Qantas 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

Spirit of Australia

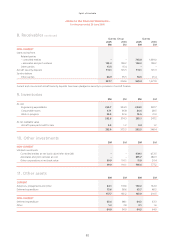

~Notes to the Financial Statements~

for the year ended 30 June 2005

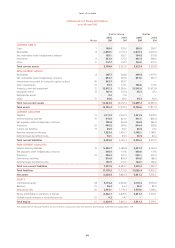

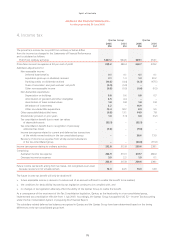

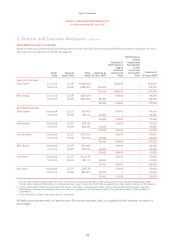

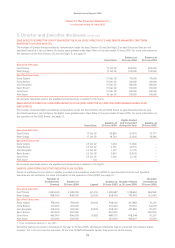

4. Income tax

Qantas Group Qantas

2005

$M

2004

$M

2005

$M

2004

$M

The prima facie income tax on profit from ordinary activities differs

from the income tax charged in the Statements of Financial Performance

and is calculated as follows:

Profit from ordinary activities 1,027.2 964.6 869.1 914.1

Prima facie income tax expense at 30 per cent of profit 308.2 289.4 260.7 274.2

Add/(less) adjustments for:

Non-assessable income

Deferred lease benefits 0.1 0.1 0.1 0.1

Imputation gross-up on dividends received 3.1 1.3 1.3 20.2

Franking credits on dividends received (10.3) (4.4) (4.3) (67.5)

Share of associates’ and joint ventures’ net profit (0.5) (5.9) ––

Other non-assessable income (0.8) (0.5) (0.6) (0.5)

Non-deductible expenditure

Depreciation on buildings 0.8 0.6 0.8 0.7

Amortisation of goodwill and other intangibles 4.5 4.4 ––

Amortisation of lease residual values 1.8 0.8 1.8 0.8

Writedown of investments 2.2 –16.9 –

Other non-deductible expenditure 14.4 18.2 8.9 5.5

Other assessable/(deductible) items (0.8) 13.1 14.9 7.8

(Over)/under provision in prior years 1.8 (1.3) 0.8 (3.2)

Tax consolidation benefit due to reset tax values

of depreciable assets (52.1) –(52.1) –

Tax consolidation benefit due to recognition of previously

unbooked tax losses (9.6) –(9.6) –

Income tax expense related to current and deferred tax transactions

of the wholly-owned entities in the tax-consolidated group ––38.6 73.0

Recovery of income tax expense from wholly-owned subsidiaries

in the tax-consolidated group ––(38.6) (73.0)

Income tax expense relating to ordinary activities 262.8 315.8 239.6 238.1

Comprising:

Australian income tax expense 258.9 313.3 237.7 238.0

Overseas income tax expense 3.9 2.5 1.9 0.1

262.8 315.8 239.6 238.1

Future income tax benefit arising from tax losses, not recognised as an asset

because recovery is not virtually certain 13.3 24.5 13.3 14.9

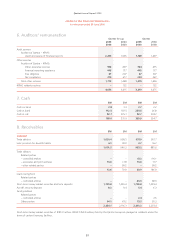

The future income tax benefit will only be obtained if:

x future assessable income is derived of a nature and of an amount sufficient to enable the benefit to be realised;

x the conditions for deductibility imposed by tax legislation continue to be complied with; and

x no changes in tax legislation adversely affect the ability of the Qantas Group to realise the benefit.

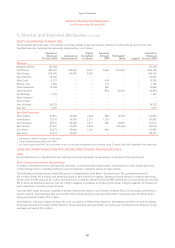

As a consequence of the enactment of the Tax Consolidation legislation, Qantas, as the head entity in a tax-consolidated group,

implemented tax consolidation effective from 1 July 2003. Accordingly, the Qantas Group has applied UIG 52 – Income Tax Accounting

under the Tax Consolidation System in preparing this Financial Report.

The subsidiary-related deferred tax balances recognised in Qantas and the Qantas Group have been determined based on the timing

differences at the tax-consolidated group level.