Qantas 2005 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

Qantas Annual Report 2005

~Notes to the Financial Statements~

for the year ended 30 June 2005

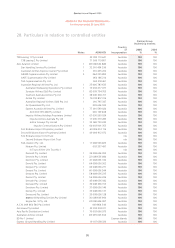

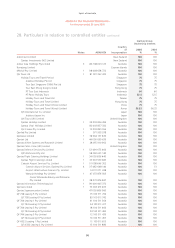

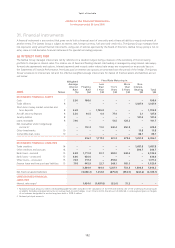

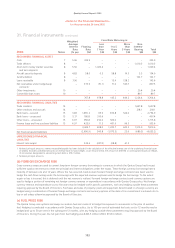

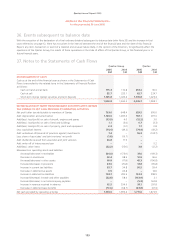

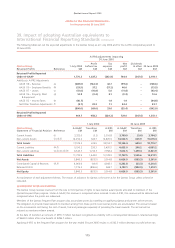

31. Financial instruments continued

Qantas Group

Carrying Amount

Qantas Group

Net Fair Value

2005

$M

2004

$M

2005

$M

2004

$M

RECOGNISED FINANCIAL INSTRUMENTS

Financial assets

Cash 198.0 335.9 198.0 335.9

Trade debtors 1,027.9 1,010.3 1,027.9 1,010.3

Short-term money market securities and term deposits 1,705.8 1,029.4 1,714.7 1,034.1

Aircraft security deposits 127.4 134.9 133.6 141.0

Sundry debtors 121.0 102.7 121.0 102.7

Loans receivable 141.7 143.6 141.7 143.6

Net receivables under hedge/swap contracts 674.4 897.5 692.2 937.9

Other investments 11.8 20.4 11.8 20.4

Convertible loan notes188.1 89.7 59.3 80.8

4,096.1 3,764.4 4,100.2 3,806.7

Financial liabilities

Trade creditors 1,687.8 1,697.8 1,687.8 1,697.8

Other creditors and accruals 206.7 218.1 206.7 218.1

Bank loans – secured 2,725.5 2,754.9 2,798.5 2,823.8

Bank loans – unsecured 630.0 497.4 644.7 507.7

Other loans – unsecured 1,171.2 1,715.8 1,273.0 1,803.1

Finance lease and hire purchase liabilities 1,023.0 935.6 1,023.5 942.4

7,444.2 7,819.6 7,634.2 7,992.9

Net financial liabilities 3,348.1 4,055.2 3,534.0 4,186.2

UNRECOGNISED FINANCIAL INSTRUMENTS

Financial liabilities

Forward commodity contracts 206.4 56.5

Option contracts 199.3 84.8

Interest rate swaps (35.5) 25.8

370.2 167.1

1 Qantas holds 220,763,477 loan notes in Air New Zealand Limited (Air NZ), which are convertible to ordinary shares in Air NZ under certain circumstances.

Based on the value of Air NZ ordinary shares as at 30 June 2005 as traded on the New Zealand Stock Exchange, the convertible loan notes would be

valued at $59.3 million. The convertible loan notes are held by Qantas for strategic purposes in relation to the proposed commercial alliance with Air NZ,

which is expected to provide significant benefits to both parties. As such, the carrying value of the convertible loan notes is considered recoverable.

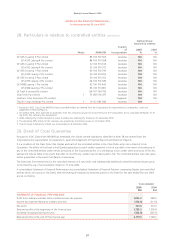

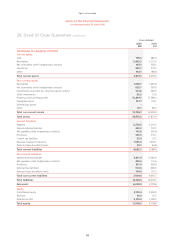

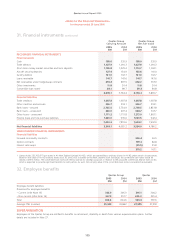

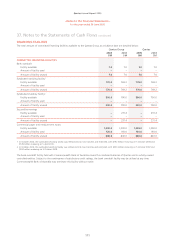

32. Employee benefits

Qantas Group Qantas

2005

$M

2004

$M

2005

$M

2004

$M

Employee benefit liabilities

Provisions for employee benefits

– Current (refer Note 16) 366.9 346.9 316.1 304.2

– Non-current (refer Note 16) 267.9 257.7 244.3 235.4

Total 634.8 604.6 560.4 539.6

Average FTEs (number) 35,520 33,862 27,585 27,218

SUPERANNUATION

Employees of the Qantas Group are entitled to benefits on retirement, disability or death from various superannuation plans. Further

details are included in Note 27.