Abercrombie & Fitch 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

FINANCIAL CONDITION

Liquidity and Capital Resources

The Company had $522.1 million in cash and equivalents available as of January 31, 2009, as well as

an additional $350 million available (less outstanding letters of credit) under its unsecured credit

agreement, as described in Note 13, “Debt” of the Notes to Consolidated Financial Statements in

“ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this Annual Report on

Form 10-K. In addition, on March 6, 2009, the Company entered into a secured, uncommitted, demand

line of credit offered under the settlement agreement entered into by the Company and UBS AG (“UBS”),

a Swiss corporation, relating to Auction Rate Securities (“ARS”) with a par value of approximately

$76.5 million as of January 31, 2009. As of March 6, 2009, the Company could borrow $44.3 million

under this agreement. The amount available to the Company fluctuates with the fair value of the related

ARS.

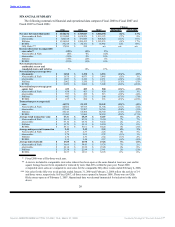

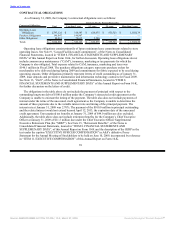

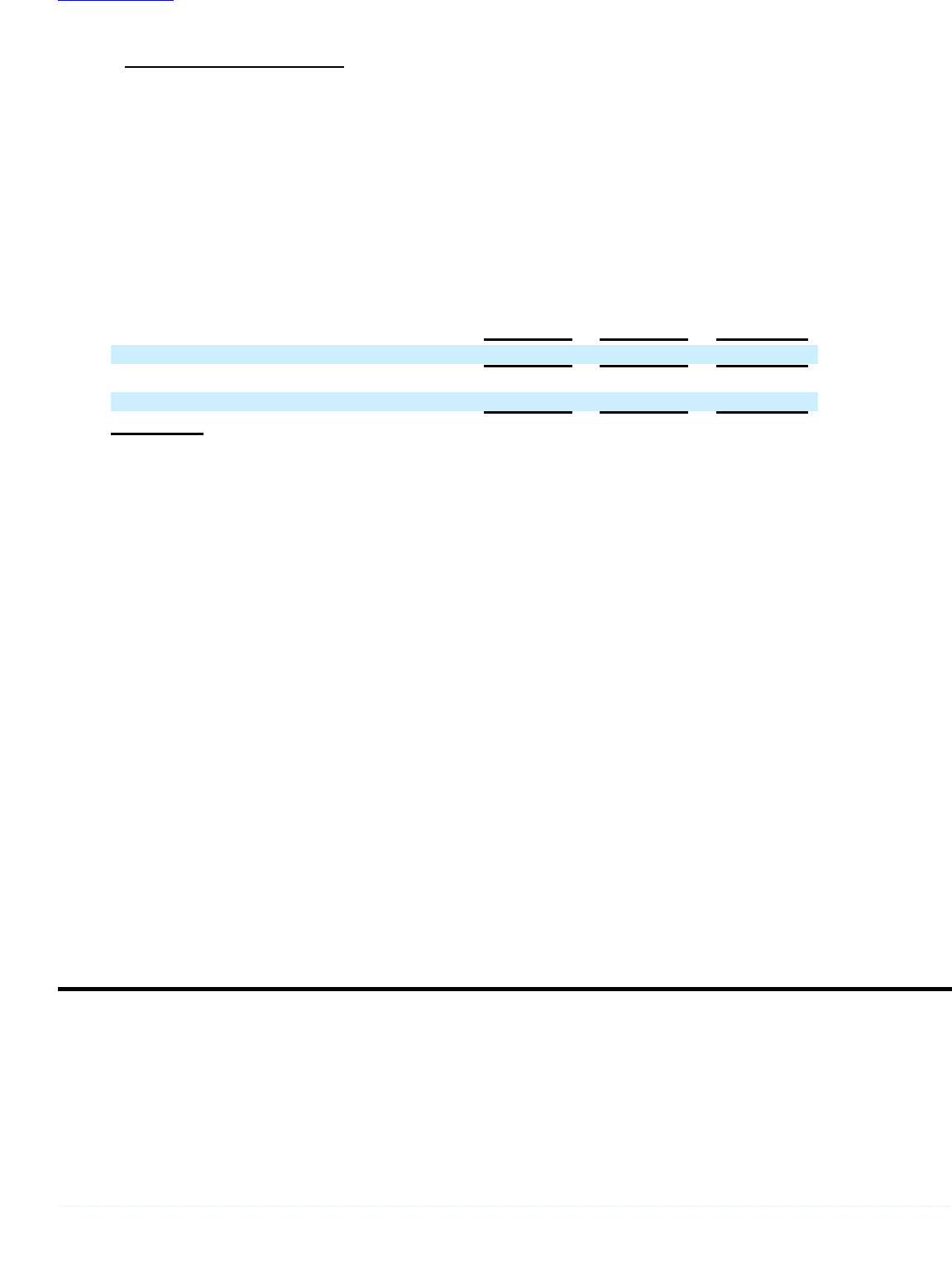

A summary of the Company’s working capital (current assets less current liabilities) and

capitalization at the end of each of the last three fiscal years follows (thousands):

2008 2007 2006*

Working capital $ 635,028 $ 597,142 $ 581,451

Capitalization:

Shareholders’ equity $ 1,845,578 $ 1,618,313 $ 1,405,297

* Fiscal 2006 was a fifty-three week year.

The increase in working capital for Fiscal 2008 as compared to Fiscal 2007 was the result of cash

generated from operations and the $100.0 million borrowed under the Company’s unsecured credit

agreement, partially offset by the reclassification of ARS from current assets to non-current assets and

cash used to fund capital expenditures and dividends. The increase in working capital in Fiscal 2007 as

compared to Fiscal 2006 was the result of higher cash and ARS, resulting primarily from cash generated

from operations, partially offset by capital expenditures for expansion, share repurchases and dividends

paid.

The ARS have maturities ranging from 10 to 34 years. Despite the underlying long-term maturity of

the ARS, such securities have been historically priced and subsequently traded as short-term investments

because of an interest-rate reset feature, which reset through a Dutch auction process at predetermined

periods ranging from seven to 35 days. Due to the frequent nature of the reset feature, ARS were

classified as current assets and reported at par, which approximated fair value. As of February 2, 2008,

$530.5 million of ARS were classified as current assets on the Consolidated Balance Sheet.

On February 13, 2008, the Company began to experience failed auctions. Based on the failure rate of

these auctions, the frequency of the failures and the overall lack of liquidity in the ARS market, the

Company determined that the ARS should be classified as non-current assets on the Consolidated Balance

Sheets for periods ending subsequent to February 13, 2008 and that the fair value of the ARS no longer

approximated par value. As of January 31, 2009, $229.1 million of ARS were classified as non-current

assets on the Consolidated Balance Sheet.

On November 13, 2008, the Company entered into an agreement with UBS, relating to ARS with a

par value of approximately $76.5 million (“UBS ARS”) as of January 31, 2009. By entering into the

agreement, UBS received the right to purchase these UBS ARS at par, commencing on November 13,

2008. The

36

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠