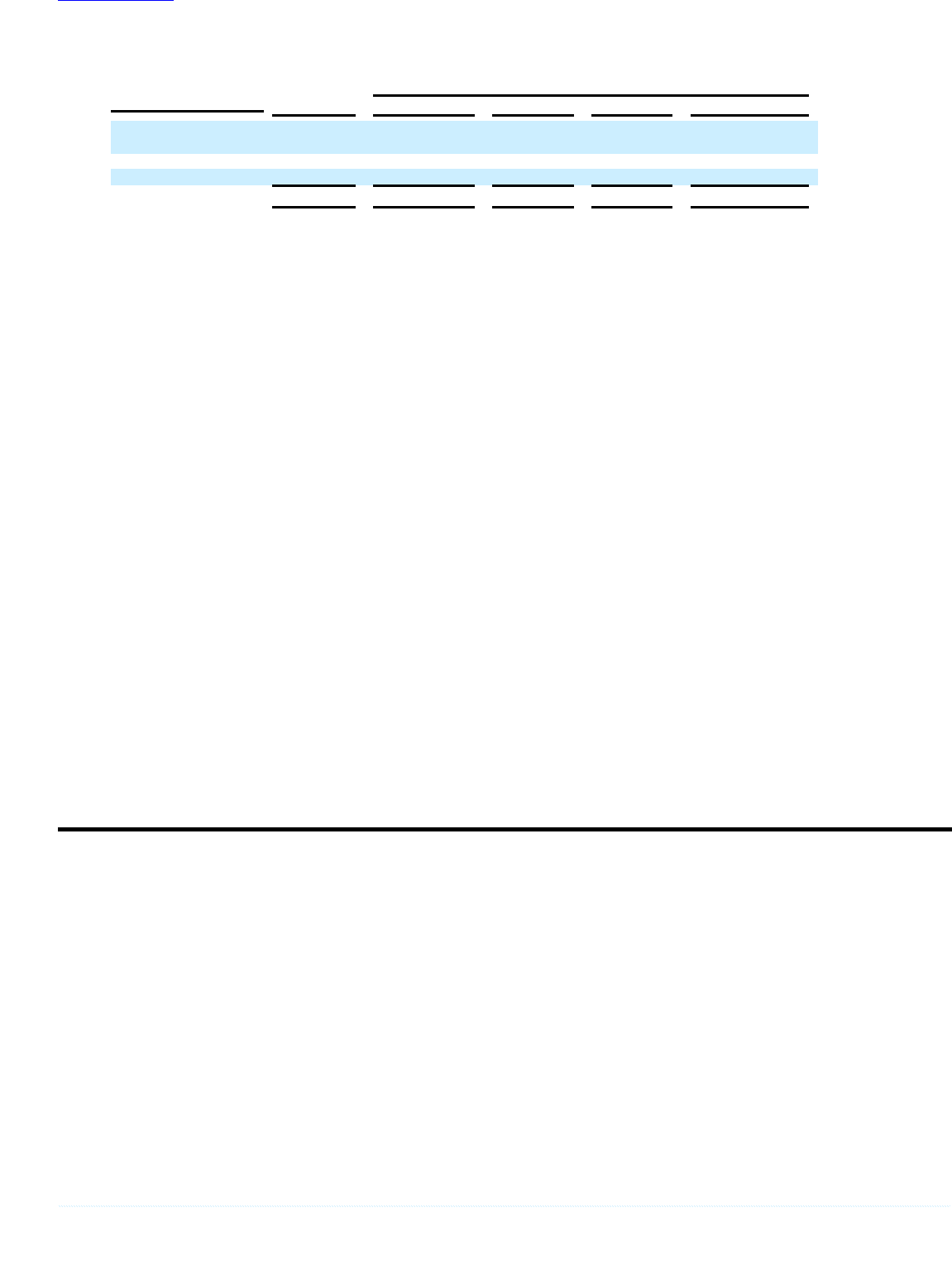

CONTRACTUAL OBLIGATIONS

As of January 31, 2009, the Company’s contractual obligations were as follows:

Payments Due by Period (Thousands)

Contractual Obligations Total Less than 1 year 1-3 years 3-5 years More than 5 years

Operating Lease

Obligations $ 2,797,124 $ 314,587 $ 624,675 $ 555,723 $ 1,302,139

Purchase Obligations 146,947 146,947 — — —

Other Obligations 80,812 78,612 2,200 — —

Totals $ 3,024,883 $ 540,146 $ 626,875 $ 555,723 $ 1,302,139

Operating lease obligations consist primarily of future minimum lease commitments related to store

operating leases. See Note 9, “Leased Facilities and Commitments”, of the Notes to Consolidated

Financial Statements, located in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENARY

DATA” of this Annual Report on Form 10-K, for further discussion. Operating lease obligations do not

include common area maintenance (“CAM”), insurance, marketing or tax payments for which the

Company is also obligated. Total expense related to CAM, insurance, marketing and taxes was

$146.1 million in Fiscal 2008. The purchase obligations category represents purchase orders for

merchandise to be delivered during Spring 2009 and commitments for fabric expected to be used during

upcoming seasons. Other obligations primarily represent letters of credit outstanding as of January 31,

2009, lease deposits and preventive maintenance and information technology contracts for Fiscal 2009.

See Note 13, “Debt”, of the Notes to Consolidated Financial Statements, located in “ITEM 8.

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this Annual Report on Form 10-K,

for further discussion on the letters of credit.

The obligations in the table above do not include the payment of principal with respect to the

outstanding long-term debt of $100.0 million under the Company’s unsecured credit agreement as the

Company is unable to estimate the timing of the payment. The table also does not include payments of

interest under the terms of the unsecured credit agreement as the Company is unable to determine the

amount of these payments due to the variable interest rate and timing of the principal payment. The

interest rate at January 31, 2009 was 2.70%. The payment of the $100.0 million in principal outstanding

and the related interest would not extend beyond April 12, 2013, the expiration date of the unsecured

credit agreement. Unrecognized tax benefits at January 31, 2009 of $44.0 million are also excluded.

Additionally, the table above does not include retirement benefits for the Company’s Chief Executive

Officer at January 31, 2009 of $11.5 million due under the Chief Executive Officer Supplemental

Executive Retirement Plan (the “SERP”). See Note 15, “Retirement Benefits”, of the Notes to

Consolidated Financial Statements, located in “ITEM 8. FINANCIAL STATEMENTS AND

SUPPLEMENARY DATA”, of this Annual Report on Form 10-K and the description of the SERP in the

text under the caption “EXECUTIVE OFFICER COMPENSATION” in A&F’s definitive Proxy

Statement for the Annual Meeting of Stockholders to be held on June 10, 2009, incorporated by reference

in “ITEM 11. EXECUTIVE COMPENSATION” of this Annual Report on Form 10-K.

39

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠