TomTom 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONSOLIDATED FINANCIAL STATEMENTS

TOMTOM / ANNUAL REPORT AND ACCOUNTS 2015 / 94

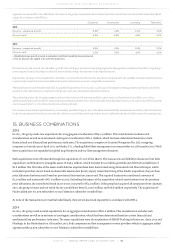

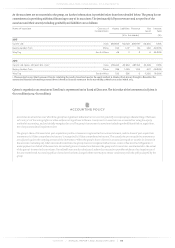

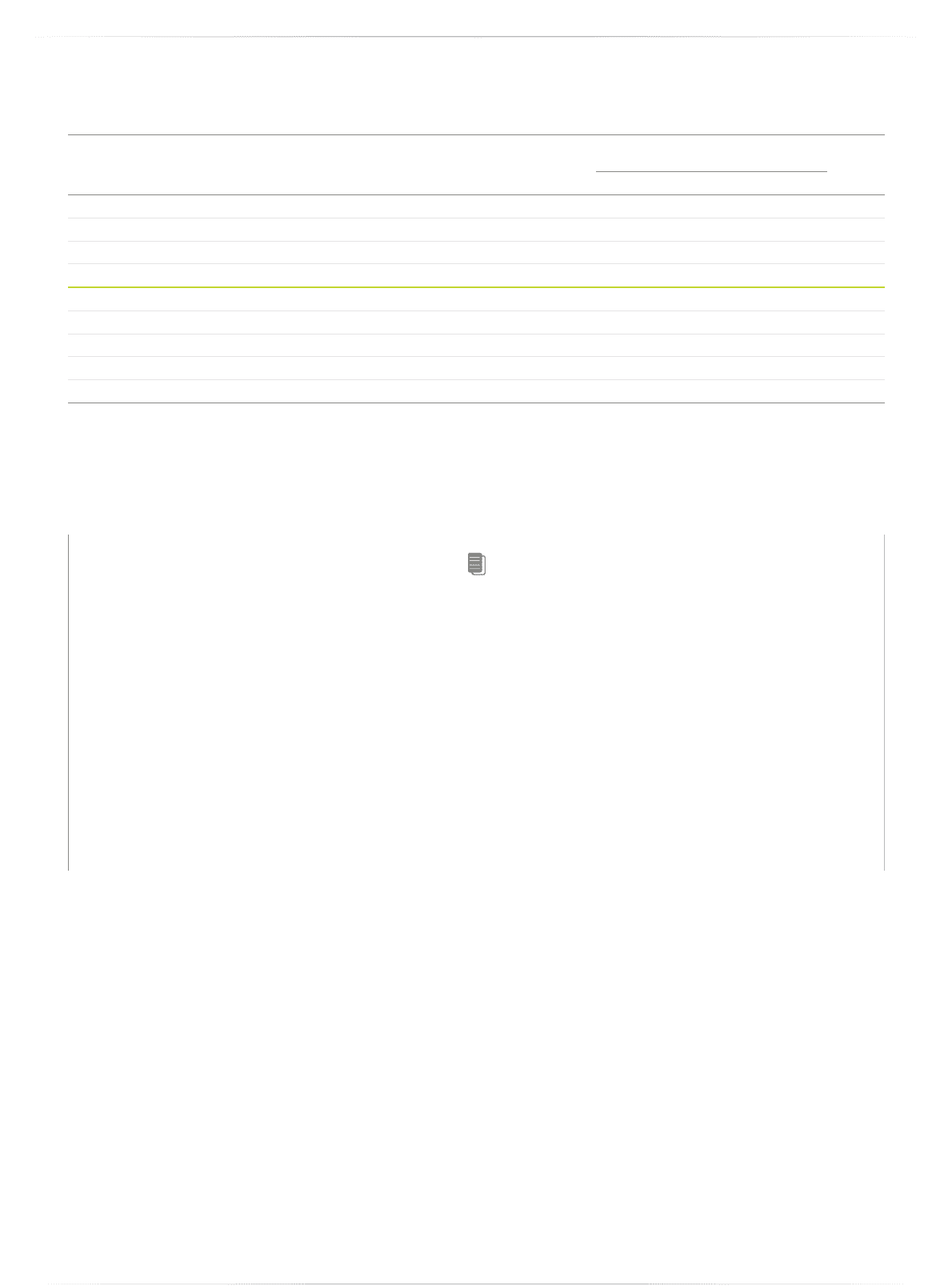

As the associates are not material to the group, no further information is provided other than those detailed below. The group has no

commitment in providing additional financing to any of its associates. The (estimated) full year revenues and net profits of the

associates and their assets (excluding goodwill) and liabilities are as follows:

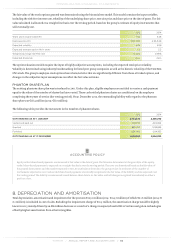

Name of associate Country of

incorporation

Assets Liabilities Revenue Net

result

Interest

held

(€ in thousands) (%)

2015

Cyient Ltd.1India 358,605 102,149 406,997 50,304 1.35%

Beijing Golden Tom China 106 1,217 132 294 49.00%

WayTag South Africa 48 11 0 6 26.00%

2014

Cyient Ltd. (prev. Infotech Ent. Ltd.)1India 255,243 46,954 287,021 34,339 1.35%

Beijing Golden Tom China 788 1,489 1,124 -637 49.00%

WayTag South Africa 106 596 0 -1,200 16.00%

1. This associate has a 31 March year-end. Data for calculating the result of associate, based on the equity method, is obtained from January through to December. The

summarised financial information presented above is based on financial statements for the year ending 31 March 2015 and 31 March 2014.

Cyient is regarded as an associate as TomTom is represented on its Board of Directors. The fair value of the investment in Cyient is

€10.0 million (2014: €10.1million).

ACCOUNTING POLICY

Associates are all entities over which the group has significant influence but not control, generally accompanying a shareholding of between

20% and 50% of the voting rights, or other evidence of significant influence. Investments in associates are accounted for using the equity

method of accounting, and are initially recognised at cost. The group's investment in associates includes goodwill identified on acquisition,

net of any accumulated impairment loss.

The group's share of its associates' post-acquisition profits or losses is recognised in the income statement, and its share of post-acquisition

movements in 'Other comprehensive income' is recognised in 'Other comprehensive income'. The cumulative post-acquisition movements

are adjusted against the carrying amount of the investment. When the group's share of losses in an associate equals or exceeds its interest in

the associate, including any other unsecured receivables, the group does not recognise further losses, unless it has incurred obligations or

made payments on behalf of the associate. Unrealised gains on transactions between the group and its associates are eliminated to the extent

of the group's interest in the associates. Unrealised losses are also eliminated, unless the transaction provides evidence of an impairment of

the asset transferred. Accounting policy of associates has been changed where necessary to ensure consistency with the policy adopted by the

group.