Abercrombie & Fitch 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

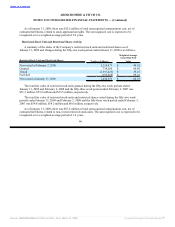

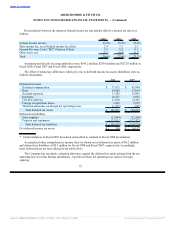

(“EITF 97-14”), and recorded at fair value, with the exception of the trust-owned life insurance policies

which are recorded at cash surrender value, in other assets on the Consolidated Balance Sheets and are

restricted to their use as noted above. Net unrealized gains and losses related to the available-for-sale

securities held in the Rabbi Trust were not material for either of the fifty-two week periods ended

January 31, 2009 and February 2, 2008. The change in cash surrender value of the trust-owned life

insurance policies held in the Rabbi Trust resulted in a realized loss of $3.6 million and a realized gain of

$1.3 million for the fifty-two weeks ended January 31, 2009 and February 2, 2008, respectively recorded

in interest income, net on the Consolidated Statements of Net Income and Comprehensive Income.

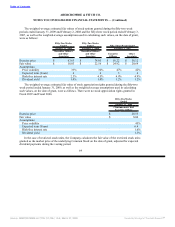

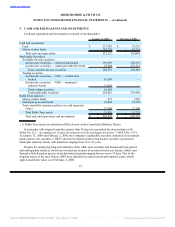

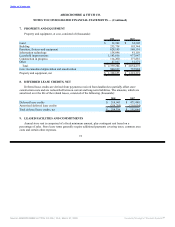

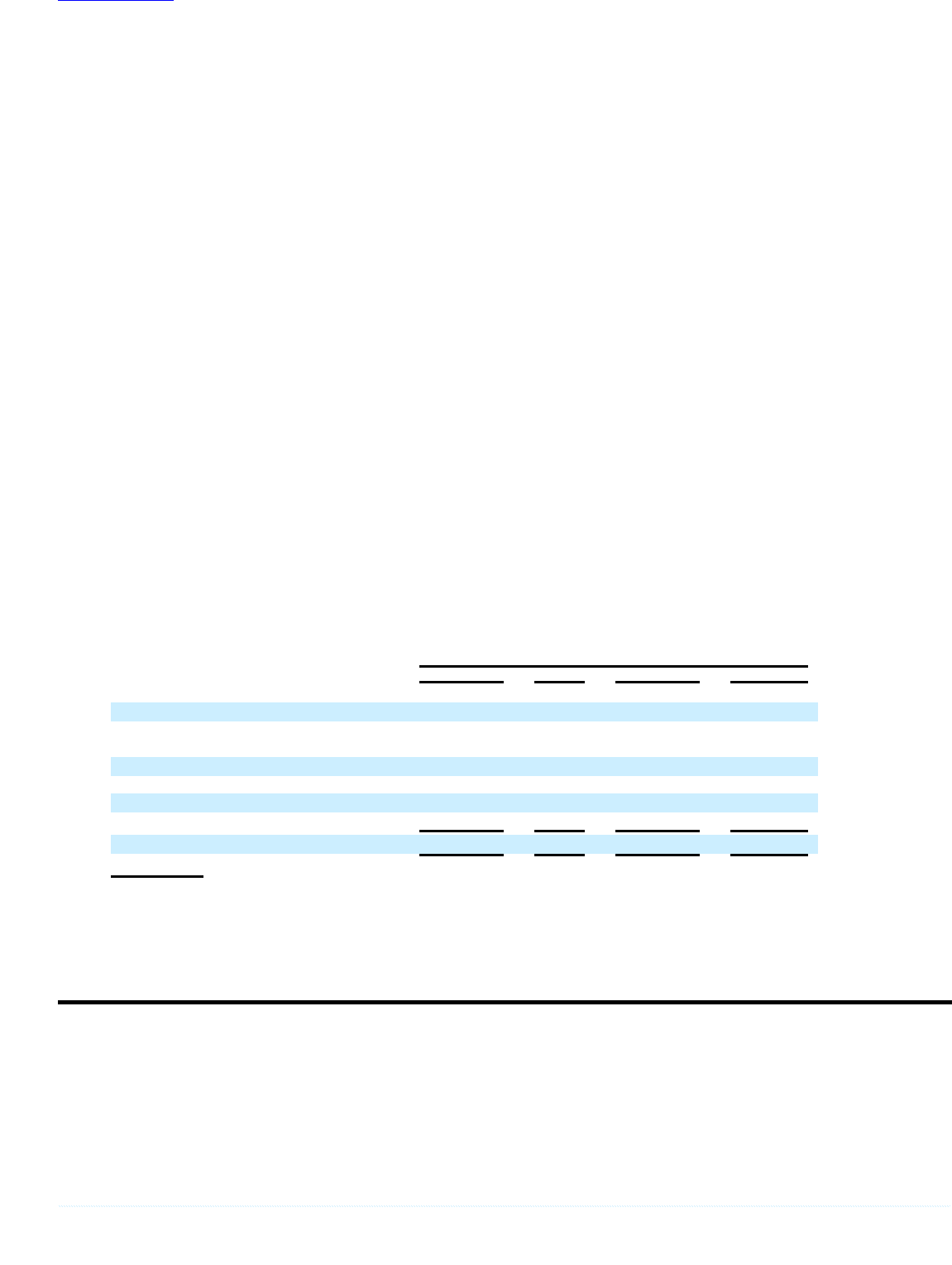

6. FAIR VALUE

Effective February 3, 2008, the Company adopted SFAS No. 157 for financial assets and liabilities

and any other assets or liabilities measured at fair value on a recurring basis. SFAS No. 157 defines fair

value, establishes a framework for measuring fair value and expands disclosures about instruments

measured at fair value. SFAS No. 157 defines fair value as the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between market participants at the measurement

date. SFAS No. 157 also establishes a three-level hierarchy for fair value measurements, which prioritizes

valuation inputs as follows:

• Level 1 — inputs are unadjusted quoted prices for identical assets or liabilities that are available in

active markets.

• Level 2 — inputs are other than quoted market prices included within Level 1 that are observable

for assets or liabilities, directly or indirectly.

• Level 3 — inputs to the valuation methodology are unobservable.

The lowest level of significant input determines the placement of the entire fair value measurement in

the hierarchy. The three levels of the hierarchy and the distribution of the Company’s financial assets

within it are as follows:

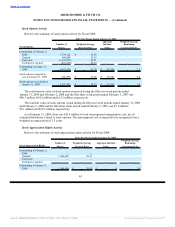

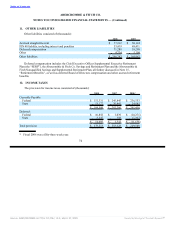

Assets Measured at Fair Value

as of January 31, 2009

Level 1 Level 2 Level 3 Total

(In thousands)

Money market funds(1) $ 385,212 $ — $ — $ 385,212

Auction rate securities —

Available-for-Sale — — 166,533 166,533

Auction rate securities — Trading — — 62,548 62,548

Put Option — — 12,309 12,309

Municipal bonds held in the Rabbi Trust 18,804 — — 18,804

Derivative financial instruments — — — —

Total assets measured at fair value $ 404,016 $ — $ 241,390 $ 645,406

(1) Includes $384.7 million in money market funds included in cash and equivalents and $0.5 million of

money market funds held in the Rabbi Trust, which are included in Other Assets on the Consolidated

Balance Sheet.

69

Source: ABERCROMBIE & FITCH CO /DE/, 10-K, March 27, 2009 Powered by Morningstar® Document Research℠