TomTom 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONSOLIDATED FINANCIAL STATEMENTS

TOMTOM / ANNUAL REPORT AND ACCOUNTS 2015 / 77

Control is achieved when the parent is exposed to, or has rights

to variable returns from its involvement with the investee and

has the ability to affect those returns through its power over the

investee. Where necessary, adjustments are made to the financial

statements of subsidiaries to bring their accounting policy in

line with the group.

All intercompany transactions, balances and unrealised gains

and losses on transactions between group companies are

eliminated.

FOREIGN CURRENCIES

The company's primary activities are denominated in euros.

Accordingly, the euro is the company's functional currency,

which is also the group's presentation currency. Items included

in the financial information of individual entities in the group

are measured using the individual entity's functional currency,

which is the currency of the primary economic environment in

which the entity operates.

Transactions and balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing on the dates of the

transactions. At each balance sheet date, monetary items

denominated in foreign currencies are retranslated at the rates

prevailing at the balance sheet date. Non-monetary items that are

measured in terms of historical cost in a foreign currency are not

retranslated.

Foreign exchange gains and losses resulting from the settlement

of such transactions and from the translation at year-end

exchange rates of monetary assets and liabilities denominated in

foreign currencies are recognised under 'Other financial result'

in the income statement, except for gains and losses that arise

from intercompany borrowings that form part of net investment

in subsidiaries which are recognised in 'Other comprehensive

income'.

Group companies and foreign operations

For consolidation purposes, the assets and liabilities of entities

that have a functional currency other than the group's

presentation currency are translated at the closing rate at the

date of the balance sheet, whereas the income statement is

translated at the average exchange rate for the period.

Translation differences arising thereon are recognised in 'Other

comprehensive income'.

CASH FLOW STATEMENTS

Cash flow statements are prepared using the indirect method.

Cash flows from derivative instruments are classified

consistently with the nature of the instrument.

3. ACCOUNTING ESTIMATES

The preparation of these financial statements requires

management to make certain assumptions, estimates and

judgements that affect the reported amounts of assets, liabilities

and disclosure of contingent assets and liabilities as of the date of

the consolidated financial statements and the reported amounts

of revenues and expenses during the reporting period. Actual

results may differ from those estimates. The estimates and

underlying assumptions are reviewed on an ongoing basis.

Revisions to accounting estimates are recognised in the period in

which the estimate is revised if the revision affects only that

period or in the period of revision and the future periods if the

revision affects both current and future periods.

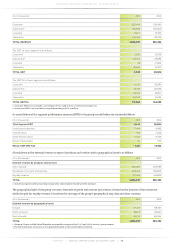

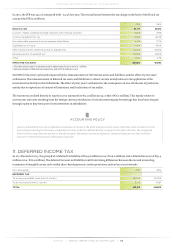

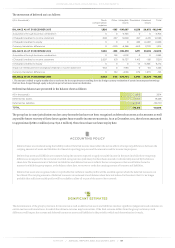

The table below presents the areas that involve a higher degree of

judgement or areas where assumptions and estimates are

significant to the financial statements:

Note

Revenue recognition 4

Internally generated intangible assets 12

Impairment of non-financial assets 14

Income tax 10 - 11

Provisions and contingent assets / liabilities 31 - 32

Detailed explanations of the degree of judgement and

assumptions used are included under each of the respective

sections in the notes to the financial statements as referenced

above.