TomTom 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONSOLIDATED FINANCIAL STATEMENTS

TOMTOM / ANNUAL REPORT AND ACCOUNTS 2015 / 82

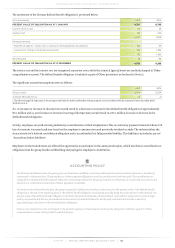

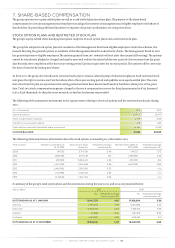

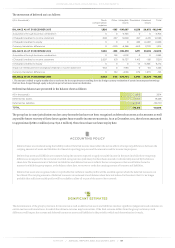

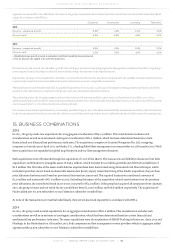

The movement of the German-defined benefit obligation is presented below:

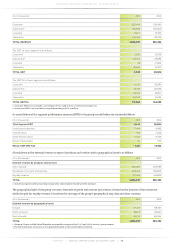

(€ in thousands) 2015 2014

PRESENT VALUE OF OBLIGATION AS AT 1 JANUARY 8,383 6,763

Current service cost 60 36

Interest cost 192 229

8,635 7,028

Remeasurements:

- Experience (gains) / losses due to change in demographical assumptions -130 59

- Losses from change in financial assumptions 265 1,394

135 1,453

Benefits paid -35 -98

PRESENT VALUE OF OBLIGATION AS AT 31 DECEMBER 8,735 8,383

The service cost and the interest cost are recognised as pension costs, while the actuarial (gains)/losses are credited/charged to 'Other

comprehensive income'. The defined benefit obligation is included as part of 'Other provisions' as disclosed in Note 31.

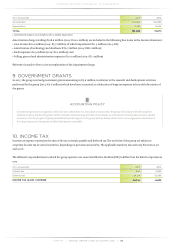

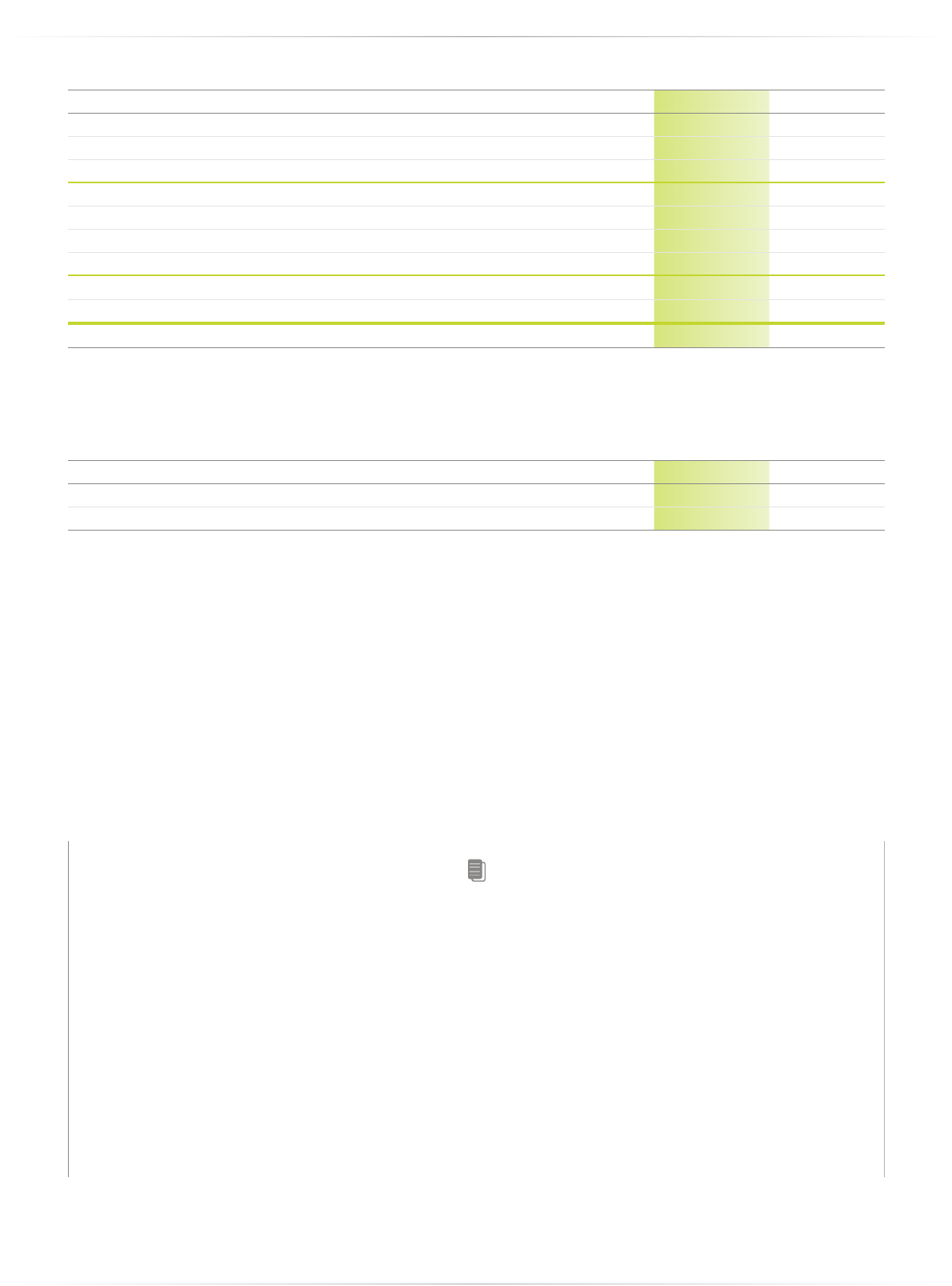

The significant actuarial assumptions were as follows:

2015 2014

Discount rate 2.10% 2.30%

Average life expectancy120 21

1. The above average life expectancy is the average actual value for males and females retiring at age 65 set in accordance with the common German mortality tables

'Heubeck 2005 G'.

A 0.1% increase or decrease in discount rate would result in a decrease or increase in the defined benefit obligation of approximately

€0.1 million and a 1-year increase or decrease in average life expectancy would result in a €0.1 million increase or decrease in the

defined benefit obligation.

In Italy, employees are paid a leaving indemnity on termination of their employment. This is a statutory payment based on Italian civil

law. An amount is accrued each year based on the employee's remuneration and previously revalued accruals. The indemnity has the

characteristics of a defined contribution obligation and is an unfunded, but fully provided liability. This liability is included as part of

'Accruals and other liabilities'.

Employees in the United States are offered the opportunity to participate in the 401K pension plan, which involves no contribution or

obligation from the group besides withholding and paying the employee's contribution.

ACCOUNTING POLICY

For defined contribution plans, the group pays contributions to publicly or privately administered pension insurance plans on a mandatory,

contractual or voluntary basis. The group has no further payment obligations once the contributions have been paid. The contributions are

recognised as employee benefit expenses when service has been rendered to the group. Prepaid contributions are recognised as an asset to the

extent that a cash refund or reduction of future payments is available.

In relation to the defined benefit plan, the group recognised a liability on the balance sheet based on the present value of the defined benefit

obligation at the end of the reporting period. The defined benefit obligation is calculated annually using the projected unit credit method. The

present value of the defined benefit obligation is determined by discounting the estimated future cash outflows using interest rates of high-

quality corporate bonds that are denominated in the currency in which the benefits will be paid, and which have terms to maturity

approximating to the terms of the related pension obligation.

Service costs and interest costs are charged to the pension expenses. Actuarial gains and losses are charged or credited to equity in 'Other

comprehensive income' in the period in which they arise.