Qantas 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.104

Spirit of Australia

~Notes to the Financial Statements~

for the year ended 30 June 2005

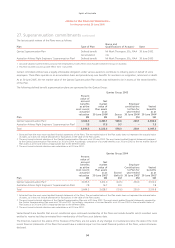

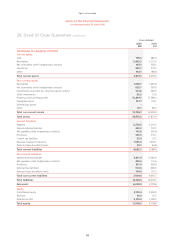

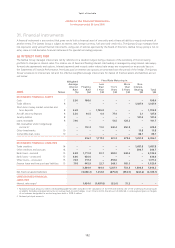

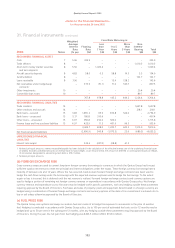

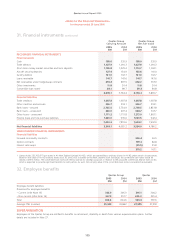

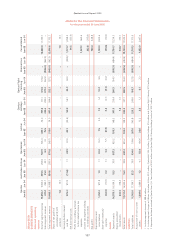

31. Financial instruments continued

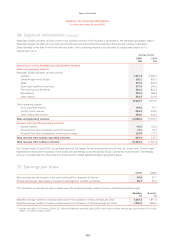

(d) DEFERRED GAINS/LOSSES ON HEDGES OF ANTICIPATED FUTURE TRANSACTIONS

Any unrealised gains/losses on contracts entered into to hedge anticipated specific sales and purchases of goods and services, together

with the cost of the contracts, are recognised in the Financial Statements at the time the underlying transaction occurs.

As at 30 June 2005, the amount of deferred or unrecognised gains on hedges of net revenue designated to service long-term debt is

$228.4 million (2004: $19.2 million loss). As at 30 June 2005, the amount of deferred gains on other hedges totalled $318.5 million

(2004: $168.5 million).

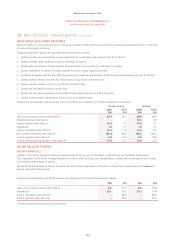

(e) CREDIT RISK

Credit risk is the potential loss from a transaction in the event of default by the counterparty during the term of the transaction or on

settlement of the transaction. Credit exposure is measured as the cost to replace existing transactions should a counterparty default.

The Qantas Group conducts transactions with the following major types of counterparties:

x trade receivable counterparties – the credit risk is the recognised amount, net of any provision for doubtful debts. As at 30 June

2005, this amounted to $1,027.9 million (2004: $1,010.3 million). The Qantas Group has credit risk associated with travel agents,

industry settlement organisations and credit provided to direct customers. The Qantas Group minimises this credit risk through the

application of stringent credit policies and accreditation of travel agents through industry programs; and

x other financial asset counterparties – the Qantas Group restricts its dealings to counterparties that have acceptable credit ratings.

Should the rating of a counterparty fall below certain levels, internal policy dictates that approval by the Board of Directors is

required to maintain the level of the counterparty exposure.

The Qantas Group minimises the concentration of credit risk by undertaking transactions with a large number of customers and

counterparties in various countries. As at 30 June 2005, the credit risk of the Qantas Group to other financial asset counterparties

amounted to $4,867.7 million (2004: $4,294.2 million) and was spread over a number of regions, including Australia, Asia, Europe

and the United States.

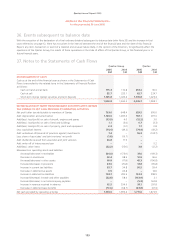

(f) NET FAIR VALUE

RECOGNISED FINANCIAL INSTRUMENTS

The net fair value of cash, cash equivalents and non-interest-bearing financial assets and liabilities approximates their carrying value due to

their short maturity. The net fair value of other financial assets and liabilities is determined by valuing them at the present value of future

contracted cash flows. Cash flows are discounted using standard valuation techniques at the applicable market yield, having regard to the

timing of the cash flows.

The convertible loan notes issued by Air New Zealand Limited are convertible to a 4.99 per cent equity stake. The net fair value of the

convertible loan notes has been determined by reference to the prevailing market price of Air New Zealand Limited shares at balance date.

UNRECOGNISED FINANCIAL INSTRUMENTS

The net fair value of forward foreign exchange and fuel contracts is determined as the unrealised gain/loss at balance date by reference

to market exchange rates and fuel prices. The net fair value of interest rate swaps is determined as the present value of future contracted

cash flows. Cash flows are discounted using standard valuation techniques at the applicable market yield, having regard to the timing of

the cash flows. The net fair value of options is determined using standard valuation techniques.