Qantas 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

Spirit of Australia

~Notes to the Financial Statements~

for the year ended 30 June 2005

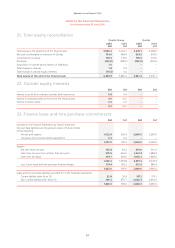

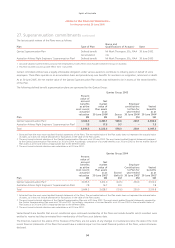

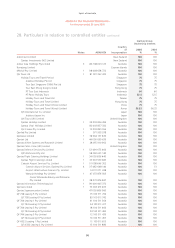

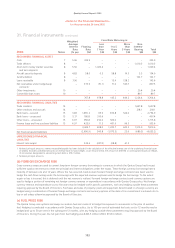

27. Superannuation commitments continued

The last actuarial reviews of the Plans were as follows:

Plan Type of Plan

Name and

Qualifications of Actuary1Date

Qantas Superannuation Plan Defined benefit Mr Mark Thompson, BSc, FIAA 30 June 2002

Accumulation n/a

Australian Airlines Flight Engineers’ Superannuation Plan2Defined benefit Mr Mark Thompson, BSc, FIAA 30 June 2003

1 Actuarial valuations performed by actuary then employed by Towers Perrin (now Russell Investment Group) in Australia.

2 This Plan has been wound up with effect from 1 July 2005.

Certain controlled entities have a legally enforceable obligation under various awards to contribute to industry plans on behalf of some

employees. These Plans operate on an accumulation basis and provide lump sum benefits for members on resignation, retirement or death.

As at 30 June 2005, the net market value of the Qantas Superannuation Plan assets was estimated to be in excess of the vested benefits

of the Plan.

The following defined benefit superannuation plans are sponsored by the Qantas Group:

Qantas Group 2005

Plan

Present

value of

accrued

benefits

as at the

most recent

actuarial

valuation

$M

Net

market

value of

Plan assets

as at

30 June 20041

$M

Excess

$M

Employer

contributions

to Plan for

year ended

30 June 20041

$M

Vested

benefits

as at

30 June 20041

$M

Qantas Superannuation Plan23,636.5 4,205.1 568.6 230.1 4,040.0

Australian Airlines Flight Engineers’ Superannuation Plan37.8 17.5 9.7 – 7.3

Total 3,644.3 4,222.6 578.3 230.1 4,047.3

1 Extracted from the most recent audited financial statements of the Plans. The net market value of the Plan assets does not represent the actuarial value

of assets, as it does not include allowance for fluctuations in the value of the Plans assets.

2 The most recent actuarial valuation of the Qantas Superannuation Plan was as at 30 June 2002. The most recent audited financial statements prepared

by the Qantas Superannuation Plan were as at 30 June 2004. Accordingly, comparison of accrued benefits as at 30 June 2002 to the net market value of

Plan assets as at 30 June 2004 is inappropriate due to the different dates.

3 The most recent actuarial valuation was undertaken as at 30 June 2003.

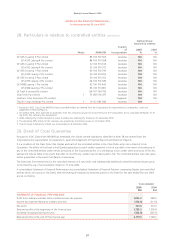

Qantas Group 2004

Plan

Present

value of

accrued

benefits

as at the

most recent

actuarial

valuation

$M

Net

market

value of

Plan assets

as at

30 June 20031

$M

Excess/

(deficit)

$M

Employer

Contributions

to Plan for

year ended

30 June 20031

$M

Vested

benefits

as at

30 June 20031

$M

Qantas Superannuation Plan23,636.5 3,612.0 (24.5) 230.0 3,512.0

Australian Airlines Flight Engineers’ Superannuation Plan37.8 16.7 8.9 – 7.8

Total 3,644.3 3,628.7 (15.6) 230.0 3,519.8

1 Extracted from the most recent audited financial statements of the Plans. The net market value of the Plan assets does not represent the actuarial value

of assets, as it does not include allowance for fluctuations in the value of the Plans assets.

2 The most recent actuarial valuation of the Qantas Superannuation Plan was at 30 June 2002. The most recent audited financial statements prepared by

the Qantas Superannuation Plan were as at 30 June 2003. Accordingly, comparison of accrued benefits as at 30 June 2002 to the net market value of

Plan assets as at 30 June 2003 is inappropriate due to the different dates.

3 The most recent actuarial valuation was undertaken as at 30 June 2003.

Vested benefits are benefits that are not conditional upon continued membership of the Plans and include benefits which members were

entitled to receive had they terminated their membership of the Plans as at balance date.

The Directors, based on the advice of the Trustees of the Plans, are not aware of any changes in circumstances since the date of the most

recent financial statements of the Plans that would have a material impact on the overall financial position of the Plans, unless otherwise

disclosed.