Qantas 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

Spirit of Australia

~Notes to the Financial Statements~

for the year ended 30 June 2005

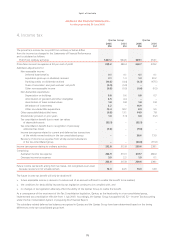

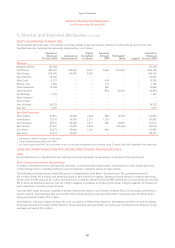

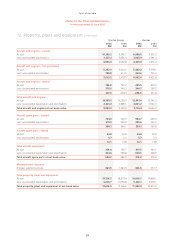

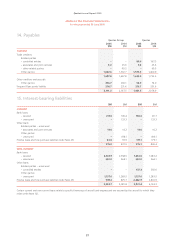

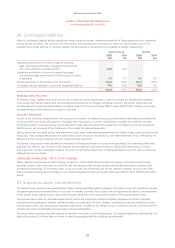

12. Property, plant and equipment continued

Independent valuations of land and buildings were obtained as at 30 June 2005. The valuations for each asset class were in excess of their

carrying amounts, however, no additional revaluations have been recognised. Details of the valuations obtained for the Qantas Group

were:

Qantas Group

2005 2004

Valuation

Amount

$M

Carrying

Amount

$M

Excess

$M

Valuation

Amount

$M

Carrying

Amount

$M

Excess

$M

ASSET CLASS

Freehold land and buildings1278.8 242.4 36.4 252.7 151.5 101.2

Leasehold buildings and improvements 959.6 612.1 347.5 907.8 642.4 265.4

1,238.4 854.5 383.9 1,160.5 793.9 366.6

1 Freehold land and buildings for Qantas have been independently valued at $240.8 million (2004: $219.3 million).

The 2005 independent valuation of land, buildings and leasehold improvements was carried out by Mr Russell Cowell, FVLE, AREI, of

Knight Frank Valuations (NSW) Pty Limited. Valuations were performed after physically inspecting a sample of properties and all significant

additions. The property valuations were performed using the open market or special use value to the Qantas Group.

SECURED ASSETS

Certain aircraft and engines act as security against related financings. Under the terms of certain financing facilities entered into by the

Qantas Group, the underwriters to these agreements have a fixed charge over certain aircraft and engines to the extent that debt has

been issued directly to those underwriters. The total carrying amount of assets under pledge was $5,075.3 million as at 30 June 2005

(2004: $3,598.7 million).

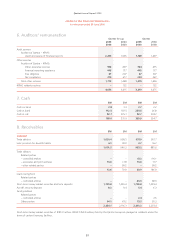

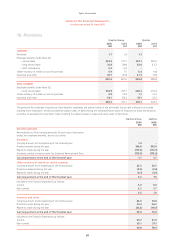

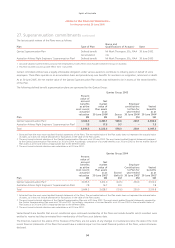

13. Intangible assets

Qantas Group Qantas

2005

$M

2004

$M

2005

$M

2004

$M

NON-CURRENT

Goodwill at cost 157.9 151.3 ––

Less: accumulated amortisation 61.2 46.1 ––

96.7 105.2 ––

Airport landing slots 47.3 47.3 47.3 47.3

Less: accumulated amortisation 2.0 0.1 2.0 0.1

45.3 47.2 45.3 47.2

142.0 152.4 45.3 47.2