TomTom 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONSOLIDATED FINANCIAL STATEMENTS

TOMTOM / ANNUAL REPORT AND ACCOUNTS 2015 / 85

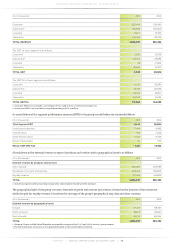

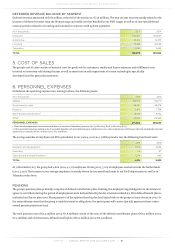

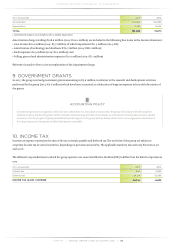

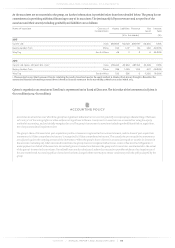

(€ in thousands) 2015 2014

Amortisation1108,609 102,089

Depreciation 14,487 12,622

TOTAL 123,096 114,711

1. Amortisation charge in 2015 includes an €11.5 million impairment.

Amortisation charge totalling €108.6 million (2014: €102.1 million) are included in the following line items in the Income Statement:

Cost of sales: €21.0 million (2014: €5.7 million) of which impairment €11.5 million (2014: nil);

●

Amortisation of technology and databases: €76.7 million (2014: €88.1 million);

●

R&D expenses: €0.9 million (2014: €2.2 million); and

●

Selling, general and administration expenses: €10.0 million (2014: €6.1 million)

●

Reference is made to Note 14 for an explanation of the impairment charge.

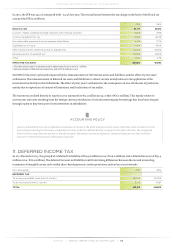

9. GOVERNMENT GRANTS

In 2015, the group received government grants amounting to €5.6 million, in relation to the research and development activities

performed by the group (2014: €4.7 million) which have been accounted as a deduction of wage tax expense in line with the nature of

the grants.

ACCOUNTING POLICY

Government grants are recognised at their fair value when there is a reasonable assurance that the group will comply with the conditions

attached to them, and that the grants will be received. Government grants that are receivable as compensation for expenses or losses already

incurred, or for the purpose of giving immediate financial support to the group with no future related costs, are recognised as a deduction of

the related expense in the period in which they become receivable.

10. INCOME TAX

Income tax expense represents the sum of the tax currently payable and deferred tax. The activities of the group are subject to

corporate income tax in several countries, depending on presence and activity. The applicable statutory tax rates vary between 12.5%

and 41.0%.

The different tax jurisdictions in which the group operates can cause the Effective Tax Rate (ETR) to differ from the Dutch corporate tax

rate.

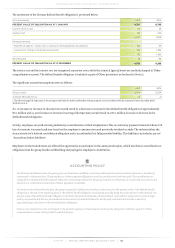

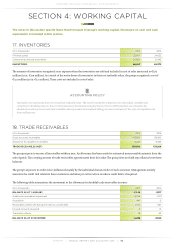

(€ in thousands) 2015 2014

Current tax -880 4,054

Deferred tax -24,914 -12,086

INCOME TAX (GAIN) / EXPENSE -25,794 -8,032