TomTom 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONSOLIDATED FINANCIAL STATEMENTS

TOMTOM / ANNUAL REPORT AND ACCOUNTS 2015 / 93

The main assets and liabilities that arose from all acquisitions combined were intangible assets of €24.5 million and deferred tax

liabilities of €3.7 million. None of the acquisitions resulted in goodwill.

As none of the transactions are material individually, they are not disclosed separately in accordance with IFRS 3.

ACCOUNTING POLICY

The group applies the acquisition method to account for business combinations. The consideration transferred for the acquisition of a

subsidiary is the fair value of the assets transferred, the liabilities incurred to the former owners of the acquiree and the equity interests issued

by the group. The consideration transferred includes the fair value of any asset or liability resulting from a contingent consideration

arrangement. Acquisition-related costs are expensed as incurred.

Identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination are measured initially at their fair

values at the acquisition date. The group recognises any non-controlling interest in the acquiree on an acquisition-by-acquisition basis, either

at fair value or at the non-controlling interest's proportionate share of the recognised amounts of acquiree's identifiable net assets.

Acquisition of additional interest in associates, which results in the group gaining control over the associate, is accounted for as a business

combination. The previously held interest in the associate is considered as part of the consideration and hence is remeasured to its fair value.

The gain or loss from this remeasurement is included in the 'Result of associates' in the income statement. The associate is accounted for as a

subsidiary and included in the consolidated financial statements from the date the control passes to the group.

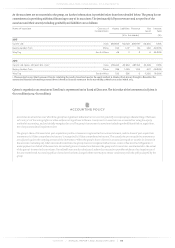

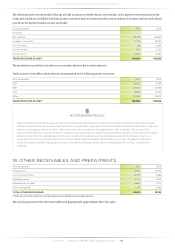

16. INVESTMENTS IN ASSOCIATES

As of 31 December 2015, the group held non-controlling interests in a number of associates: Cyient Ltd. ('Cyient'), WayTag (Pty) Ltd.

(WayTag) and Beijing Golden Tom Information Technology Co. Ltd. (Beijing Golden Tom). Cyient provides content development and

support services. WayTag is a South Africa-based company that allows people and businesses to create a unique location identifier that

either refers to a fixed location or to an individual's current location. Although our Chinese activities will continue, Beijing Golden

Tom is in process to be liquidated.

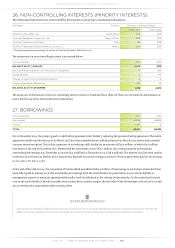

The movements in the investments in associates can be specified as follows:

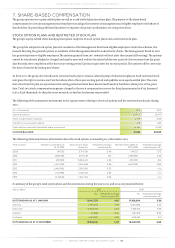

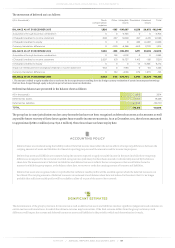

(€ in thousands) 2015 2014

BALANCE AS AT 1 JANUARY 3,289 2,854

Result of associates1167 536

Dividend received -167 -117

Other direct equity movements 257 16

BALANCE AS AT 31 DECEMBER 3,546 3,289

1. The group's share in 'Other comprehensive income' of the associates are presented under 'Other direct equity movements' in the table above.