TomTom 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

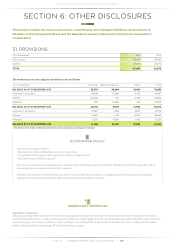

CONSOLIDATED FINANCIAL STATEMENTS

TOMTOM / ANNUAL REPORT AND ACCOUNTS 2015 / 97

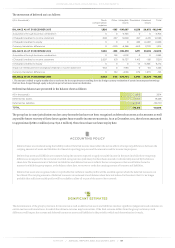

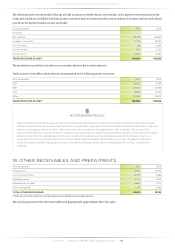

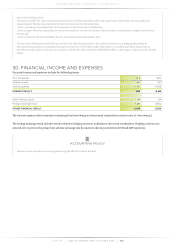

20. OTHER FINANCIAL ASSETS/LIABILITIES

Other financial assets/liabilities include derivative financial instruments carried at fair value through profit or loss.

(€ in thousands) 2015 2014

Assets Liabilities Assets Liabilities

Derivatives at fair value through profit or loss 967 -573 1,186 -23

The notional principle amounts of the outstanding forward foreign exchange and option contracts on 31 December 2015 were €58

million (2014: €54 million). All the group's outstanding options and forwards have a contractual maturity of less than one year. The

group does not apply hedge accounting.

ACCOUNTING POLICY

Derivatives are initially and subsequently measured at fair value. Gains or losses arising from changes in fair value of derivatives are

recognised in the income statement, except for derivatives designated as hedging instruments, in a highly effective hedge relationship, for

which cash flow hedge accounting is applied. Transaction costs are expensed in the income statement.

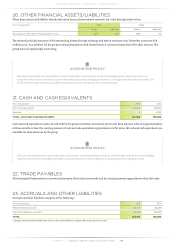

21. CASH AND CASH EQUIVALENTS

(€ in thousands) 2015 2014

Cash and equivalents 147,565 148,614

Deposits 0 4,335

TOTAL CASH AND CASH EQUIVALENTS 147,565 152,949

Cash and cash equivalents consist of cash held by the group sometimes invested in short-term bank deposits with an original maturity

of three months or less. The carrying amount of cash and cash equivalents approximates its fair value. All cash and cash equivalents are

available for immediate use by the group.

ACCOUNTING POLICY

Cash and cash equivalents are stated at face value and comprise cash on hand, deposits held on call with banks, and other short-term highly

liquid investments that are readily convertible to a known amount of cash and subject to an insignificant risk of changes in value.

22. TRADE PAYABLES

All trade payable balances have a contractual maturity of less than six months and the carrying amount approximates their fair value.

23. ACCRUALS AND OTHER LIABILITIES

Accruals and other liabilities comprise of the following:

(€ in thousands) 2015 2014

Margin-related accruals165,140 64,238

Operating expenses accruals 78,648 86,456

TOTAL 143,788 150,694

1. Margin-related accruals include items such as sales return allowance, rebates and stock protection accrual.