Qantas 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

Qantas Annual Report 2005

~Notes to the Financial Statements~

for the year ended 30 June 2005

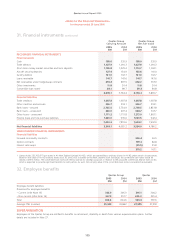

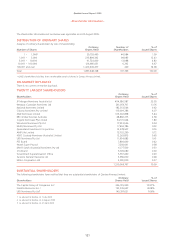

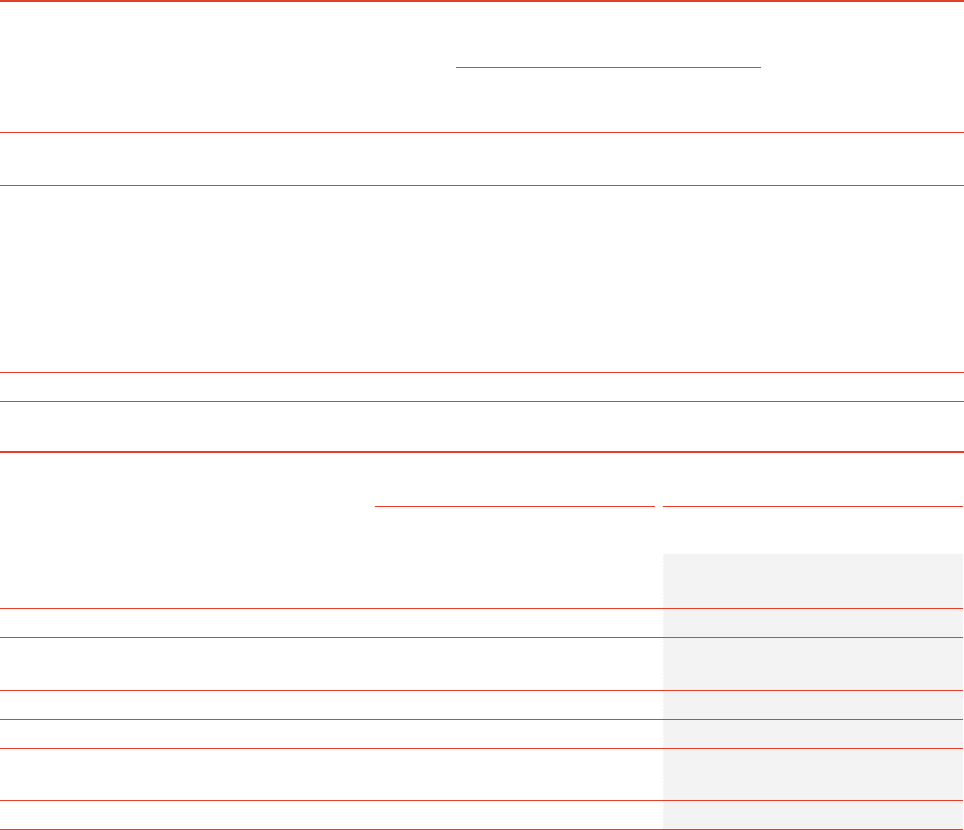

39. Impact of adopting Australian equivalents to

International Financial Reporting Standards continued

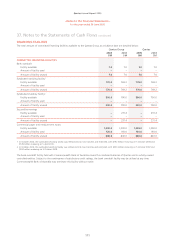

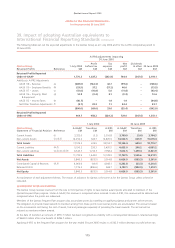

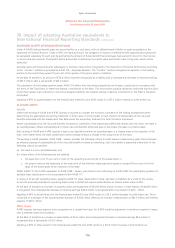

The following tables set out the expected adjustments to the Qantas Group as at 1 July 2004 and for the A-IFRS comparative period to

30 June 2005.

Qantas Group

Retained Profits Reference

1 July 2004

$M

A-IFRS adjustments impacting

30 June 2005

Dividends

& other

$M

30 June 2005

$M

Profit

before tax

$M

Tax

expense

$M

Net

profit

$M

Retained Profits Reported

Under A-GAAP 1,776.3 1,027.2 (262.8) 764.4 (347.6) 2,193.1

Add/(Less): A-IFRS Adjustments

AASB 118 – Revenue (a) (669.0) (142.3) 42.7 (99.6) – (768.6)

AASB 119 – Employee Benefits (b) (53.5) 57.2 (17.2) 40.0 – (13.5)

AASB 117 – Leases (c) (51.6) (16.8) 5.0 (11.8) – (63.4)

AASB 116 – Property, Plant

& Equipment

(d) 14.9 (0.4) 0.1 (0.3) – 14.6

AASB 112 – Income Taxes (e) (46.7) – 1.9 1.9 – (44.8)

Net Other Transition Adjustments

(f) (0.7) 33.3 1.1 34.4 – 33.7

(806.6) (69.0) 33.6 (35.4) – (842.0)

Retained Profits Reported

Under A-IFRS 969.7 958.2 (229.2) 729.0 (347.6) 1,351.1

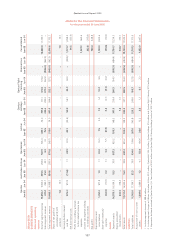

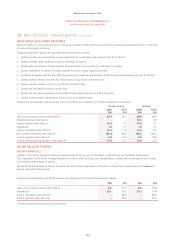

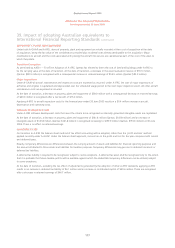

Qantas Group

Statement of Financial Position Reference

1 July 2004 30 June 2005

A-GAAP

$M

Transition

$M

A-IFRS

$M

A-GAAP

$M

Transition

$M

A-IFRS

$M

Current Assets (f) 3,322.0 (5.2) 3,316.8 3,709.9 (5.6) 3,704.3

Non-current Assets (c),(d),(f) 14,252.2 624.7 14,876.9 14,424.5 645.9 15,070.4

Total Assets 17,574.2 619.5 18,193.7 18,134.4 640.3 18,774.7

Current Liabilities (a),(f) 5,190.2 230.3 5,420.5 4,635.0 246.2 4,881.2

Non-current Liabilities (a),(b),(c),(d),(e) 6,543.7 1,214.7 7,758.4 7,072.5 1,259.4 8,331.9

Total Liabilities 11,733.9 1,445.0 13,178.9 11,707.5 1,505.6 13,213.1

Net Assets 5,840.3 (825.5) 5,014.8 6,426.9 (865.3) 5,561.6

Contributed Capital & Reserves (d),(f) 4,064.0 (18.9) 4,045.1 4,233.8 (23.3) 4,210.5

Retained Profits 1,776.3 (806.6) 969.7 2,193.1 (842.0) 1,351.1

Net Equity 5,840.3 (825.5) 5,014.8 6,426.9 (865.3) 5,561.6

An explanation of each adjustment follows. The impact of adoption for Qantas is the same as for the Qantas Group unless otherwise

indicated.

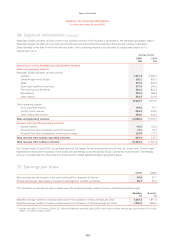

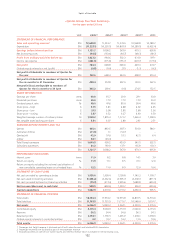

(a) FREQUENT FLYER ACCOUNTING

The Qantas Group receives revenue from the sale to third parties of rights to have Qantas award points allocated to members of the

Qantas Frequent Flyer program. Under A-GAAP, this revenue is recognised when received. Under A-IFRS, this revenue will be deferred and

recognised when the points are redeemed.

Members of the Qantas Frequent Flyer program also accumulate points by travelling on qualifying Qantas and partner airline services.

The obligation to provide travel rewards to members arising from these points is accrued as points are accumulated. The accrual is based

on the incremental cost (being the cost of meals, fuel and passenger expenses) of providing the travel rewards. The accrual will be

reduced as members redeem awards.

At the date of transition an amount of $955.7 million has been recognised as a liability with a consequential decrease in retained earnings

of $669.0 million after a tax benefit of $286.7 million.

Applying A-IFRS to the Frequent Flyer program for the year ended 30 June 2005 results in a $142.3 million decrease in profit before tax.