Qantas 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Spirit of Australia

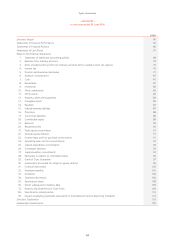

~Contents~

for the year ended 30 June 2005

page

Directors’ Report 45

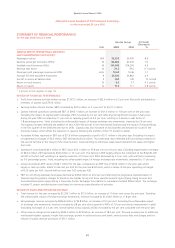

Statements of Financial Performance 65

Statements of Financial Position 66

Statements of Cash Flows 67

Notes to the Financial Statements

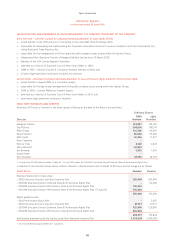

1. Statement of significant accounting policies 68

2. Revenue from ordinary activities 74

3. Items included within profit from ordinary activities before related income tax expense 75

4. Income tax 76

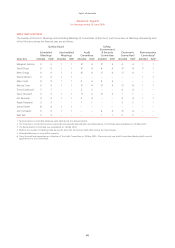

5. Director and Executive disclosures 77

6. Auditors’ remuneration 81

7. Cash 81

8. Receivables 81

9. Inventories 82

10. Other investments 82

11. Other assets 82

12. Property, plant and equipment 83

13. Intangible assets 86

14. Payables 87

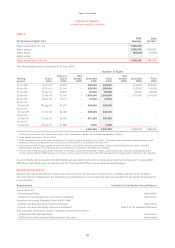

15. Interest-bearing liabilities 87

16. Provisions 88

17. Current tax liabilities 89

18. Contributed equity 89

19. Reserves 90

20. Retained profits 90

21. Total equity reconciliation 91

22. Outside equity interests 91

23. Finance lease and hire purchase commitments 91

24. Operating lease and hire commitments 92

25. Capital expenditure commitments 92

26. Contingent liabilities 93

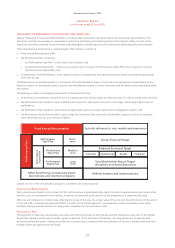

27. Superannuation commitments 93

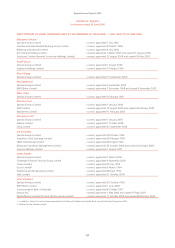

28. Particulars in relation to controlled entities 95

29. Deed of Cross Guarantee 97

30. Investments accounted for using the equity method 99

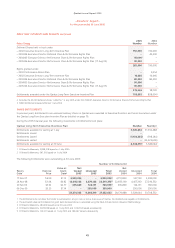

31. Financial instruments 102

32. Employee benefits 105

33. Dividends 106

34. Segment information 106

35. Earnings per share 108

36. Events subsequent to balance date 109

37. Notes to the Statements of Cash Flows 109

38. Non-Director related parties 112

39. Impact of adopting Australian equivalents to International Financial Reporting Standards 114

Directors’ Declaration 119

Independent Audit Report 120