Abercrombie & Fitch 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

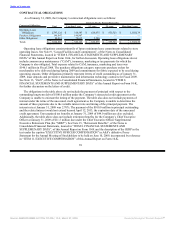

outstanding letters of credit, under its unsecured credit agreement. Assuming no changes in the

Company’s financial structure, if market interest rates average an increase of 100 basis points over the

next fifty-two week period compared to the interest rates for the fifty-two week period ended January 31,

2009, interest expense for the fifty-two week period ended January 30, 2010 would increase by

approximately $1.0 million. This amount was determined by calculating the effect of the average

hypothetical interest rate increase on the Company’s variable rate unsecured credit agreement. This

hypothetical increase in interest rate for the fifty-two week period ended January 30, 2010 may be

different from the actual increase in interest expense from a 100 basis point increase in interest rates due

to varying interest rate reset dates under the Company’s unsecured credit agreement.

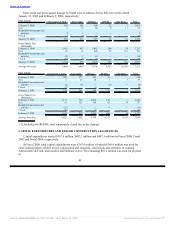

The irrevocable rabbi trust (the “Rabbi Trust”), established by the Company in the third quarter of

Fiscal 2006, is intended to be used as a source of funds to match respective funding obligations to

participants in the Abercrombie & Fitch Nonqualified Savings and Supplemental Retirement Plan (I), the

Abercrombie & Fitch Nonqualified Savings and Supplemental Retirement Plan (II) and the Chief

Executive Officer Supplemental Executive Retirement Plan. As of January 31, 2009, total assets held in

the Rabbi Trust were $51.8 million, which included $18.8 million of available-for-sale municipal notes

and bonds with maturities that ranged from three to five years, trust-owned life insurance policies with a

cash surrender value of $32.5 million and $0.5 million held in money market funds. The Rabbi Trust

assets are consolidated in accordance with Emerging Issues Task Force Issue No. 97-14, “Accounting for

Deferred Compensation Arrangements Where Amounts Earned are Held in a Rabbi Trust and Invested,”

and recorded at fair value, with the exception of the trust-owned life insurance policies which are recorded

at cash surrender value, in other assets on the Consolidated Balance Sheet and are restricted as to their use

as noted above. Net unrealized gains and losses related to the available-for-sale securities held in the

Rabbi Trust were not material for the thirteen and fifty-two week periods ended January 31, 2009 and

February 2, 2008, respectively. The change in cash surrender value of the trust-owned life insurance

policies held in the Rabbi Trust resulted in a realized gain of $0.2 million for the thirteen weeks ended

January 31, 2009 and a realized loss of $3.6 million for the fifty-two weeks ended January 31, 2009,

respectively. The change in cash surrender value of the trust-owned life insurance policies held in the

Rabbi Trust resulted in a realized loss of $0.2 million for the thirteen weeks ended February 2, 2008 and a

realized gain of $1.3 million for the fifty-two weeks ended February 2, 2008, respectively.

The Company has exposure to changes in currency exchange rates associated with foreign currency

transactions, including inter-company transactions. Such foreign currency transactions are denominated in

Euros, Canadian Dollars, Japanese Yen, Danish Krones, Swiss Francs, Hong Kong Dollars and British

Pounds. The Company has established a program that primarily utilizes foreign currency forward

contracts to partially offset the risks associated with the effects of certain foreign currency exposures.

Under this program, increases or decreases in foreign currency exposures are partially offset by gains or

losses on forward contracts, to mitigate the impact of foreign currency transaction gains or losses. The

Company does not use forward contracts to engage in currency speculation. All outstanding foreign

currency forward contracts are recorded at fair value at the end of each fiscal period.

49

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠