Qantas 2005 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.116

Spirit of Australia

~Notes to the Financial Statements~

for the year ended 30 June 2005

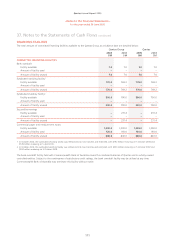

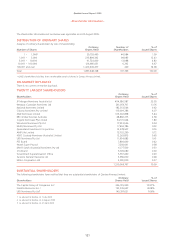

39. Impact of adopting Australian equivalents to

International Financial Reporting Standards continued

(b) DEFINED BENEFIT SUPERANNUATION PLANS

Under A-GAAP, defined benefit plans are accounted for on a cash basis, with no defined benefit liability or asset recognised on the

Statement of Financial Position. Under A-IFRS, the Qantas Group’s net obligation in respect of defined benefit superannuation plans will

be calculated separately for each plan by estimating the amount of future benefit that employees have earned in return for their service

in current and prior periods. The benefit will be discounted to determine its present value and the fair value of any plan assets will be

deducted.

Actuarial gains and losses that arise subsequent to transition date will be recognised to the Statement of Financial Performance according

to the “corridor” method as provided by AASB 119 – Employee Benefits. The “corridor” method recognises movements in the funding

position to the extent they exceed 10 per cent of the greater of the plan’s assets or liabilities.

At the date of transition, an amount of $76.4 million has been recognised as a liability with a consequential decrease in retained earnings

of $53.5 million after a tax benefit of $22.9 million.

The calculation of the funding position under AASB 119 differs from the method applied by the Actuary, conducted in accordance with

the terms of the Trust Deed, to determine Qantas’ contribution to the Plans. The most recent actuarial valuations confirmed that the value

of the Plans’ assets were sufficient to meet all anticipated liabilities. No material change in Qantas’ contribution to the Plans is therefore

anticipated.

Applying A-IFRS to superannuation for the financial year ended 30 June 2005 results in a $57.2 million increase in profit before tax.

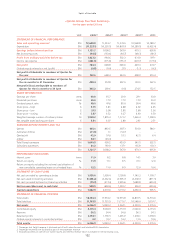

(c) LEASED ASSETS

Aircraft

Under both existing A-GAAP and A-IFRS, Qantas is required to consider the economic substance of the leasing arrangement when

determining the appropriate accounting treatment. In both cases, it is the transfer (or lack thereof) of substantially all the risks and

benefits associated with the leased asset that determines the accounting treatment for both the lessor and lessee.

Where substantially all of the risks and benefits incidental to ownership of the leased asset effectively remain with the lessor, the lease is

an operating lease. Where substantially all of these risks and benefits effectively pass to the lessee, the lease is a finance lease.

Both existing A-GAAP and A-IFRS requires a lease to be classified as either an operating lease or a finance lease at the inception of the

lease. Once determined, the lease classification cannot change without a change in the actual terms of the lease.

The existing A-GAAP standard, AASB 1008 – Leases, provides the following criteria to assist lessees in determining when there has been

an effective passing of substantially all of the risks and benefits incident to ownership. Such risk transfer is presumed where both of the

following criteria are satisfied:

(a) the lease is a non-cancellable lease; and

(b) where either of the following tests are satisfied:

x the lease term is for 75 per cent or more of the remaining economic life of the leased asset; or

x the present value at the beginning of the lease term of the minimum lease payments equals or exceeds 90 per cent of the fair

value of the leased asset at the inception of the lease.

Whilst AASB 117, the A-IFRS equivalent to AASB 1008 – Leases, was stated to be conforming to AASB 1008, this quantitative guidance to

facilitate lease classification is not incorporated within AASB 117.

A review of all aircraft operating leases, applying AASB 117 lease classification criteria, has been completed. As a result of this review,

six aircraft previously classified as operating leases under A-GAAP will require reclassification as finance leases under A-IFRS.

At the date of transition an increase in property, plant and equipment of $337.8 million and an increase in lease liability of $404.8 million

is recognised. The consequential decrease in retained earnings $46.9 million is recognised after a tax benefit of $20.1 million.

Applying A-IFRS to aircraft leases for the financial year ended 30 June 2005 results in a $4.2 million decrease in profit before tax. This is

comprised of a decrease in the operating lease expense of $79.8 million offset by an increase in depreciation of $43.3 million and interest

expense of $40.7 million.

Other Leases

A-IFRS requires the lease expense to be recognised on a straight-line basis. An A-IFRS transition adjustment is therefore required to leases

with a predetermined rent escalation.

At the date of transition an increase in lease liability of $6.6 million and consequential decrease in retained earnings $4.6 million is

recognised after a tax benefit of $2.0 million.

Applying A-IFRS to other leases for the financial year ended 30 June 2005 results in a $12.6 million increase in profit before tax.