TomTom 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONSOLIDATED FINANCIAL STATEMENTS

TOMTOM / ANNUAL REPORT AND ACCOUNTS 2015 / 96

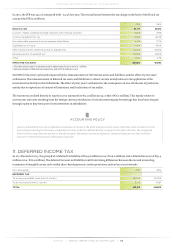

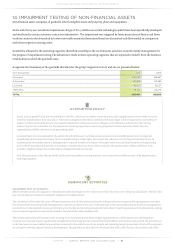

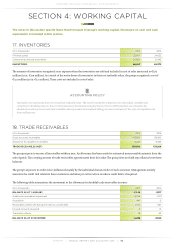

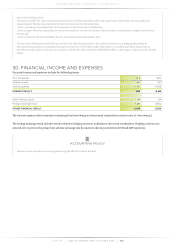

The following table sets out details of the age of trade accounts receivable that are not overdue, as the payment terms specified in the

terms and conditions established with the group's customers have not been exceeded, and an analysis of overdue amounts and related

provisions for doubtful trade accounts receivable:

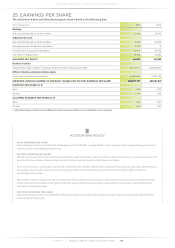

(€ in thousands) 2015 2014

Of which:

Not overdue 134,891 118,289

Overdue < 3 months 4,128 13,422

3 to 6 months 199 2,826

Over 6 months 3,611 2,275

less provision -4,236 -3,546

TRADE RECEIVABLES (NET) 138,593 133,266

The provisions recorded in 2015 and 2014 are mainly related to the overdue amounts.

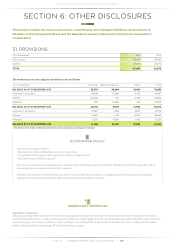

Trade accounts receivable include amounts denominated in the following major currencies:

(€ in thousands) 2015 2014

EUR 78,923 71,358

GBP 20,764 24,785

USD 18,898 22,914

Other 20,008 14,209

TRADE RECEIVABLES (NET) 138,593 133,266

ACCOUNTING POLICY

Trade receivables are initially recognised at fair value, and subsequently measured at amortised cost (if the time value is material), using the

effective interest method, less provision for impairment. A provision for impairment of trade receivables is established when there is objective

evidence that the group will not be able to collect all amounts due, according to the original terms of the receivables. The amount of the

provision is the difference between the asset's carrying amount and the present value of estimated future cash flows, discounted at the original

effective interest rate. The carrying amount of the asset is reduced through the use of an allowance account and the amount of the loss is

recognised in the income statement within 'Cost of sales'. When a trade receivable is uncollectible, it is written off against the allowance

account for trade receivables. Subsequent recoveries of amounts previously written off are credited against 'Cost of sales' in the income

statement.

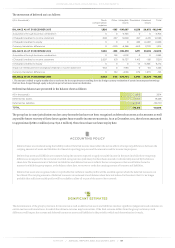

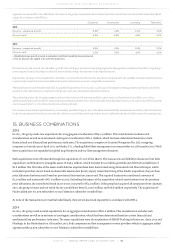

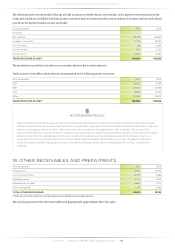

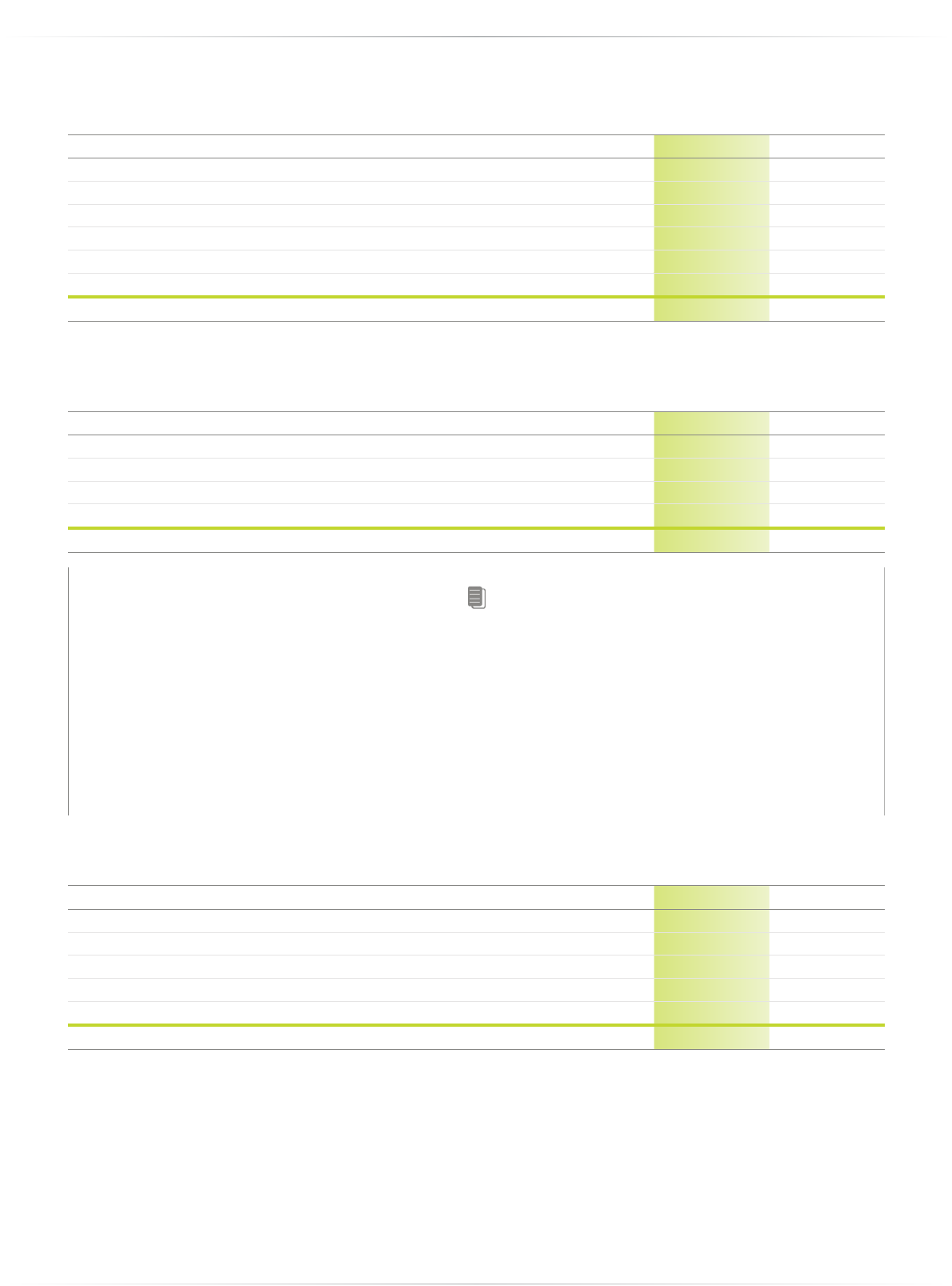

19. OTHER RECEIVABLES AND PREPAYMENTS

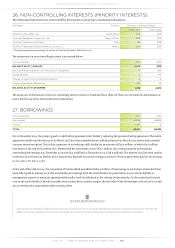

(€ in thousands) 2015 2014

Prepayments 21,905 12,673

VAT and other taxes 9,770 3,389

Unbilled revenue 14,150 9,475

Deferred cost of sales14,603 4,721

Other receivables 3,105 2,940

TOTAL OTHER RECEIVABLES 53,533 33,198

1. Deferred cost of sales related to cost of providing services which have been paid in advance.

The carrying amount of the other receivables and prepayments approximates their fair value.