Qantas 2005 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.117

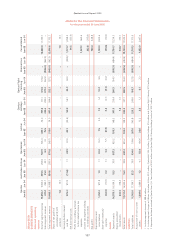

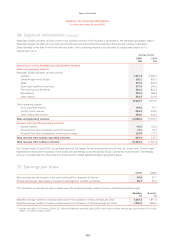

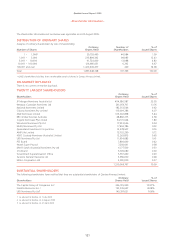

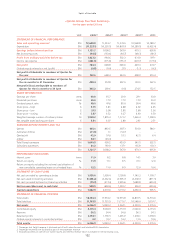

39. Impact of adopting Australian equivalents to

International Financial Reporting Standards continued

(d) PROPERTY, PLANT AND EQUIPMENT

Under both A-GAAP and A-IFRS, items of property, plant and equipment are initially recorded at their cost of acquisition at the date

of acquisition, being the fair value of the consideration provided plus incidental costs directly attributable to the acquisition. Major

modifications to aircraft and the costs associated with placing the aircraft into service are capitalised as part of the cost of the asset to

which they relate.

Transition Exemption

As permitted by AASB 1 – First-Time Adoption of A-IFRS, Qantas has elected to deem the cost of land and buildings under A-IFRS to

be the carrying value at the date of transition. At the date of transition, a decrease in the asset revaluation reserve of $55.5 million

(Qantas: $82.9 million) is recognised with a consequential increase in retained earnings of $55.5 million (Qantas: $82.9 million).

Major Inspections

Under A-GAAP all aircraft maintenance and inspection costs are expensed as incurred. Under A-IFRS, the cost of major inspections of

airframes and engines is capitalised and depreciated over the scheduled usage period to the next major inspection event. All other aircraft

maintenance costs are expensed as incurred.

At the date of transition, a decrease in property, plant and equipment of $58.0 million with a consequential decrease in retained earnings

of $40.6 million is recognised after a tax benefit of $17.4 million.

Applying A-IFRS to aircraft inspection costs for the financial year ended 30 June 2005 results in a $0.4 million increase in aircraft

depreciation and operating costs.

Software Development Costs

Under A-IFRS software development costs that meet the criteria to be recognised as internally generated intangible assets are capitalised.

At the date of transition, a decrease in property, plant and equipment of $141.8 million (Qantas: $141.8 million) and an increase in

intangible assets of $141.8 million (Qantas: $141.8 million) is recognised increasing to $159.9 million (Qantas: $159.6 million) at 30 June

2005. There is no effect on retained earnings.

(e) INCOME TAXES

On transition to A-IFRS the balance sheet method of tax effect accounting will be adopted, rather than the ‘profit and loss’ method

applied currently under A-GAAP. Under the balance sheet approach, income tax on the profit and loss for the year comprises both current

and deferred taxes.

Broadly, temporary differences are differences between the carrying amount of assets and liabilities for financial reporting purposes and

the amount attributed to those assets and liabilities for taxation purposes. Temporary differences may give rise to deferred tax assets or

deferred tax liabilities.

A deferred tax liability is required to be recognised, subject to some exceptions. A deferred tax asset shall be recognised only to the extent

that it is probable that future taxable profits will be available against which the deductible temporary differrence can be utilised, subject

to some exceptions.

At the date of transition, excluding the tax effect of adjustments generated by the adoption of other A-IFRS standards, applying A-IFRS

results in an increase in deferred tax liability of $6.1 million and an increase in contributed capital of $40.6 million. These are recognised

after a decrease in retained earnings of $46.7 million.

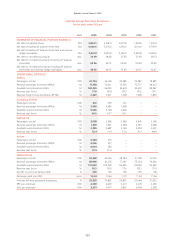

Qantas Annual Report 2005

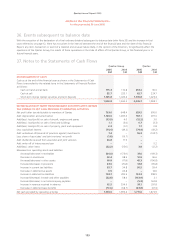

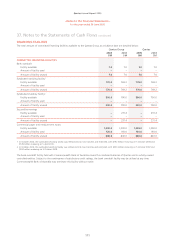

~Notes to the Financial Statements~

for the year ended 30 June 2005