Qantas 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

Qantas Annual Report 2005

~Notes to the Financial Statements~

for the year ended 30 June 2005

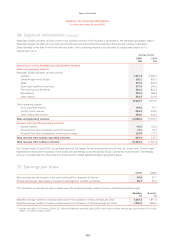

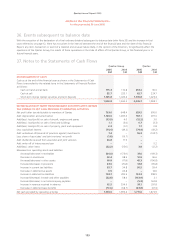

36. Events subsequent to balance date

With the exception of the declaration of a final ordinary dividend subsequent to balance date (refer Note 33) and the increase in fuel

costs referred to on page 12, there has not arisen in the interval between the end of the financial year and the date of this Financial

Report, any item, transaction or event of a material and unusual nature likely, in the opinion of the Directors, to significantly affect the

operations of the Qantas Group, the results of those operations or the state of affairs of the Qantas Group, in this financial year or in

future financial years.

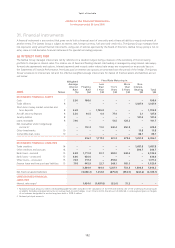

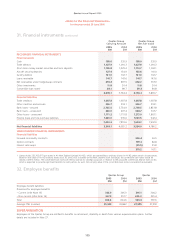

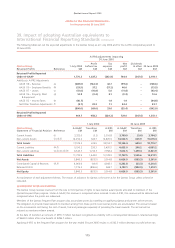

37. Notes to the Statements of Cash Flows

Qantas Group Qantas

2005

$M

2004

$M

2005

$M

2004

$M

RECONCILIATION OF CASH

Cash as at the end of the financial year as shown in the Statements of Cash

Flows is reconciled to the related items in the Statements of Financial Position

as follows:

Cash on hand and at bank 115.3 110. 8 257.2 30.0

Cash at call 82.7 225.1 82.7 224.7

Short-term money market securities and term deposits 1,705.8 1,029.4 1,705.8 1,029.4

1,903.8 1,365.3 2,045.7 1,284.1

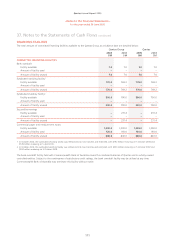

RECONCILIATION OF PROFIT FROM ORDINARY ACTIVITIES AFTER INCOME

TAX EXPENSE TO NET CASH PROVIDED BY OPERATING ACTIVITIES

Net profit after tax attributable to members of Qantas 763.6 648.4 629.5 676.0

Add: depreciation and amortisation 1,100.0 1,005.6 961.1 871.0

Add/(less): loss/(profit) on sale of aircraft, engines and spares (13.0) 4.0 (12.2) 3.0

Add/(less): loss/(profit) on sale of land and buildings 1.1 (3.4) 0.7 (3.3)

Add/(less): loss/(profit) on sale of property, plant and equipment 2.3 (0.1) 1.7 0.8

Less: capitalised interest (74.4) (49.2) (74.4) (49.2)

Add: writedown of/(reversal of provision against) investments 7.4 –56.3 (130.7)

Less: share of associates’ and joint ventures’ net profit (1.8) (19.7) –

Add: dividends received from associates and joint ventures 26.8 11.9 ––

Add: write-off of intercompany loan –––5.2

Add/(less): other items (22.2) (35.6) 3.8 (12.2)

Movements in operating assets and liabilities:

(Increase)/decrease in receivables (44.0) (173.9) 37.6 (181.3)

Decrease in inventories 42.4 98.9 10.9 96.6

(Increase)/decrease in other assets 40.8 (17.8) 45.3 (106.8)

Increase/(decrease) in provisions 23.0 (76.8) 14.8 (65.8)

Increase in current tax liabilities 55.7 34.8 56.5 59.4

Decrease in deferred tax assets 0.5 43.8 –14.6

Increase in deferred tax liabilities 103.7 203.9 122.3 298.9

Increase/(decrease) in trade and other payables (52.8) 58.4 (143.9) 2.1

Increase/(decrease) in net intercompany payables ––(5.3) 163.8

Increase in revenue received in advance 42.5 334.9 50.1 291.8

Decrease in deferred lease benefits (51.6) (68.7) (43.8) (61.0)

Net cash provided by operating activities 1,950.0 1,999.4 1,711.0 1,872.9